Вusiness / Real Estate / Investments / Tourism & hospitality / Analytics / Research / Ireland / United Kingdom / Spain / Netherlands / France / Russia / Litva / Bulgaria / Portugal / Hungary / Poland 11.01.2026

European Hotel Operating Profit: Margins, RevPAR and Costs

In the first half of 2025, Europe’s hotel market shifted to a more moderate trajectory following a period of rapid recovery, according to Cushman & Wakefield. Hotel revenues increased primarily through higher room rates, while occupancy growth remained limited. This widened disparities between regions and city markets, with operating profit emerging as the key indicator of sector resilience.

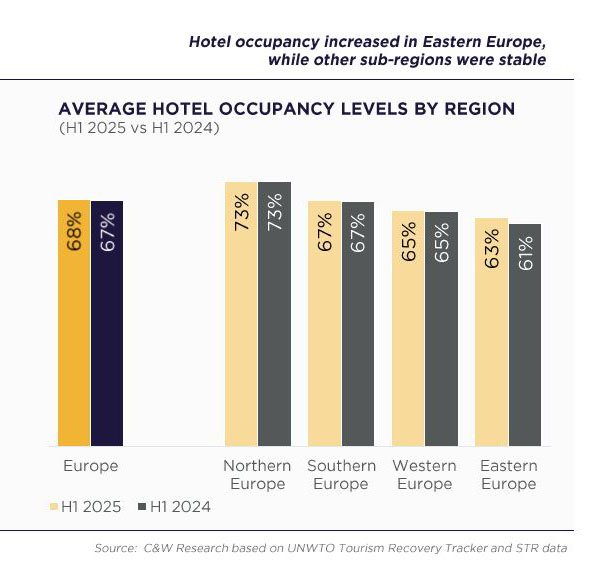

Hotel occupancy

Average hotel occupancy in Europe reached 68% in H1 2025, up by 1 percentage point year on year. The most visible increase was recorded in Eastern Europe, where occupancy rose from 61% to 63%. In Northern Europe, occupancy remained at 73%, while Southern and Western Europe posted levels of 67% and 65% respectively, pointing to a broadly stable situation across most sub-regions.

Average occupancy across Europe remained more than two percentage points below pre-pandemic levels, which were close to 70% in the first half of 2019. This leaves room for further recovery, particularly in markets with more subdued demand dynamics. The highest occupancy rates in H1 2025 were recorded in Ireland, the UK, Spain and the Netherlands. Of the 26 countries covered in the report, 21 posted year-on-year increases, with the strongest gains seen in Latvia, Bulgaria and Croatia.

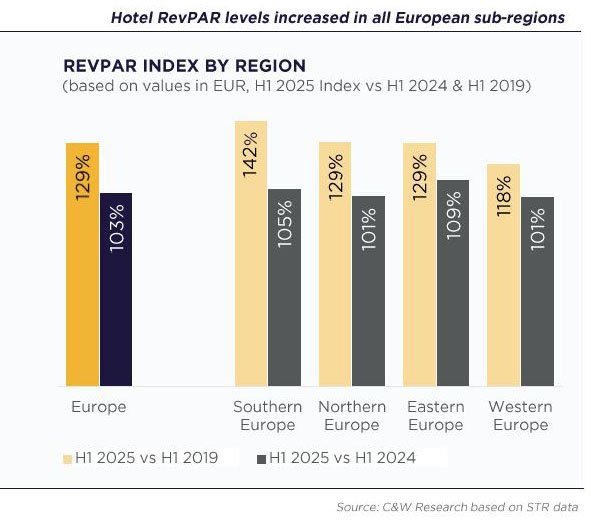

Revenue per room

With occupancy growth remaining moderate, RevPAR growth in H1 2025 was driven mainly by pricing. Average RevPAR across Europe reached €98, up 3% year on year. The increase reflected an approximate 2.1% rise in average daily rates, while the contribution from higher occupancy was limited.

At the regional level, RevPAR growth was broad-based. Across Europe, the RevPAR index reached 129% compared with H1 2019 and 103% versus 2024. Southern Europe recorded the strongest outperformance of pre-pandemic levels, with the index at 142% versus 2019 and 105% year on year. Northern and Eastern Europe also reached 129% relative to 2019, with annual growth of 101% and 109% respectively. Western Europe showed more restrained dynamics, at 118% versus 2019 and 101% compared with H1 2024.

At the country level, the strongest year-on-year RevPAR growth was recorded in Russia (+23%), Latvia (+13%) and Bulgaria (+12%). In total, six European countries reported RevPAR growth of more than 10%. Among major city markets, the highest absolute RevPAR levels were recorded in Paris, Geneva and Rome. The strongest year-on-year increases were seen in Moscow (+33%), St Petersburg (+30%), Riga (+16%), Vilnius (+15%) and Warsaw (+13%).

Cost structure and margin dynamics

In the first half of 2025, operating costs for European hotels increased by around 2% on average compared with the same period of 2024. The most pronounced cost growth was recorded in Warsaw and Budapest; in both markets, however, higher revenue growth more than offset rising expenses, allowing margins to improve.

Labour remained the largest cost component. On average, payroll expenses increased by nearly 4%. Paris was the main exception, where staff costs declined, although this coincided with a 5.2 percentage point drop in occupancy. Against a backdrop of weaker RevPAR, growth in operating profit in the French capital was driven largely by cost reductions.

Other operating expenses increased by around 1% on average. In several markets, utility costs declined by between 2% and 14% per room. Manchester stood out, however, with utility costs surging by 51%, placing significant pressure on financial performance.

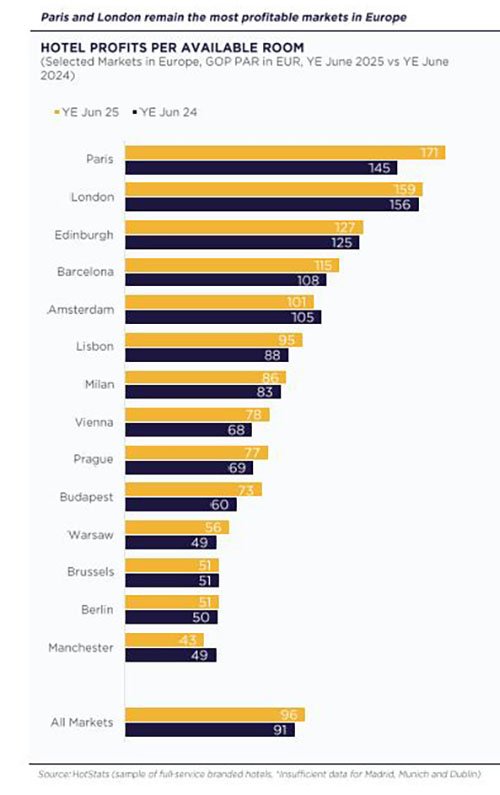

Profitability across key city markets

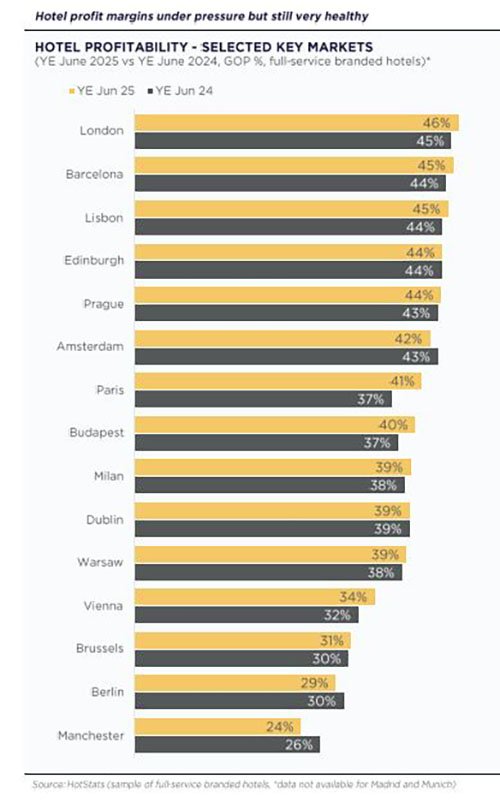

Paris ranked as Europe’s largest market by absolute operating profit. Over the 12-month period ending June 2025, GOP PAR reached €171, the highest level among the cities analysed. Operating margin stood at around 41%, below several peer markets. Profit growth was driven mainly by cost reductions, while occupancy declined by 5.2 percentage points and RevPAR dynamics remained weak, highlighting the cost-led nature of the improvement.

London retained its position as the market with the highest operating margin at 46%. GOP PAR reached €159, securing second place. Revenue and costs grew at a moderate pace, but declining RevPAR constrained further upside, with the profitability index falling to 92% compared with 2024. Edinburgh posted a GOP margin of around 44% and GOP PAR of €127, ranking third in Europe by profit per room. Cost increases were offset by a stable revenue base, without pronounced imbalances between income and expenses.

In Barcelona and Lisbon, GOP margins were close to 45%, with GOP PAR at €115 and €95 respectively, reflecting revenue growth outpacing cost increases. Comparable results were recorded in Prague, with a margin of around 44% and GOP PAR of €77. In Vienna, GOP PAR increased to €78, supported by revenue growth alongside controlled cost increases.

In Budapest, the GOP PAR index reached 116% year on year, with an absolute level of €60 and margins rising to 40%. Warsaw recorded GOP PAR of €56, with a profitability index of 114%, despite higher costs. In both markets, stronger revenue growth underpinned the improvement.

Amsterdam faced moderate pressure, with a margin of around 42% and GOP PAR of €105, as rising costs coincided with softer revenue performance. More pronounced deterioration was recorded in Berlin and Manchester. In Berlin, the margin fell to 29% with GOP PAR at around €51, while in Manchester margins declined to 24% and GOP PAR to €43 amid falling revenues and rising costs.

Conclusion

For the 12-month period ending June 2025, absolute operating profit emerged as the key indicator of hotel market performance in Europe. GOP PAR distribution confirmed a high concentration of financial results in the continent’s largest city markets, with a persistent gap between leaders and other destinations.

Year-on-year GOP PAR growth was recorded in 12 of 14 key markets. Average growth across the sample of branded full-service hotels reached around 6%, indicating continued positive momentum despite slower recovery. Markets with a strong revenue base and resilient demand, including during major events, made the largest contribution, reinforcing scale effects.

The performance gap between branded full-service hotels and independent properties remained in place. Analysts at International Investment note that stronger profit growth among chain-operated hotels reflects the benefits of scale, standardised operating models and more efficient revenue and cost management. The resilience of operating margins continues to underpin the investment appeal of the hotel sector, supported by ongoing transaction activity and investor interest in assets with predictable cash flows.