read also

Iceland’s Four-Day Workweek Five Years On

Iceland’s Four-Day Workweek Five Years On

Mortgage Approvals in Ireland Slump Sharply in January

Mortgage Approvals in Ireland Slump Sharply in January

Lisney Property Market Outlook: Irish Property Market Poised for Steady Growth in 2026

Lisney Property Market Outlook: Irish Property Market Poised for Steady Growth in 2026

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Riots in Mexico Disrupt Air Links to Resort Destinations

Riots in Mexico Disrupt Air Links to Resort Destinations

UK House Prices Stabilise After 2025 Slowdown

UK House Prices Stabilise After 2025 Slowdown

Georgia’s Economy to Grow by 6% in 2025 – ADB Forecast

According to the Asian Development Bank’s (ADB) April 2025 Outlook, Georgia will continue its strong economic growth in 2025, maintaining resilience amid global uncertainty and rising geopolitical risks. The ADB projects a 6% GDP increase in 2025 and 5% in 2026, supported by strong domestic demand, investment, and stable macroeconomic policy.

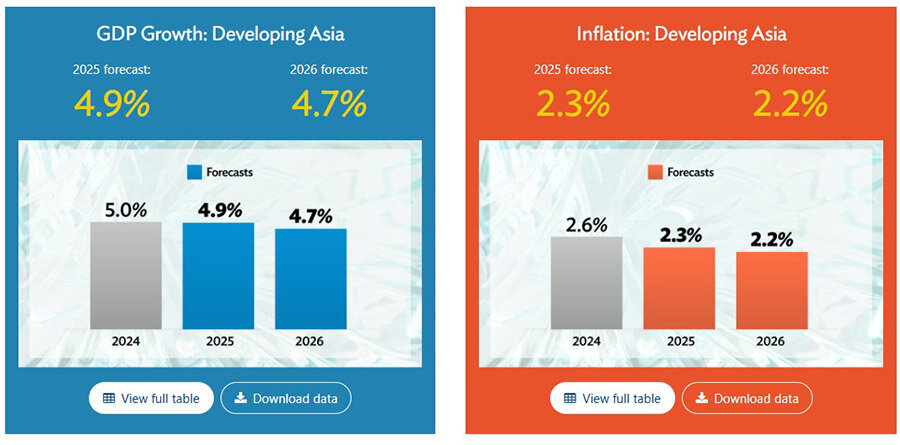

ADB notes that developing economies in Asia are expected to grow by 4.9% in 2025 and 4.7% in 2026, largely driven by domestic consumption and electronics exports. Inflation across the region is expected to ease to 2.3% in 2025 and 2.2% in 2026, allowing many central banks to pursue more accommodative monetary policies. However, the report precedes the escalation of U.S. tariffs, which may significantly alter global economic dynamics.

Regional Outlook: Caucasus and Central Asia

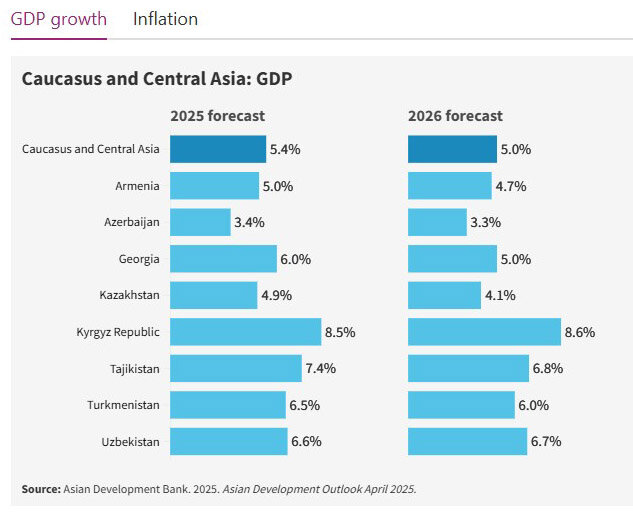

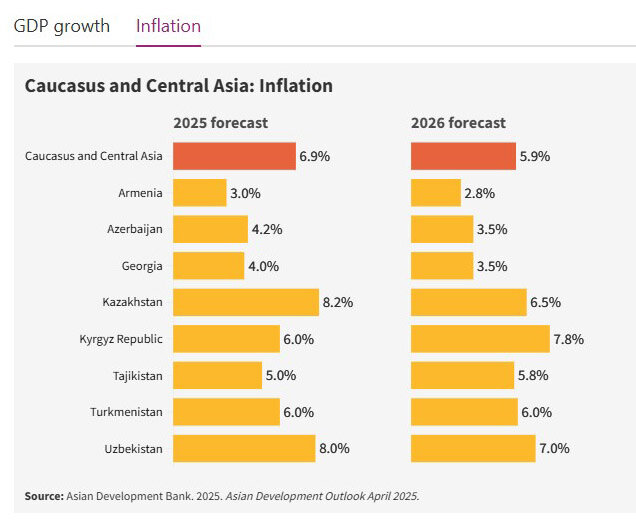

In the Caucasus and Central Asia, growth is projected to slow slightly—from 5.7% in 2024 to 5.4% in 2025, and 5% in 2026, mainly due to weaker external demand and declining remittances. Inflation in the region is expected to rise modestly to 6.9% in 2025 before easing to 5.9% in 2026.

Country-specific forecasts:

Armenia: Growth slows from 5.9% (2024) to 5% (2025) and 4.7% (2026), impacted by reduced consumption and weaker exports.

Kazakhstan: Growth of 3.9% in 2025 and 4.1% in 2026 due to increased oil output and industrial investment.

Uzbekistan: Steady growth at 5.5–5.6% supported by industrial and service sectors.

Kyrgyzstan, Tajikistan, Turkmenistan: Domestic demand and public investment remain key drivers.

Inflation risks are expected to rise due to utility price adjustments (Azerbaijan, Kyrgyzstan), credit expansion (Tajikistan), and increased public spending (Turkmenistan).

Georgia’s Outlook: Strong and Balanced Growth

Despite regional pressures, Georgia is expected to remain one of the fastest-growing economies in the region:

GDP growth: 6% in 2025, 5% in 2026

Inflation: 4% in 2025, declining to the central bank’s 3% target by 2026

Budget deficit: 2.5% of GDP (2025), 2.6% (2026)

Public debt: To fall from 25% to 24.5% of GDP

Growth Drivers:

Industry: +4.6% in 2025, +3.1% in 2026

Agriculture: +3.9%

Consumption: +4.8% (2025), +3.5% (2026)

Investment: +7–7.5% annually, driven by public-private infrastructure and energy projects

According to Lesley Birman Lam, ADB’s Georgia country director, further development of logistics, digital services, and renewable energy could unlock significant opportunities. Georgia’s geostrategic position and growing integration with EU and Asian markets are seen as key advantages.

Broader Endorsement of Georgia’s Growth

The European Bank for Reconstruction and Development (EBRD) and IMF also forecast 6% growth in 2025. Deputy Economy Minister Vakhtang Tsintsadze noted that Georgia's growth rate is among the highest in Europe and the broader region.

According to a World Bank report from January, Georgia’s average GDP growth forecast for 2025–2026 is 1.5x higher than other EU candidate countries, and 5x higher than the eurozone average.

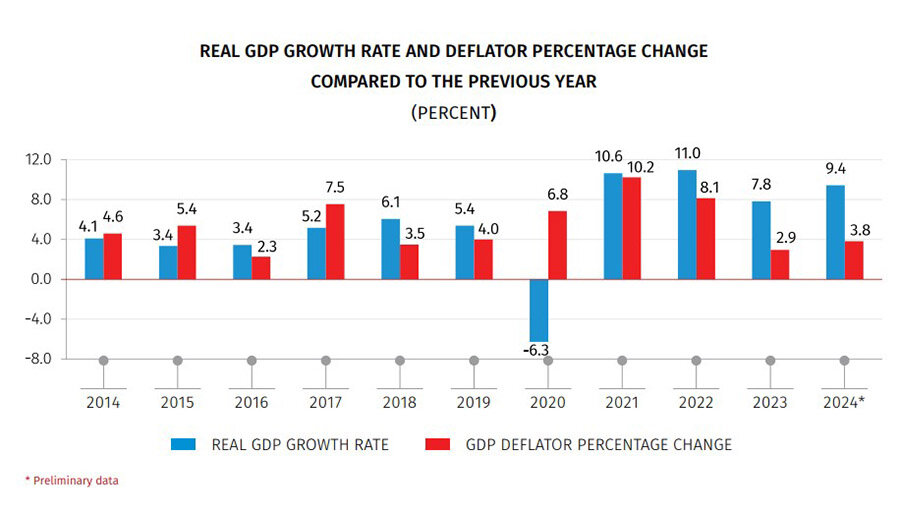

In 2024, Georgia’s real GDP grew by 9.4% (GeoStat), and the government expects similar results for 2025.

Подсказки: Georgia, ADB, GDP forecast, economic growth, Caucasus, Central Asia, investment, infrastructure, inflation, consumption, IMF, EBRD, World Bank, macroeconomic policy