read also

Gulf Attacks Raise Concerns for Tourism and Aviation

Gulf Attacks Raise Concerns for Tourism and Aviation

Indonesia tightens compliance rules for Bali short-term rentals

Indonesia tightens compliance rules for Bali short-term rentals

Ireland plans new restrictions on short-term rentals

Ireland plans new restrictions on short-term rentals

Europe Faces Growing Housing Crisis

Europe Faces Growing Housing Crisis

Budapest Joins European Crackdown on Airbnb Rentals

Budapest Joins European Crackdown on Airbnb Rentals

Oman Air Launches Bus Route From UAE to Muscat

Oman Air Launches Bus Route From UAE to Muscat

Real Estate / Вusiness / Investments / Analytics / Research / Montenegro / Real Estate Montenegro 14.10.2025

Airbnb in Podgorica: Moderate Yields and Seasonal Swings

Photo: Unsplash

The short-term rental market on Airbnb in Montenegro’s capital remains broadly stable, though revenue growth has slowed. An AirROI report analyzed 472 active listings in Podgorica covering November 2024–October 2025.

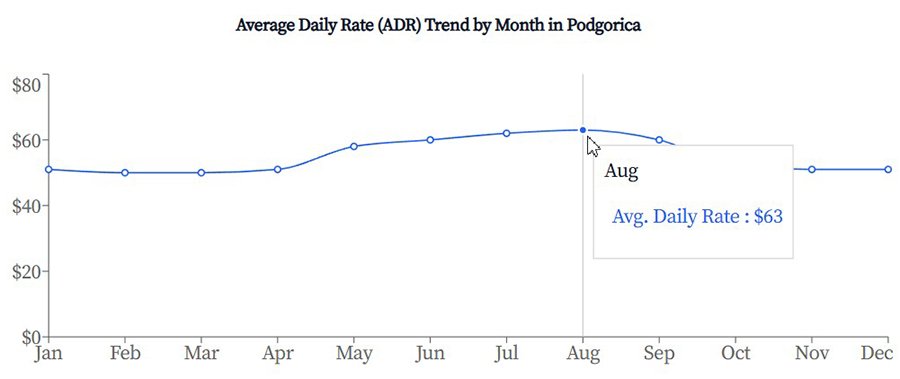

The Average Daily Rate (ADR) was $53 with 36% occupancy. A typical unit earned $5,031 over 12 months (–6.9% YoY). August was the peak month; January the weakest. The top 10% of listings (≈50 apartments) generated $1,214+ per month at 78%+ occupancy. Market medians: $528 and 34%. The bottom 25% earned about $247 with 17% occupancy.

Monthly dynamics show strong seasonality. Revenues/occupancy:

- Jan $457 / 32%, Feb $493 / 36%;

- Mar $565, Apr $570, May $649 (39%);

- Jun $665 (39%), Jul $828 / 44%, Aug $839 / 45%;

- Sep $619, Oct $669, Nov $513, Dec $596 (avg occupancy 38%).

ADR variation was tight—about $12 across the year. Lows were $50–51 (Jan, Feb, Mar, Apr, Nov, Dec), near-low $52 in Oct; higher rates in May $58, Jun/Sep $60, and peaks in Jul–Aug $62–63.

Stock mix. One-bedroom apartments dominate (64.2% of all listings). Together with two-bedroom units they account for 81.1%, reflecting demand from solo travelers and couples. Homes with 3+ bedrooms are just 2.3%—a niche for groups. Apartments and condos make up 86% of listings; houses <7%; hotels & unique stays ≈6% combined. A typical unit hosts 3 guests; 2–4-person stays exceed two-thirds of supply.

Booking rules & availability. ~42% allow 1-night stays, 19% allow 2 nights, and 24% target 30-day+ stays. Cancellation policies: flexible 41%, strict 25%, moderate 23%. Lead time averages 22 days, rising to 34 in summer and 42 in August. 54.9% of listings are open 271–366 days a year; 83.1% stay open ≥6 months. Common amenities: Wi-Fi, kitchen, AC; TV, washer, hairdryer are not universal.

Guests & origins. Around 94% of guests are foreign: UK 17.2%, USA 11.5%, Germany 7.5%. Montenegrin travelers comprise 6.2%. Most common languages: English (42.5%), French (7.8%). Gen Z (born after 2000) accounts for roughly half of guests.

What drives returns. Performance hinges on location and professional management (pricing, reviews, response times). The central districts of Podgorica lead demand; the Old Town offers historic appeal; Gorica has modern family apartments. Dajbabe and Koplik (green outskirts) show eco-tourism potential.

City vs. coast. Podgorica underperforms Adriatic and cross-border hotspots, per AirROI’s comparison (e.g., Krimovice, Ledenice, Lapčići, Radovčići; in Croatia’s Konavle: Močići, Trebesin, Čilipi, Čibača, Zavrelje).

- Podgorica: ADR $53, 36% occupancy, $5,031/yr (~$420/mo).

- Coastal resorts: $2,000–$2,400/mo at $220–$490 ADR and 30–48% occupancy.

- Dubrovnik: ~4,900 active listings, $198 ADR, 49% occupancy.

Key risks. Marked seasonality and reliance on foreign tourism make income sensitive to external shocks. Liquidity is lower than on the coast; exits or switching to long-term rental can be harder. There are transparency gaps and occasional fraud, while policymakers discuss mandatory registration and tax reporting for short lets—potentially reducing appeal for small landlords.

Подсказки: Podgorica, Montenegro, Airbnb, rentals, real estate, ADR, occupancy, seasonality, tourism, hosting, revenue, regulation, Dubrovnik, Adriatic Coast