read also

Tourism & hospitality / Вusiness / Real Estate / Investments / Analytics / Research / Georgia / Tourism Georgia 17.09.2025

Tourism and Key Sectors Bolster Georgia’s Economic Resilience

Photo: Unsplash

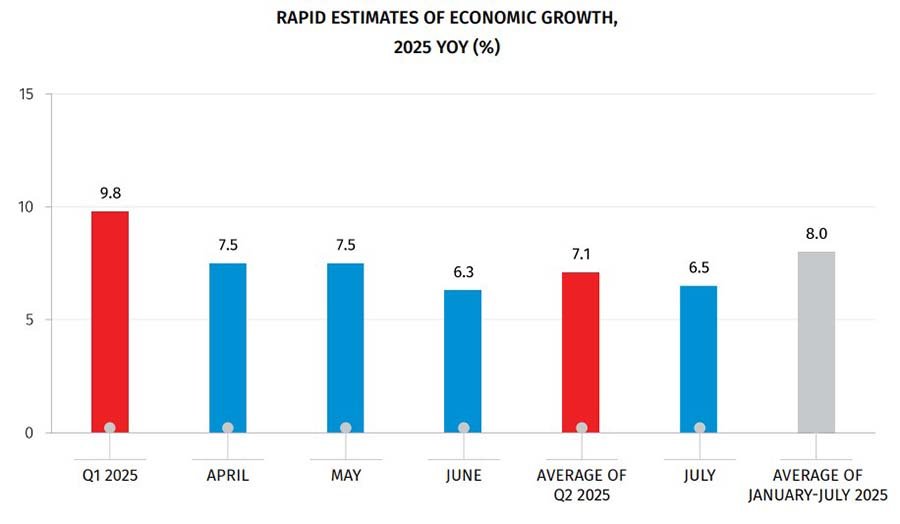

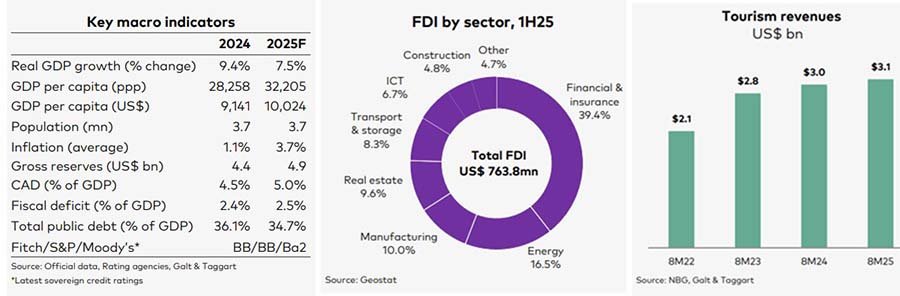

Georgia’s economy continues to expand successfully. GDP for the first seven months of 2025 increased by 8%, while tourism revenues for January–August reached $3.1 billion, up 3.3% compared with the same period in 2024. Foreign investment is concentrated mainly in finance, real estate, and energy, according to Galt & Taggart experts.

July dynamics

In July 2025, tourism revenues in Georgia rose by 2.7% to $520 million. Cumulatively for January–July, receipts reached $2.5 billion (+3.6%). Georgia’s GDP increased by 6.5% in July, bringing total growth for the first seven months to 8%. The main contributors were transport and warehousing, information and communications technology, arts and entertainment, and trade.

The National Statistics Office reports that over seven months exports rose 9% to $3.85 billion, while imports expanded by 10.8% to $10.3 billion. Total foreign trade turnover increased by 10.3% to $14.2 billion. The consumer price index in July stood at 104.3 points, comparable to the 2024 level (99.8%), and the producer price index held at 103.6, reflecting moderate pressures.

Business activity supported the positive momentum: VAT-payers’ turnover in July amounted to GEL 16 billion (about $6 billion), 9.2% higher year-on-year. Some 6.1 thousand new companies were registered during the month. The banking sector and the state budget maintained a positive trend, strengthening the economy’s resilience.

Galt & Taggart analysts note that inflation accelerated from 4% to 4.3% due to rising prices for domestically produced goods (5.4% year-on-year) and mixed categories (7.5%). Imports became 1.6% cheaper. Core inflation remained stable at 2.2%.

August economy

In August, tourism revenues in Georgia grew by 2.1% to $600 million. Cumulatively for eight months, receipts totaled $3.1 billion, 3.3% above last year’s level, according to Galt & Taggart.

Foreign direct investment in Q2 amounted to $580.1 million. Funds were directed primarily to finance ($327.2 million), real estate ($66.4 million), and energy ($54.4 million), followed by transport ($41.8 million) and industry ($41.6 million). The United Kingdom led with $242.7 million, or 41.8% of the total. Investors from Turkey, Czechia, and the UAE were also active. Overall, FDI in H1 reached $763.8 million, equivalent to 4.5% of GDP.

On September 10, 2025, the National Bank of Georgia kept the key rate at 8%. The average inflation forecast for 2025 is 3.8%, with a gradual decline toward the 3% target in the medium term. Galt & Taggart expect real GDP to increase by 7.5% for the year, with the tourism sector bringing in about $4.5 billion.

IMF analysis

IMF experts assess that inflation will remain close to 3%, while the economy will grow by 7.2%. International reserves will accumulate through FX interventions and FDI inflows. The Fund’s report also notes that since 2021 Georgia’s real GDP has grown by more than 9% on average per year, inflation has returned to target, and public debt fell to 36% of GDP in 2024.

Georgia’s economic activity is supported by tourism, ICT, and transport, as well as immigration, financial flows, and transit trade, with risks assessed as balanced. Key directions include raising employment and productivity. Priorities include modernizing vocational education, supporting the agricultural sector, and improving conditions for returning migrants and the inflow of skilled professionals.

The report also underscores the need to reform state-owned enterprises, reduce dollarization, and establish supervisory frameworks for new financial services. Continued investment in infrastructure and regional integration is recommended to lower logistics costs and strengthen competitiveness.