read also

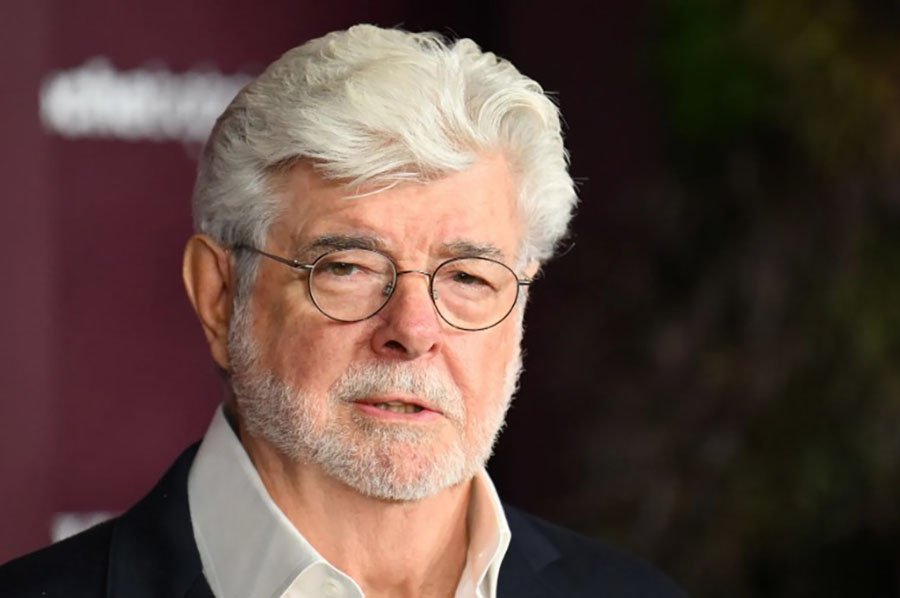

George Lucas buys a £40 million London mansion amid a downturn in the luxury market

Photo: Bloomberg

Hollywood filmmaker and producer George Lucas has acquired one of the most expensive residential properties in London in 2025, writes Bloomberg. The deal became a notable episode for the UK capital’s prime property segment, which has been under pressure in recent months due to tax changes and weakening demand.

The creator of Star Wars purchased a mansion in a prestigious area of northwest London for about £40 million ($52.3 million) in September. The previous owner of the house was a senior lawyer from the City of London. Lucas, who also created the Indiana Jones film franchise, sold his production company Lucasfilm to Disney in 2012 for $4.1 billion. His net worth is estimated at $6.6 billion, according to the Bloomberg Billionaires Index.

The transaction is another example of interest from wealthy Americans, which has been partly supporting London’s luxury housing market amid a broader downturn. Last summer, designer Tom Ford purchased a mansion for about £80 million. At the end of April 2025, Silicon Valley investor Matt Kohler bought a house in Notting Hill for roughly £22 million ($28.8 million), while a member of a billionaire family linked to Thomson Reuters acquired luxury apartments in London for around £25 million (about $32.7 million). Standing somewhat apart is a £15 million ($19.6 million) investment by Nigerian banker Roosevelt Ogbonna in a mansion in the British capital’s Hampstead area.

The market has come under pressure following an increase in stamp duty and the abolition of the preferential tax status for ultra-wealthy foreign residents, which has sharply reduced demand. At the same time, the share of Americans among homebuyers in the UK capital rose from 3.3% in 2023 to 6.1% in the first half of 2025, marking one of the sharpest increases in the past 12 years, according to Knight Frank. Brokers attribute this to a strong dollar, London’s relative price attractiveness, and domestic socio-political factors in the United States.

Prices in the most prestigious postcode areas of the capital remain about 14% below their 2014 peaks in pounds and nearly 30% lower in dollar terms. This makes London one of the few global prime residential markets where the combination of exchange rates and limited price growth creates relative value for foreign buyers.

Nevertheless, the overall number of transactions in the top price segment continues to decline. According to research firm LonRes, in September the number of deals involving properties priced at £5 million or more was 41% lower than in the same month last year, while uncertainty over future taxation ahead of the UK budget further dampened buyer activity.

Additional negative pressure on the market comes from the new “mansion tax”, which UK authorities plan to introduce from April 2028. According to a forecast by Hamptons, prices for properties valued above £2 million (about $2.7 million) could fall by around 5%, as the market pre-emptively factors future tax costs into home values. The measure involves an annual surcharge ranging from £2,500 to £7,500 ($3,400–10,200) depending on the property price, increasing ongoing ownership costs.

The most pronounced pressure is expected in London, where most high-end homes are concentrated and where the market has already been weakened by previous changes. As a result, the capital may become the only region of the country where no price growth is expected in the coming years. In addition, the tax could become a starting point for broader property tax reform. Analysts at International Investment note that a temporary measure may turn into a permanent source of budget revenue, increasing buyer caution and reducing the appeal of high-end property as an investment asset.