Data Centers in Asia: Growth Driven by AI and Resource Constraints

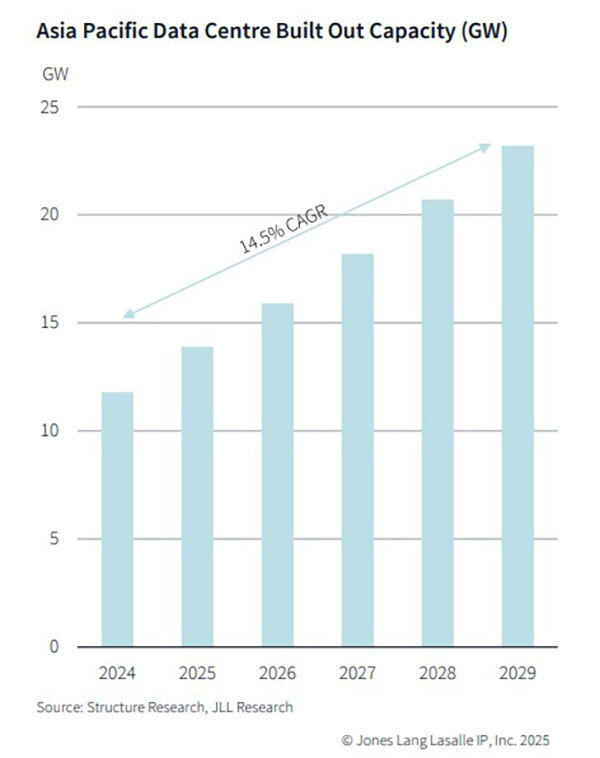

The Asia-Pacific data center market continues to expand rapidly amid the integration of artificial intelligence (AI), according

to JLL’s Q4 2024 report. New investors are entering the sector, existing operators are scaling up capacity, and mergers and acquisitions remain a critical driver, despite the limited availability of assets.

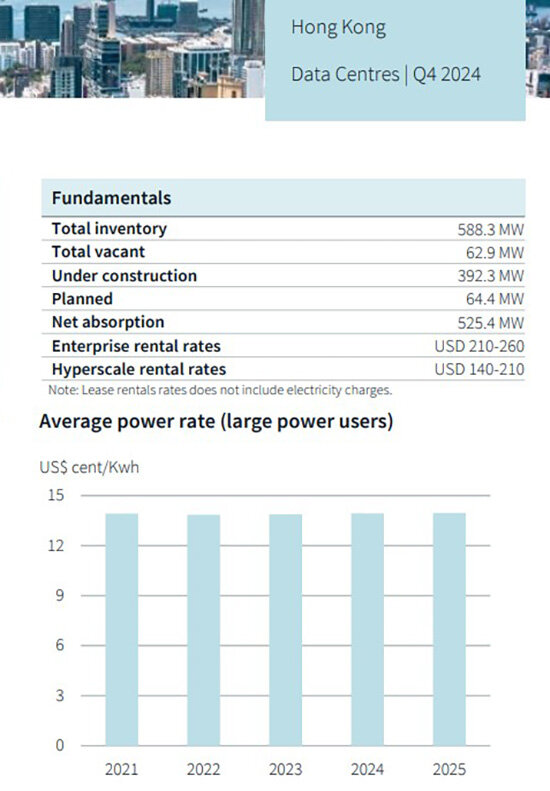

Hong Kong: Capacity Growth Under Pressure

Geopolitical tensions and high land and energy costs pose challenges for Hong Kong, but the city retains its status as a vital hub linking mainland China with global networks. Demand is fueled primarily by hyperscale operators, who rely on Hong Kong infrastructure mainly for AI inference workloads rather than training.

Equinix is developing the new 17-story HK6 data center in Tsuen Wan, with capacity for up to 3,550 server cabinets. SUNeVision signed a six-year renewable energy contract with Green Valley Landfill and CLP Power, while Goodman is upgrading existing facilities. By the end of Q4 2024, Hong Kong’s total installed capacity reached 588.3 MW, with around 63 MW still available. Another 392 MW are under construction, and 64 MW in planning. Rental rates ranged from $210–260/kW for enterprise customers and $140–210/kW for hyperscale clients.

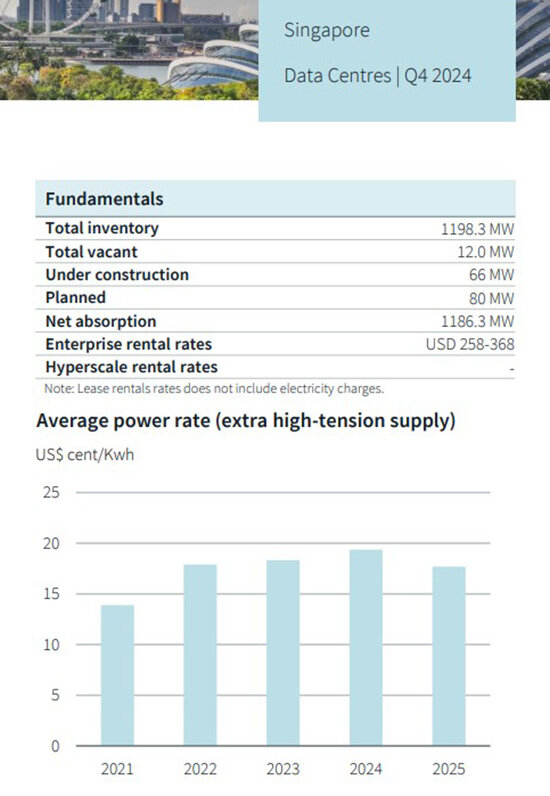

Singapore: Regional Expansion and Green Strategy

Due to land scarcity and strict environmental standards, Singapore restricts new data center construction. Demand is shifting to nearby Johor (Malaysia) and Batam (Indonesia), integrated into the SIJORI Growth Triangle, where Singapore serves as the financial and intellectual hub while neighbors provide land, energy, and labor.

The government’s Green Data Centre Roadmap, enhanced Green Mark certification, and targeted subsidies support sustainable growth. Recent projects include Keppel DC Singapore 8 and GDS’s conversion of an industrial site into a data center. By late 2024, Singapore’s installed capacity was nearly 1,200 MW, with just 12 MW available. Another 66 MW were under construction and 80 MW in planning. Net absorption reached 1,186 MW. Rental rates ranged from $258–368/kW per month for enterprise tenants.

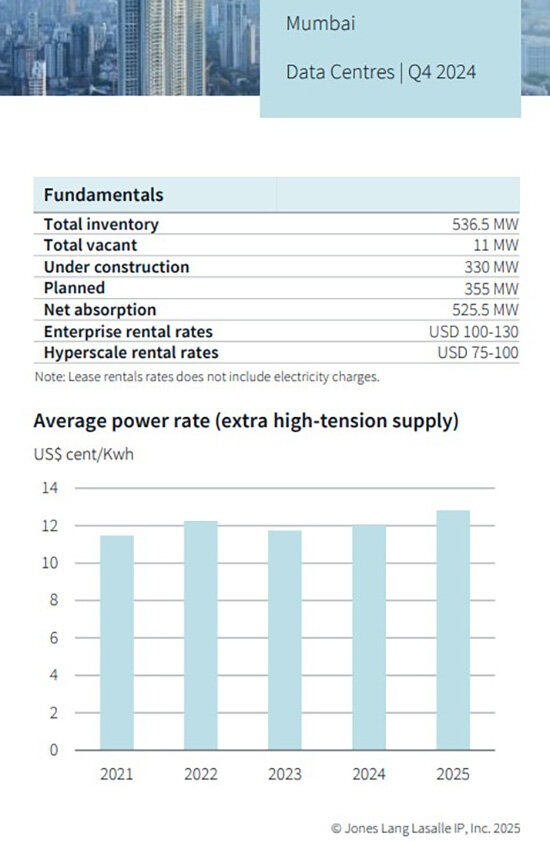

Mumbai: AI-Driven Investment

Mumbai is becoming one of India’s fastest-growing data center hubs, driven by BFSI institutions and hyperscale operators. Regulatory tightening and growing AI demand are shifting the market toward colocation models. Cloud AI platforms like Yotta’s Shakti Cloud, powered by NVIDIA GPUs, are providing further momentum.

Maharashtra launched a policy supporting integrated 500 MW green parks. Hyperscale providers are acquiring land near major power sources for dedicated projects. By 2024, Mumbai’s total installed capacity reached 536.5 MW, with 11 MW still available, 330 MW under construction, and 355 MW in planning. Net absorption was 525.5 MW. Rental rates ranged from $100–130/kW (enterprise) and $75–100/kW (hyperscale).

India

reforms Waqf property law

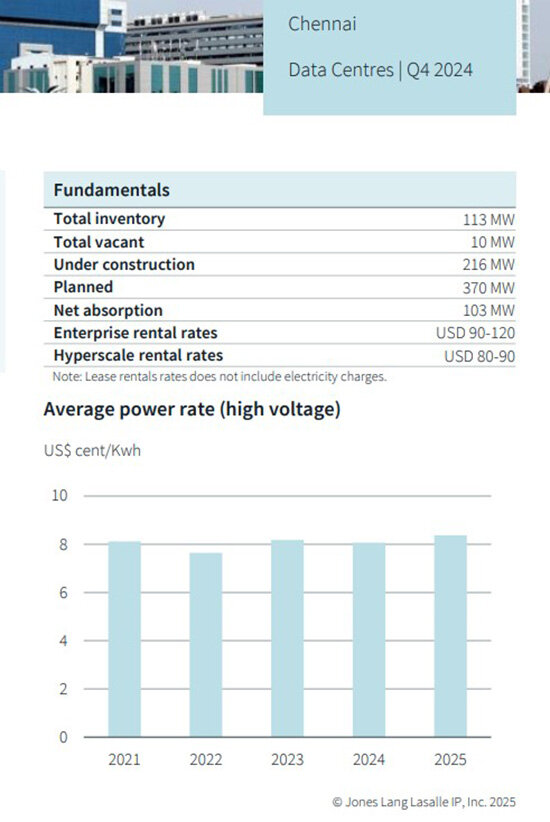

Chennai: Hyperscale-Driven Growth

Chennai is seeing strong demand from hyperscale operators, cloud service providers, banks, and Global Capability Centres. Emerging CSPs are leasing from 500 kW to 2 MW. Land banking is a common strategy, with plots reserved for future builds backed by pre-lease agreements.

While AI workloads remain limited, GPU-as-a-service models are growing. Companies are buying GPUs and colocating them. Chennai is also connected to the SEA-ME-WE 6 subsea cable linking Southeast Asia to Europe. Installed capacity is 113 MW, with 10 MW available. Another 216 MW are under construction, and 370 MW are planned. Net absorption reached 103 MW. Rental rates were $90–120/kW for enterprise and $80–90/kW for hyperscale tenants.

Outlook: Technology Shift and Strategic Reorientation

Asia’s data center sector is moving beyond traditional cloud models toward infrastructure designed for high-density AI workloads. Since 2023, specialized formats with higher rack densities, immersion cooling, and reinforced architecture have become priorities. This evolution is reshaping development strategies from design to scaling.

Market conditions are increasingly complex: some areas face oversupply, while others suffer shortages. Regulatory, environmental, and energy disparities across countries highlight the need for precise geographic and strategic choices—AI, cloud, or retail formats.

Growth will continue in established hubs like Singapore and Hong Kong, as well as emerging markets like Mumbai, Chennai, Johor, and Batam. Edge computing is also gaining importance, bringing data processing closer to end users.

The winners will be those who combine technological flexibility, secure energy access, and long-term strategy in a fragmented but rapidly evolving digital landscape.

Подсказки: Asia, data centers, AI, cloud, Singapore, Hong Kong, Mumbai, Chennai, hyperscale, colocation, APAC real estate, JLL