Georgia’s Economy: GDP Growth and Slowing Inflation

Georgia continues to demonstrate a stable economic trajectory and sustained growth. According to reports from the National Bank for 2024 and Q1 2025, forecasts for GDP growth have been raised from 5% to 6.7% due to robust macroeconomic indicators and consistent development trends.

2024: Production Growth and Strong Domestic Demand

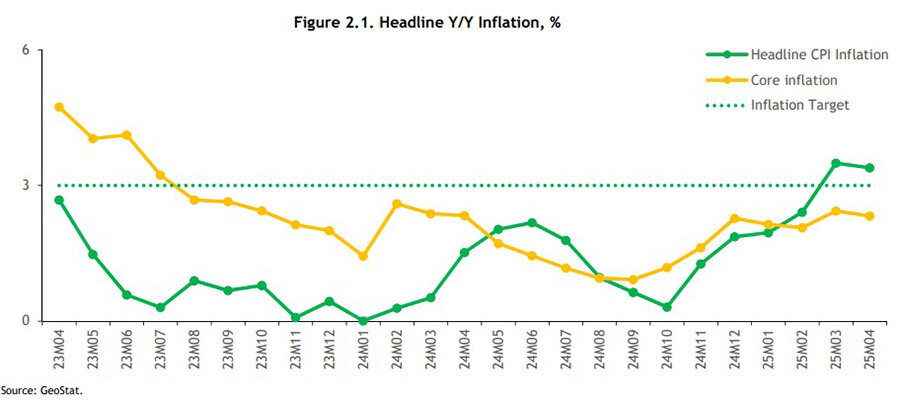

The President of the National Bank of Georgia, Natia Turnava, presented the 2024 report to parliament, highlighting the country’s remarkably low inflation rate — averaging just 1.1%. Core inflation, which excludes volatile food, energy, and tobacco prices, was slightly higher at 1.6%.

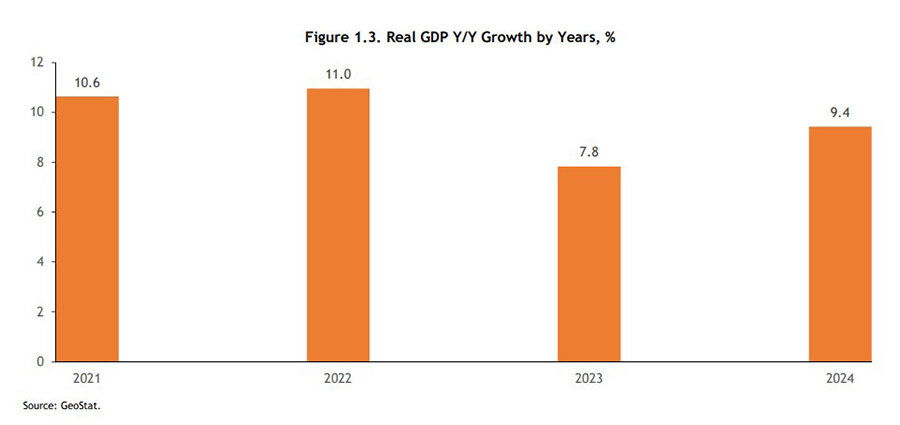

This outcome, according to Turnava, stems from internal economic drivers and consistent monetary policy. Economic output capacity and strong consumer demand both played key roles. Georgia’s real GDP growth in 2024 reached 9.4%, while the national currency, the lari, remained relatively stable — helping keep inflation down.

Turnava also stressed the importance of boosting high-productivity sectors such as IT, logistics, transport, and construction. She emphasized that Georgia has seen strong economic growth in recent years without inflationary overheating:

“There are few examples of countries with high growth and low, stable inflation,” she noted.

2025: Construction, Trade, and Core Sectors Lead

According to the macroeconomic review of the National Bank for March–April 2025, the country’s economic activity is still driven primarily by domestic demand and sectors with high employment rates — notably construction, retail and wholesale trade, and financial and insurance services. In contrast, manufacturing posted a drop in production.

Inflation remains low: as of April 2025, the consumer price index rose just 2% YoY, with core inflation at 2.3%. Meanwhile, goods exports fell by 1.5% compared to April 2024 — mainly due to a drop in shipments to Russia, while exports to the EU rose by 7.4%.

Tourism revenues in Q1 2025 rose by 24.9% compared to the same period in 2024, thanks to an increase in visitor numbers and average per-tourist spending. As a result, Georgia's current account deficit dropped significantly.

The banking sector remains resilient, with 14.6% loan growth and a stable 2.4% share of non-performing loans. While deposit growth slowed, the lari’s share in deposits increased, and lending in foreign currencies declined, in line with dedollarization goals.

Forecasts and Outlook

The National Bank of Georgia raised its 2025 GDP growth forecast from 5% to 6.7%, citing stronger-than-expected activity and a slower normalization of global conditions.

The refinancing rate remains unchanged at 8% amid global uncertainties. Inflation risks could emerge from both domestic and international fronts. However, the weakening of the U.S. Dollar Index (DXY) is supporting the lari and lowering the cost of foreign debt servicing, thus helping curb inflation.

Falling global oil prices also have a disinflationary effect, tied to lower demand expectations and potentially higher supply. Analysts underline that Georgia's macro fundamentals remain solid.

According to national statistics, real GDP in Q1 2025 grew by 9.3%, while foreign trade turnover rose to $5.62 billion, up 16.1% YoY. Exports increased by 5.7%, and imports surged by 20.1%. Georgia’s main trade partners remain the U.S., Turkey, Russia, China, and Azerbaijan.

International rating agencies have also upgraded Georgia’s growth projections to around 6%, but the government anticipates an even stronger year — expecting GDP growth to hit 10% by the end of 2025.

Подсказки: Georgia, economy, GDP, inflation, tourism, construction, exports, investment, National Bank of Georgia, 2025 forecast, macroeconomics