Key Trends for the EMEA Real Estate Markets in 2025

Colliers experts have published a study dedicated to the capital markets of EMEA countries, considering recent market and geopolitical developments. The report highlights changes in investor sentiment regarding opportunities and challenges in European real estate. It also examines asset preferences, capital costs, and resilience.

European Economic Outlook

The dissolution of the French parliament and Germany’s coalition at the end of 2024, combined with concerns over the viability of the UK government's autumn budget, have contributed to uncertain prospects for Europe's largest economies. This has led to an increase in bond yields. The new U.S. administration plans to introduce a series of new economic and foreign policy measures, increasing uncertainty, particularly concerning inflation forecasts.

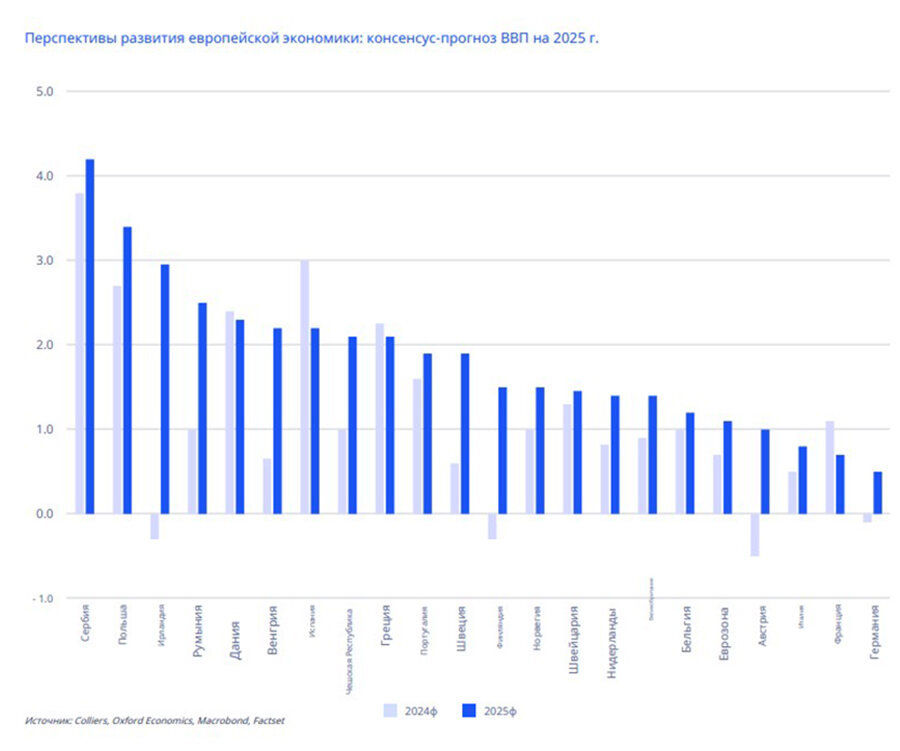

In 2024, economic indicators were weak as inflation took longer to reach target levels, allowing for rate cuts to stimulate market liquidity. GDP forecasts for 2025 are more promising.

Europe’s largest economies face structural challenges reflected in GDP growth rates, which are currently at the lower end of the spectrum. Meanwhile, Northern Europe, Iberia, Italy, Greece, and the Central and Eastern European (CEE) markets are showing growth at the higher end.

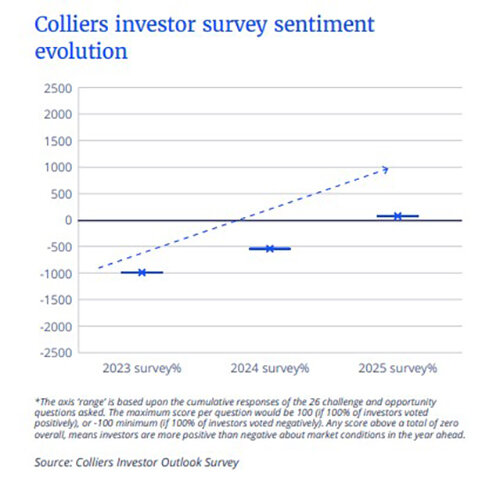

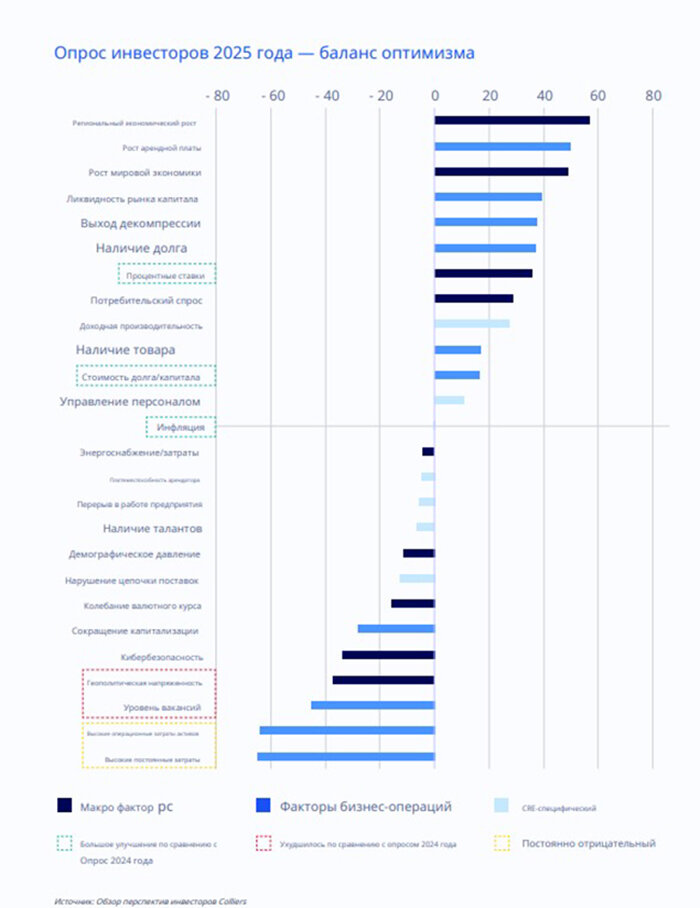

Investor sentiment on inflation improved significantly by the end of 2024, reaching a neutral stance. Much will depend on the new U.S. government's economic policies. The EU is expected to increase LNG and oil imports from the U.S., which could ease concerns over high tariffs. Similarly, many European manufacturers already produce goods in the U.S. for the American market. Despite external pressures, policymakers aim to normalize interest rates in 2025.

Global cross-border activity hit a low in early 2024 but began to increase in the second half as key market indicators improved. Despite ongoing uncertainty, global capital activity is expected to expand in 2025, led by U.S. private equity. Japanese capital allocations are also anticipated to rise.

Investment Activity by Sector

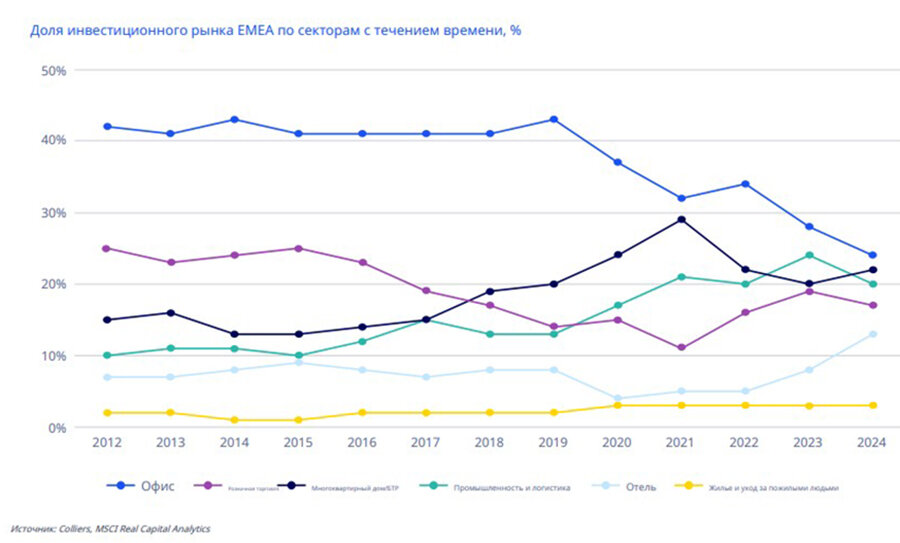

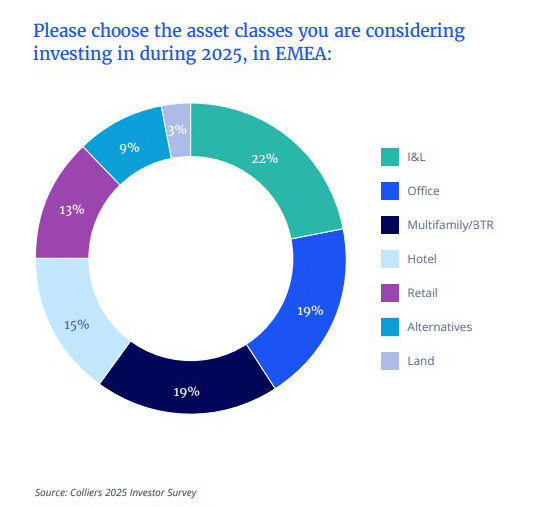

In recent months, investment activity in Europe has become more balanced across asset classes. The hospitality and tourism sectors have seen significant growth, while office investments have declined. Investor surveys for 2025 indicate that this trend is expected to continue. While all sectors are likely to remain active, there will be significant variations in where and how capital is allocated.

Offices

Colliers experts had anticipated a gradual recovery in office investments, but recent bond rate changes have pushed core office strategies to the background. Slower rate cuts will also limit liquidity in the sector, given high levels of capital erosion (over €100 billion) accumulated in recent years (as of Q4 2024).

U.S. capital is expected to remain active overall, but office investments remain a lower priority. With $2 trillion in office debt maturing in major U.S. markets by the end of 2026—some of which may struggle to secure refinancing—sentiment toward the sector remains cautious.

Conversely, APAC investors are more optimistic about the office sector, particularly due to potential rental growth in Grade A office spaces across European markets. However, analysts predict that value-add and opportunistic strategies will be the most active—at least in the short term—as the sector continues repositioning toward high-quality core assets.

Retail

Shopping centers made a comeback in 2024, with several major deals completed across European markets. Retail has benefited from early price corrections and reassessments of existing centers in terms of size, scale, format, and tenant mix. New supply remains very limited, and rental prices have stabilized at more affordable levels.

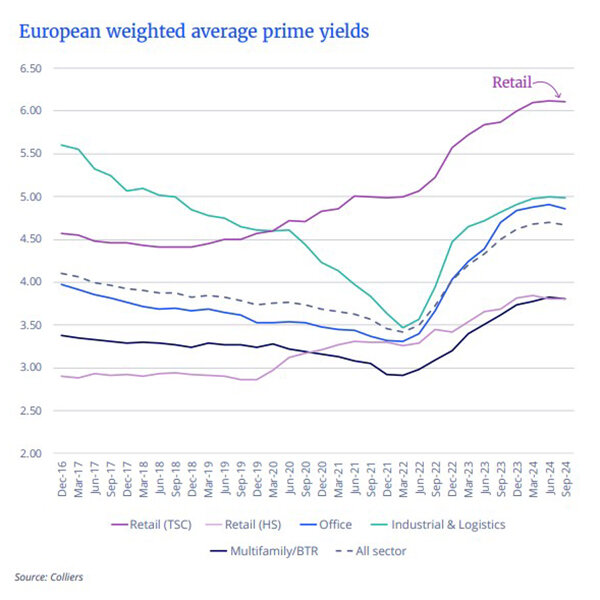

The retail rental outlook for 2025 suggests stability for the first time in years. With household incomes and retail spending also on stable or growing trajectories, the sector is well-positioned for further recovery. Another key advantage, according to experts, is the yield premium over other sectors—at least 125 basis points higher than the next best-performing sectors (industrial and logistics). Retail parks also continue to show strong fundamentals, with rental growth and lower asset management costs driving investor interest.

Hotels

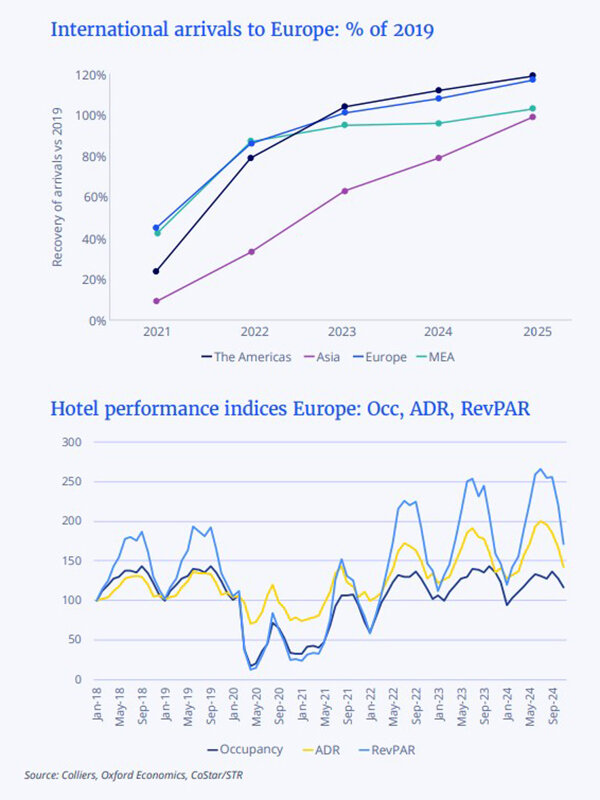

Colliers' forecasts for the hospitality sector remain unchanged for 2025, with experts maintaining a positive outlook. Pricing remains somewhat opaque, but prime yields at around 5% remain attractive. Occupancy rates are now near or at pre-COVID levels, and these trends are expected to continue.

Arrivals from the Asia-Pacific region have yet to fully recover but are expected to increase by more than 20% in 2025. Arrivals from the Middle East are also set to rise further. In some locations, record-high occupancy levels are expected to surpass previous peaks, driving new hotel supply.

ADR growth slowed in 2024, reducing the sector’s impact on broader inflation and maintaining affordability. This suggests that RevPAR will be more sustainably driven by higher occupancy levels.

With increasing capital inflows into the hospitality sector and growing investor interest in joint ventures, mergers, and acquisitions, the sector is ripe for activity due to the fragmented nature of hotel ownership—especially among small to mid-sized operators.

Residential Sector

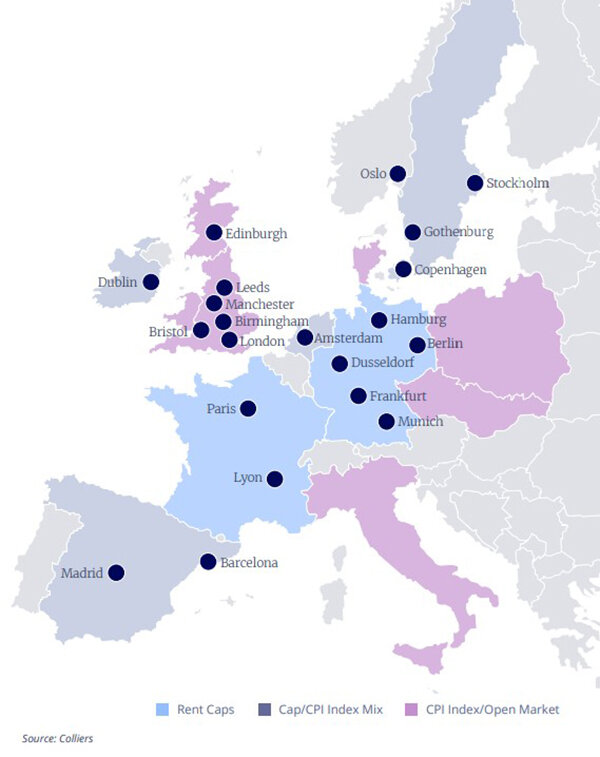

The residential sector offers numerous opportunities and remains a highly popular asset class. However, the investment appeal of the core build-to-rent (BTR) segment is uncertain due to very low yields. Value-add and development strategies face pricing challenges given high and often complex construction costs, depending on location. The gap between supply and demand appears significant, with buyers expecting higher returns. Rent control regulations across Europe add to the sector’s challenges—only a few countries operate on a fully open-market basis, while most are tightening regulatory frameworks.

Co-living and student housing remain active, with growing momentum as these segments benefit from more straightforward planning, construction, and rental structures. PBSA investment activity is expected to expand in 2025.

The most attractive alternative investment choice in 2025 may be senior housing. Cross-border investors from the UK were more active in this segment than in any other sector in 2024.

Industrial & Logistics

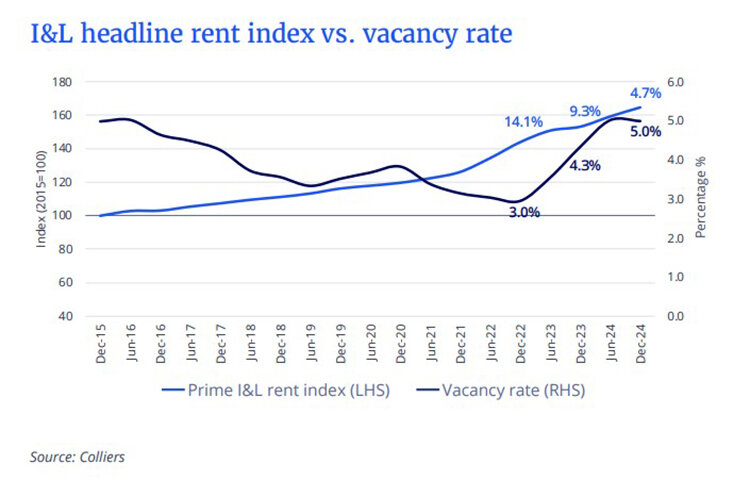

The industrial and logistics (I&L) sector presents multiple reasons for optimism. Experts anticipate real rental growth, even though the post-COVID boom in the sector has ended. Vacancy rates average around 5%, significantly below the natural level. E-commerce is resuming its growth trajectory as real retail spending and incomes improve, which should support continued absorption. Overall, I&L investment volumes are expected to rise across Europe.

The ability of I&L assets to generate on-site renewable energy, support broader networks, and integrate increasingly sophisticated technological infrastructure further enhances their value. Liquidity in the sector may be at an all-time high, supporting rental price stability and improving operational performance. Additionally, data centers continue to attract significant interest, driven by the growth of AI.

Peripheral European countries are experiencing higher economic and consumer growth, with much lower operational costs—particularly labor—than in core Europe. This has driven increased activity in CEE, Northern, and Southern European markets, where investors are becoming more comfortable, particularly as return profiles remain attractive.

Global capital is reawakening. The industrial and logistics sector is on a path of sustained growth, supported by AI, technology, energy, and infrastructure development. Core office markets remain constrained, with modernization and repositioning expected to dominate investment strategies.

In the residential sector, student housing and senior living will lead in investment volume growth, while multifamily BTR faces yield challenges.

Retail and hospitality are poised for the most substantial expansion, with rising prices, yields, supply volumes, and overall investment activity.