US housing construction fell to its lowest level since May 2020

Photo: Rjt-constructionllc.com

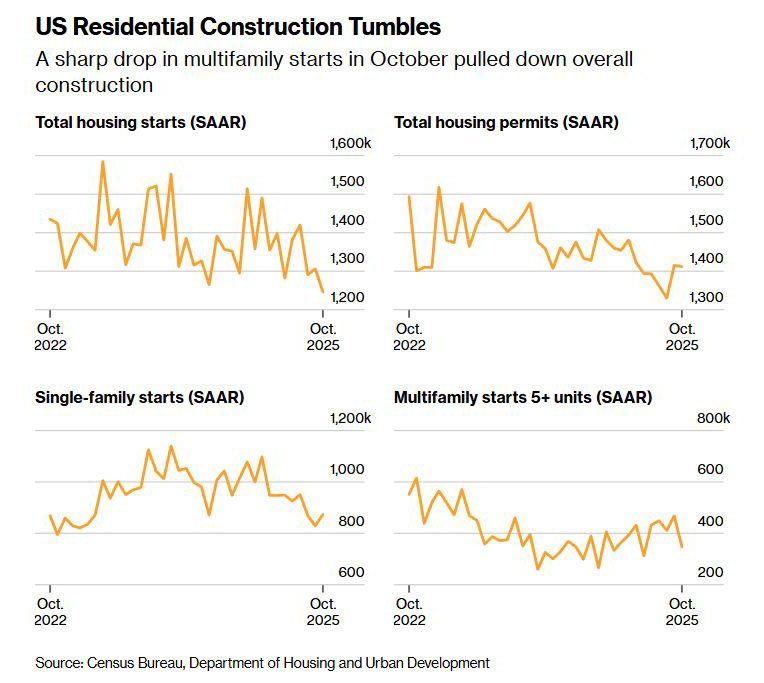

US housing construction in October fell to its lowest level since the onset of the pandemic, Bloomberg reports, citing data from the US Department of Commerce. Developers continue to scale back activity amid high property prices and persistently elevated mortgage rates. The main contribution to the decline came from the multifamily segment.

New residential construction in the US declined by 4.6% in October compared with the previous month, to an annualized rate of 1.25 million homes. The figure came in below the median forecast of economists surveyed by Bloomberg, who had expected 1.33 million. Starts of single-family homes rose by 5.4% to 874,000, but remained near the lowest levels of the past two years. At the same time, construction of buildings with five or more units fell by nearly 26%, dropping to a five-month low and becoming the key driver of the overall downturn.

In the autumn, builders continued to slow construction activity, seeking to shorten project timelines and improve operational efficiency. At the same time, they maintained a cautious stance, waiting for a recovery in buyer demand. The homebuilder sentiment index compiled by the National Association of Home Builders in cooperation with Wells Fargo remains at 39 points; a reading below 50 indicates that negative assessments outweigh positive ones.

Regionally, housing starts in the southern states, the country’s largest homebuilding region, edged higher after falling in September to the lowest level since May 2020. A modest increase was also recorded in the Midwest, while activity declined in the Northeast and the West. The report also highlights the high volatility of the dаta: with 90% confidence, the monthly change ranged from a decline of 15.8% to a gain of 6.6%. This adds to forecasting uncertainty and reinforces the cautious strategies of market participants.

Against the backdrop of growing concerns over housing affordability, US President Donald Trump proposed banning institutional investors from purchasing single-family homes and urged mortgage agencies Fannie Mae and Freddie Mac to buy $200 billion in mortgage bonds to help lower borrowing costs.

Developers’ restrained activity persists despite some improvement in affordability conditions. Mortgage rates, which approached 7% in May, declined through September and October and reached 6.25% in early January, the lowest level in more than a year. In addition, according to the latest available federal data through August, prices for new homes fell for most of last year.

Executives at construction companies have yet to see a clear turning point. Lennar Chief Executive Officer Stuart Miller said during a recent earnings call that falling interest rates could signal the start of a market recovery, but that the anticipated turnaround has not yet materialized.

A number of analytical centers and industry organizations agree that the current decline in construction volumes does not point to a long-term crisis, but rather reflects a wait-and-see strategy among developers. Economists at Zillow expect the US housing market to move toward gradual stabilization in 2026, with existing-home sales potentially rising by around 4.3% and price growth remaining moderate at about 1.2%. At the same time, analysts emphasize that new construction remains the weakest link in the market, as builders are reluctant to launch projects before demand shows a sustained recovery.

A more optimistic scenario is outlined by the National Association of Realtors. Its forecasts for 2026 suggest double-digit growth in home sales compared with current levels, while the new-home segment, despite fewer starts, could see transaction growth of about 5%. The association believes that pent-up demand and a gradual easing of credit conditions could bring back buyers who previously exited the market due to high rates.

Data on the secondary market also point to relatively resilient demand. Existing-home sales in the US in recent months have remained near 4.1 million units on an annualized basis, indicating that core market activity is being maintained even as new construction declines. This supports the view that the market has not stalled, but is instead adapting to new financial conditions.

Another factor that could shift the balance in 2026 is the trajectory of mortgage rates. US business media note that in early January rates on 30-year mortgages fell below 6%, a psychologically important threshold for buyers. Against this backdrop, shares of major homebuilders rose, and interest in home purchases began to recover even before any potential government support measures are implemented.

At the same time, Federal Reserve officials in comments to Reuters stress that lower rates alone will not solve the housing affordability problem. The key constraint remains a shortage of supply, particularly in fast-growing regions, and without an increase in construction volumes, any market recovery may be fragmented and uneven.

Analysts at International Investment note that the October drop in housing construction to the lowest levels since 2020 shows the market remains in a phase of cautious adjustment to expensive mortgages and high prices. At the same time, easing rates and forecasts for sales growth in 2026 create conditions for a gradual recovery in demand. The key question for the coming quarters is whether supply will be able to catch up with a potential rebound in buyer activity; without an expansion in construction, improvements in housing affordability risk remaining limited and uneven across regions.