read also

Evacuation from the Middle East: How Countries Are Bringing Their Citizens Home

Evacuation from the Middle East: How Countries Are Bringing Their Citizens Home

Japan Corporate Bankruptcies Hit 13-Year High

Japan Corporate Bankruptcies Hit 13-Year High

Japan’s New Condo Prices Reach Record High

Japan’s New Condo Prices Reach Record High

European Gas Prices Surge Amid Middle East War

European Gas Prices Surge Amid Middle East War

EU prepares new foreign investment screening rules

EU prepares new foreign investment screening rules

Collapse of Air Travel in the Middle East

Collapse of Air Travel in the Middle East

Millions of young Chinese workers are refusing to participate in the national pension system, adding pressure to a system already strained by a record-low birth rate and an aging population, Bloomberg reports. Even before this emerging challenge, experts had forecasted funding shortfalls in the pension system within a decade.

Growing Discontent Among the Young

The publication highlights the example of Gao, a 22-year-old from Shenzhen, who, like many of his peers, sees no point in contributing $200 a month to the pension fund. He fears the funds might be depleted by the time he retires. Young workers are also dissatisfied with a system that ostensibly allows them to save for their own retirement but in reality, supports others.

Analysts estimate that approximately 10 million young workers in China are opting out of pension programs, depriving the system of critical funding just as payouts are increasing due to an aging population. Over the next decade, more than 20 million workers are expected to retire annually, while the low birth rate means fewer people will enter the workforce to sustain contributions.

Aging Population and Pension Challenges

According to a report by state broadcaster CCTV, people aged 65 and older are expected to account for 30% of the population by 2035, compared to 14.2% in 2021. By then, the number of people over 60 is projected to exceed 400 million—more than the combined populations of the U.S. and Canada. This group will make up 29% of China’s population, compared to 23% in the U.S. today.

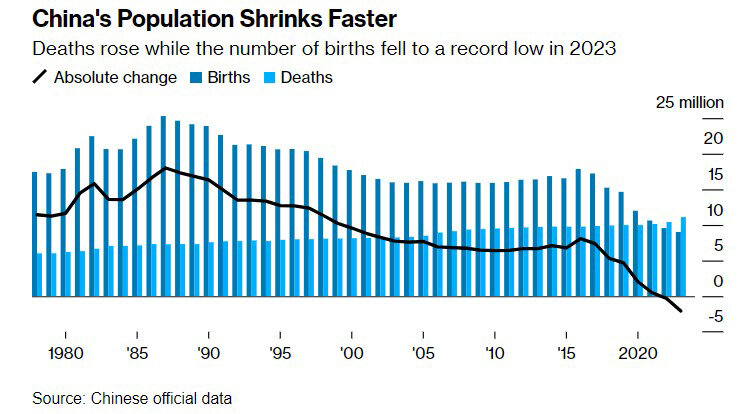

Government efforts to encourage higher birth rates have had limited impact. The birth rate fell to a record low in 2024, exacerbated by the legacy of China’s 35-year-long one-child policy, which ended in 2016. Most families now find it financially unfeasible to have multiple children. The United Nations projects that China’s population could shrink by half by 2100.

Without additional government support, the primary component of the pension system, which serves 460 million workers, could face its first annual deficit within four years. As the economy struggles with deflationary risks and a prolonged real estate slump, a potential collapse of the pension system poses another significant challenge for the world's second-most populous country.

Erosion of Trust and Economic Impact

Failure to ensure pension payouts could undermine trust in the Communist Party, particularly among disillusioned younger generations. This raises the risk of social unrest and hampers economic growth, as workers feel compelled to save what little they have instead of spending.

“A lack of trust further reduces households’ willingness to spend,” noted Zongyuan Zoe Liu, Senior Fellow for China Studies at the Council on Foreign Relations in New York. “This will intensify pressure on government finances, which are already stretched in a slowing economy.”

Government Efforts to Reform

To address the pension system’s challenges, authorities have pushed for raising the retirement age. Previously delayed due to public backlash, a policy approved in September 2024 marked the first increase since 1978. The new rules, effective January 1, 2025, will be implemented gradually over 15 years:

- Men will retire at 63 instead of 60.

- Female employees will retire at 55 instead of 50.

- Female managers will retire at 58 instead of 55.

The reform aims to boost productivity and address aging-related challenges. Economists, such as Societe Generale SA’s Michelle Lam, believe the gradual approach reflects careful consideration of the potential negative impacts. However, Shen Meng, Director of Beijing-based investment bank Chanson & Co., warned that delaying retirement could exacerbate health issues and increase demand for elderly care facilities.

Delayed Relief

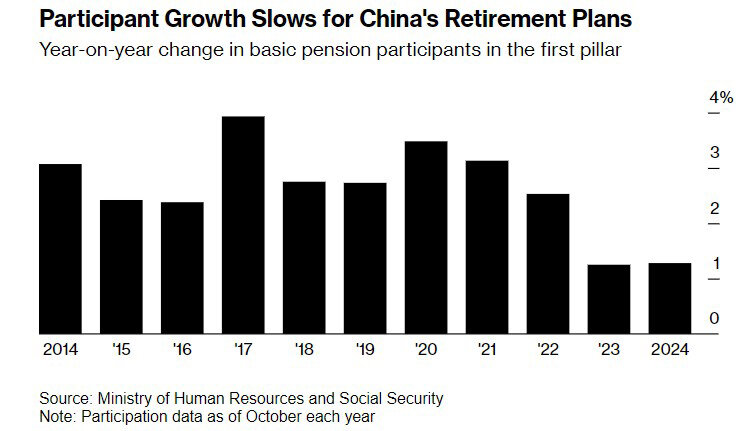

For many, these reforms may come too late. Workers refusing to contribute to the pension system risk receiving only a basic monthly pension of around $100 unless they resume payments or save independently. Analysis by Bloomberg based on Ministry of Human Resources data showed that net inflows into the two primary pension plans grew by just 2.3% in the first 10 months of 2024, totaling 542 billion yuan ($74 billion). This is a sharp contrast to double-digit growth in previous years. The total number of participants rose by only 1.3%, half the growth rate of 2019.

The slower pace of contributions exacerbates the pension fund’s financial challenges, with reserves potentially running out by 2035 even with government support. According to the Chinese Academy of Social Sciences (CASS), the urban pension system’s annual net inflows could turn negative by 2028, and the deficit is projected to reach 11.3 trillion yuan by 2050.

The CASS report recommends several measures, including:

- Delaying Retirement: Further extending the retirement age to align with global standards.

- Incentivizing Contributions: Increasing the share of personal pension accounts to encourage participation.

- State Asset Transfers: Accelerating the transfer of state-owned assets to reserve funds.

- Currency Reserves: Using part of China’s foreign exchange reserves to establish a pension fund.

While the effectiveness of these reforms remains uncertain, China’s pension system ranked 31st out of 48 in the 2021 Global Pension Index by Mercer CFA Institute.