Czech Republic Warns of Inflation Risks and Calls for Fiscal Discipline

Czech National Bank Governor Aleš Michl has urged the government to balance the budget to prevent a resurgence of inflation, Bloomberg reports. He emphasized that maintaining tight monetary policy is essential to limit borrowing by households, businesses, and the state.

In December 2024, the Czech National Bank (CNB) halted its rate-cutting cycle, leaving the key interest rate unchanged at 4% after eight consecutive reductions that had lowered borrowing costs by 300 basis points.

"The process of reducing inflation in key consumption sectors, particularly services, is not yet complete," Michl stated. "For this reason, the bank’s board has decided to temporarily pause the rate-cutting process."

Inflationary Pressures and CNB Priorities

Although inflation slowed in 2024, wage growth in Q3 exceeded expectations, and service costs continued to rise, prompting concerns that core inflation could accelerate.

The CNB is closely monitoring:

- Long-term inflation trends;

- The exchange rate’s impact on the economy;

- The fiscal deficit and government spending;

- Labor market conditions;

- Domestic and external demand.

The next policy meeting is scheduled for February 2025, with markets expecting 50 basis points of easing later this year. Analysts at Ceska Sporitelna AS, a unit of Erste Group Bank AG, believe that rates will likely remain unchanged until at least May.

Fiscal Pressures and Economic Challenges

Michl has identified the fiscal deficit as a key inflationary risk, alongside rising service costs and a recovering housing market.

"The biggest inflation risks are the budget deficit and excess money supply," he warned. "We need a balanced budget. That’s the best way to fight inflation."

Despite aggressive austerity measures, Prime Minister Petr Fiala’s government has struggled to eliminate the deficit due to high defense and infrastructure costs.

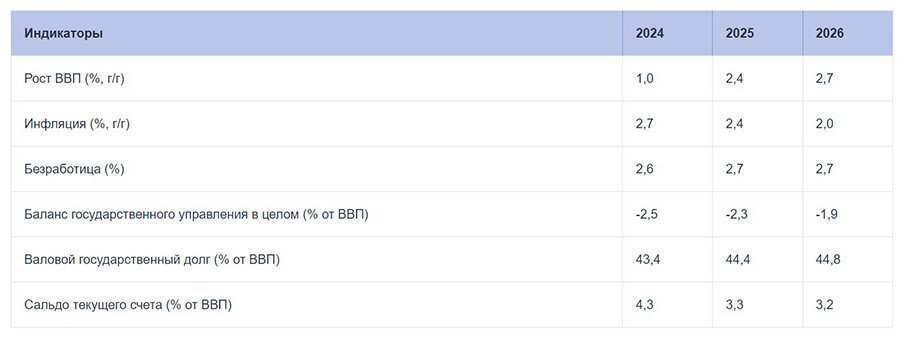

According to European Commission forecasts, Czech economic growth will remain slow in 2025, hindered by weak consumer demand and sluggish exports.

While inflation appears under control, Czechia’s economy remains vulnerable to external shocks. With Poland adopting expansionary policies and Georgia attracting foreign real estate investment, Czechia’s conservative approach may hinder growth.

Balancing inflation control with economic momentum will be the biggest challenge for policymakers in 2025. Can Czechia maintain stability without stalling growth? The next few months will be decisive.