read also

Evacuation from the Middle East: How Countries Are Bringing Their Citizens Home

Evacuation from the Middle East: How Countries Are Bringing Their Citizens Home

Japan Corporate Bankruptcies Hit 13-Year High

Japan Corporate Bankruptcies Hit 13-Year High

Japan’s New Condo Prices Reach Record High

Japan’s New Condo Prices Reach Record High

European Gas Prices Surge Amid Middle East War

European Gas Prices Surge Amid Middle East War

EU prepares new foreign investment screening rules

EU prepares new foreign investment screening rules

Collapse of Air Travel in the Middle East

Collapse of Air Travel in the Middle East

Real Estate / Investments / Analytics / Research / Turkey / Bulgaria / Croatia / Hungary / Slovakia / Netherlands / Japan 03.10.2025

Global House Price Index by Knight Frank: Price Dynamics in 2025

Photo: Pexels

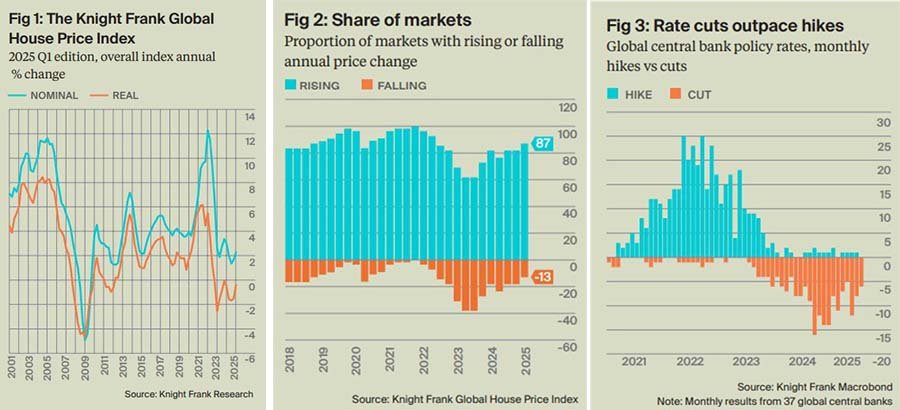

In the first quarter of 2025, the global housing market entered a trajectory of moderate recovery. According to Knight Frank, average prices in 55 countries rose by 2.3% compared to the same period in 2024. This is the best result in three quarters, but inflation continues to “eat up” nominal growth, leaving real dynamics in negative territory.

The moderate rebound reflects a shift in monetary policy: at the beginning of 2025, the number of rate cuts exceeded the number of hikes for the first time. This eased mortgage pressure and allowed markets to show positive dynamics. Knight Frank’s Global House Price Index shows that the acceleration remains modest – the overall figure is still below the long-term level of 5.1%.

Turkey topped the global index for the second year in a row. In Q1 2025, average housing prices there increased by 32.2% year-over-year. Within the quarter alone, prices rose another 9.7%, highlighting the Turkish market as one of the most dynamic. However, high inflation offset the nominal growth: in real terms, the index showed a decline of 4.2%. Investors are effectively losing returns due to the depreciation of their assets.

North Macedonia ranked second in the global index. Over the year, housing prices rose by 22.6%, with a quarterly increase of 9.9% – one of the highest among all markets. Unlike Turkey, growth here also holds in real terms: the indicator reached 24.2%. Portugal takes the third spot in the global ranking. Over the year, housing prices increased by 16.9%, with a 5.7% rise in Q1 2025. Even considering inflation, the growth remains firmly positive (+14.8%).

The top five also includes Bulgaria and Croatia. In Bulgaria, average housing prices rose by 15.1% year-over-year, with a quarterly gain of 4.2%. Real growth reached 10.6%. In Croatia, the figures are slightly lower but still impressive: 13.1% annually and 4.5% quarterly, with a real increase of 9.6%.

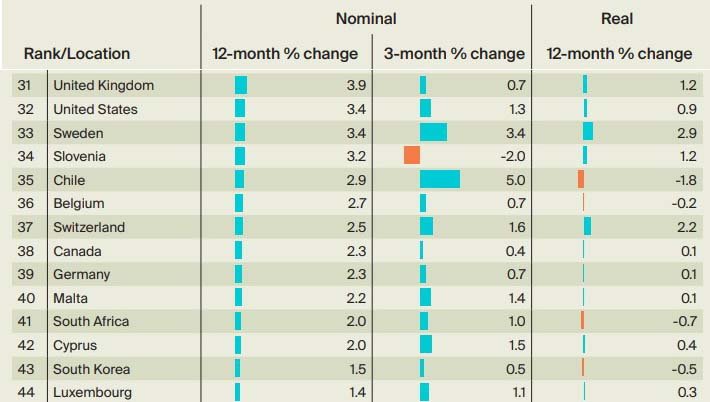

Hungary ranks sixth with +12.1%, followed by Slovakia (+11.4%) and the Netherlands (+10.6%). Outside Europe, notable results were recorded in Colombia (+9.9%) and Japan (+9.5%). Thus, European markets dominate the top ten: seven out of ten countries showed double-digit growth rates, underscoring the regional concentration of price dynamics.

The study highlights a group of countries with moderate nominal growth that, when adjusted for inflation, often loses strength. In the Czech Republic (+9.3%) and Spain (+9.0%), the market remains above the global average, but inflation almost entirely cancels out the gains. Ireland (+7.6%) and Greece (+6.8%) maintain positive momentum, while Poland (+6.6%) is nearly flat in real terms.

In Northern Europe, the gap is even more evident. Iceland (+7.0%) and Norway (+6.5%) show steady growth, while Sweden is limited to 3.4%. Finland posted –6.0% and joined the index’s underperformers. In Western Europe, France and Austria show the weakest results (both +0.4%), where inflation turns nominal growth into actual decline. Germany and Belgium recorded around 2–3%, also indicating stagnation.

Asian markets develop unevenly. India (+7.7%) and Taiwan (+6.0%) outperform the average, Singapore added 4.7%, but South Korea and Malaysia are essentially on the edge of stagnation (1.5% and 0.9% respectively), with Malaysia showing a negative quarterly result. In the Americas, Mexico (+8.2%) and Brazil (+8.1%) lead. In the US (+3.4%) and Canada (+2.3%), growth remains weak.

At the lower end of the global index are markets with negative dynamics. The sharpest decline was recorded in Mainland China (–7.5%) and Hong Kong (–6.5%). Negative figures were also seen in New Zealand (–1.9%), Jersey (–3.2%), and Peru (–0.9%).

Experts noted negative results in only a small group of countries: according to Knight Frank, price growth was recorded in 87% of markets, while the remaining 13% showed declines. This underlines that overall global dynamics remain positive, but some individual markets continue to face pressure.

Market prospects are directly tied to monetary policy. Knight Frank notes that the first rate cuts enabled prices to rise at the beginning of the year. However, inflation in a number of countries remains above target levels, so further easing will occur more slowly than homeowners and buyers would like. Achieving the long-term trend of 5.1% will only be possible if the course toward lowering borrowing costs is maintained.