China’s Central Bank Is in No Hurry to Cut Rates: Support for the Economy Will Be Targeted

Photo: Wikipedia

The People’s Bank of China confirmed it will maintain a supportive monetary policy stance while expressing concern over aggressive stimulus measures. Borrowing costs will be kept at low levels, but easing will remain targeted, Bloomberg reports.

In a statement following the fourth-quarter meeting of its monetary policy committee, the People’s Bank of China made no reference to potential cuts to interest rates or the reserve requirement ratio, despite market expectations. The regulator said it intends to deploy “multiple tools” and again used the term “cross-cyclical” policy, signaling an approach aimed at managing the economy beyond the short-term cycle.

Goldman Sachs economist Xinquan Chen described the central bank’s rhetoric as a signal in favor of a reactive approach. In his view, the changes in wording point to a more cautious and flexible stance toward easing. This restrained position persists despite deteriorating domestic demand indicators. Retail sales growth in November was the weakest since the pandemic-driven slump, while fixed-asset investment is heading toward its first annual decline since at least the late 1990s.

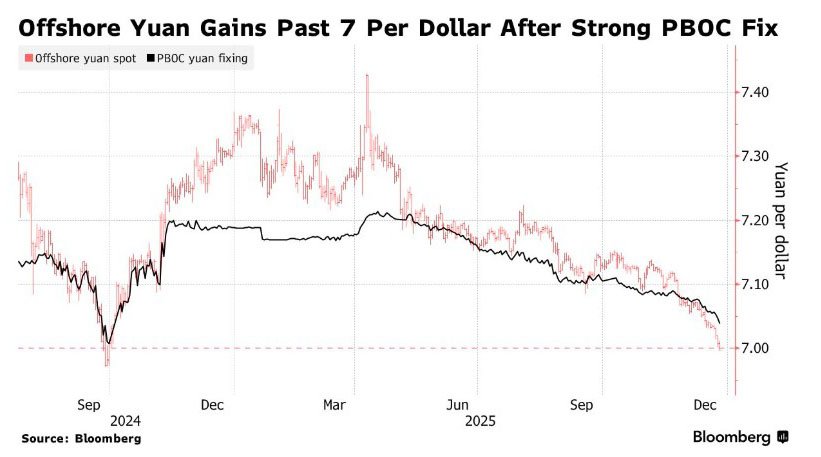

The monetary policy committee said it would determine the scale and timing of measures based on changes in domestic and external conditions. It also reaffirmed its commitment to the basic stability of the yuan at a reasonable and balanced level to avoid sharp exchange-rate swings. Meanwhile, the national currency strengthened amid expectations that the People’s Bank of China would allow a gradual appreciation to bolster market confidence. In December, the yuan rose past the 7-per-dollar level for the first time since September 2024 after the regulator set its daily reference rate at the strongest level for that period. The offshore yuan climbed to 6.9964 per dollar, while in onshore trading the rate strengthened to 7.0067, with flows tilted toward selling the US currency.

Experts note that the yuan is on track for its best annual performance in the past five years, supported by a weaker US dollar, capital inflows into Chinese equities and easing geopolitical tensions. In recent months, authorities have guided the currency higher in a controlled manner, avoiding sharp volatility in the foreign-exchange market. Analysts at Goldman Sachs say that despite the recent gains, the yuan remains undervalued by about 25% relative to economic fundamentals. ANZ expects the exchange rate to trade in a range of 6.95–7 per dollar in the first half of next year.

Over the past year, the regulator has repeatedly refrained from deeper rate cuts despite economists’ expectations. At the same time, the statement retained the wording on “ample” liquidity, with the emphasis placed not on volume but on the efficiency of fund use, pointing to a preference for targeted measures rather than broad-based monetary expansion.

Analysts at China Galaxy Securities expect a 50-basis-point cut to the reserve requirement ratio in the first quarter of 2026 to ensure sufficient liquidity and keep government borrowing costs in check. Any reduction in the key policy rate of 10–20 basis points, they say, would likely be triggered only by mounting economic pressure, including rising unemployment or a deterioration in US-China relations.

Analysts at International Investment note that the current rhetoric of the People’s Bank of China suggests policy adjustments will only come in response to a significant shift in economic conditions. Until then, the regulator is likely to limit itself to fine-tuning individual instruments, avoiding pre-announced moves. Against the backdrop of weak domestic demand and pressure on investment activity, the room for abrupt decisions remains limited.