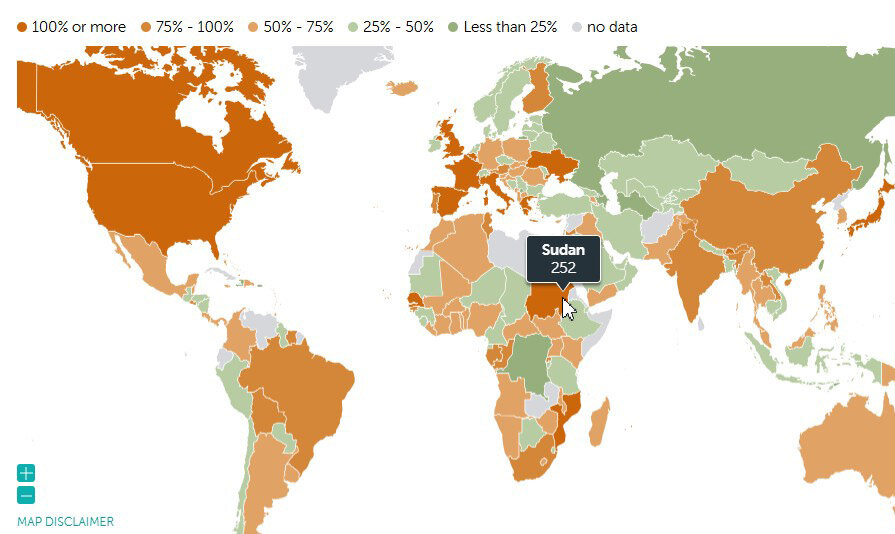

The International Monetary Fund (IMF) has published its World Economic Outlook containing data on government debt levels for countries around the world in 2025. These figures help assess fiscal pressure amid rising interest rates, geopolitical instability, and a slowdown in the global economy.

According to IMF experts, global government debt could reach 100% of the world’s gross domestic product by the end of the decade if current trends continue. Rising debt-to-GDP ratios reflect renewed economic pressure and the lingering consequences of financial support during the pandemic. This trend raises new concerns about long-term fiscal sustainability, as many countries face growing budgetary challenges.

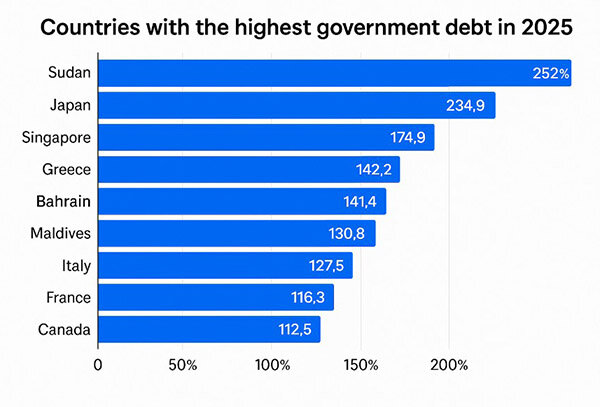

Top 10 Most Indebted Countries

The IMF report names Sudan as the global leader in government debt, with an expected debt-to-GDP ratio of 252% in 2025. This figure underscores the severity of the situation for a country enduring prolonged internal conflict and instability. Japan ranks second with 234.9% of GDP. Much of Japan’s debt is held domestically, and interest rates remain low. Third on the list is Singapore at 174.9% of GDP. The country’s high debt level is linked to significant infrastructure programs and active issuance of government bonds to raise domestic resources.

Greece stands at 142.2% of GDP, the result of a long fiscal overhaul following the crisis of the early 2010s and EU fiscal policy. Bahrain ranks fifth at 141.4%, driven by dependence on oil revenues and the need to fund domestic social programs.

In sixth place are the Maldives (140.8%), owing to active state investments in tourism and infrastructure. Italy follows in seventh with 137.3% of GDP, as reducing debt remains a top fiscal priority in the Eurozone. Next is the United States, projected at 122.5% of GDP, due to pandemic-era economic support measures, high defense spending, and servicing existing obligations.

In France, the figure is expected to reach 116.3%, driven by robust social policies and business support amid economic shocks. Canada rounds out the top ten with a ratio of 112.5% of GDP, reflecting ongoing funding for social and infrastructure policies despite rising interest rates.

From Senegal to Albania

Senegal leads the second tier with a debt-to-GDP ratio of 111.4%. Ukraine follows in twelfth place at 110.0%. This figure reflects prolonged instability and rising public spending during wartime. For Ukraine, fiscal support from external partners and the state’s ability to address domestic challenges remain key.

Belgium ranks 14th with 106.4%, a mature EU economy facing rising social costs and higher interest rates. The United Kingdom (103.9%) struggles to balance major social obligations with tightening fiscal policy. Spain sits in 18th place at 100.6%.

In the third tier are China (96.3%) and Portugal (91.8%). Further down are Egypt (86.6%), Finland (86.4%), India (80.4%), and the Bahamas (79.4%). Hungary ranks 45th at 73.5%, followed by Argentina at 73.1%. Israel occupies the 54th spot at 69.1%, and Germany is in 63rd place at 65.4%. Also included are:

- Thailand – 64.5%

- Cyprus and Montenegro – 60.3%

- Seychelles – 59.3%

- Philippines – 58.1%

- Croatia – 55.9%

- New Zealand – 55.3%

- South Korea and Armenia – both at 54.5%

- Albania – 54.3%

Low Debt Levels

Some countries in 2025 maintain low government debt levels—around 30–40% of GDP—highlighting effective fiscal policy and the ability to balance expenditures, borrowing, and growth support.

Switzerland (36.9%) maintains low debt through careful budget planning and efficient government spending, creating space for social programs and technology development. Ireland (36.7%) is similar, demonstrating effective tax policy and the ability to attract major investors in technology, healthcare, and innovation.

Moldova (36.3%) follows a restrained borrowing model for funding development programs, maintaining resilience amid regional instability. Georgia (35.8%) keeps moderate debt levels while making large-scale infrastructure and energy investments, which help strengthen logistics and tourism.

Sweden (33.7%) ensures stable funding for social programs and economic modernization, contributing to financial resilience. For the UAE (32.8%), low debt results from building reserves and developing key industries like energy, logistics, and tourism, forming a strong financial base for ambitious projects.

Russia maintains an exceptionally low debt level for a major economy—about 21.4% of GDP in 2025. This provides flexibility under external risks and limited capital market access, enabling social and infrastructure programs despite global instability. Similarly, Turkey is at 26.7%, indicating a relatively stable fiscal position for an emerging economy.

The Lowest Debts

Some jurisdictions will keep government debt at minimal levels—just a few percent of GDP—in 2025. Macau ranks first with a debt ratio near 0%, ensuring solid budgetary stability for a territory relying on tourism and gaming.

Brunei maintains a 2.2% debt ratio, thanks to oil and gas revenues that reduce the need for external borrowing. Tuvalu (3.3%) operates on a small economy and international aid. Turkmenistan (4.5%) also shows low debt due to natural resource revenues.

In these countries, low debt often results from unique economic models, reserve accumulation strategies, and limited external financing needs. This offers room for domestic reforms even amid global uncertainty.

Conclusion

According to the IMF, debt is rising faster in 80% of the world’s economies in 2025, meaning not only increased fiscal burdens but also reduced maneuverability in a volatile global environment. The current landscape underscores the importance of a balanced approach—combining fiscal discipline with growth support is key to safeguarding public finances. For nations nearing critical debt levels, solutions will require both debt reduction strategies and institutional reforms to improve government spending efficiency. This combination can help contain debt growth and restore sustainable development potential in a changing global economy.