China Lowers Inflation Targets as Deflation Concerns Grow

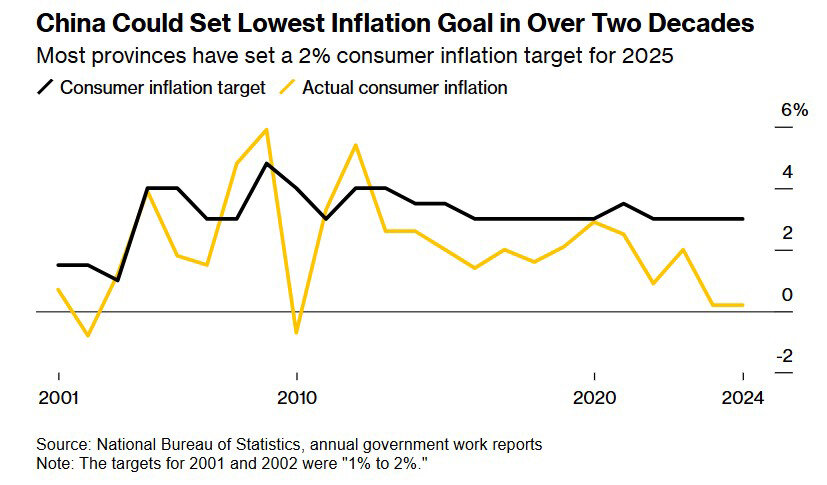

Almost all Chinese regions have reduced their inflation forecasts for 2025, Bloomberg reports. Experts believe that these new trends could signal a decision in March to set the national inflation target below 3% for the first time in more than 20 years.

As the world's second-largest economy struggles to overcome deflationary pressures, Chinese authorities are beginning to acknowledge the difficulty of achieving faster price growth. Consumer inflation stood at just 0.2% in both 2023 and 2022. Out of 31 provinces in China, 27 have set an inflation target of around 2% by the end of the year, according to local government statements. This marks a decline from the 3% level forecasted for 2024, which aligned with the national outlook.

Local economic policies are closely tied to the priorities that will be announced after China's annual parliamentary session in March. This shift at the provincial level likely indicates that central authorities will adopt a similar inflation target. This view is supported by economists at Goldman Sachs and Chinese brokerage firms such as Guosheng Securities.

China typically treats its annual inflation target as a ceiling rather than a mandatory goal. Since 2004, the government has maintained a 3% target, with the last adjustment occurring in 2020 during the pandemic when it was raised to 3.5%. Lynn Song, chief economist at ING Bank in Hong Kong, believes the new target will serve as a benchmark for officials. Unlike growth targets, inflation levels are rarely achieved through specific intervention measures.

A Shift in Economic Strategy

Breaking with long-standing practices reflects a more pragmatic approach to managing China's $18 trillion economy, as the country faces the risk of higher U.S. tariffs following a wave of stimulus measures in late 2024. Domestic demand remains weak due to the ongoing housing crisis, and China is experiencing its longest period of price declines in decades.

Lowering inflation targets may also signal a reduction in credit expansion goals, which are usually set based on economic growth and price trends. Total lending grew by 8% last year, aligning with these two key indicators. China began setting annual consumer inflation forecasts in 2001. Before that, the country used other price indicators without specific numerical targets.

Policy Dilemmas and Market Reactions

Central banks in developed economies typically set a 2% inflation target and adjust monetary policy to achieve it. However, the People’s Bank of China (PBOC) does not have a single inflation target. Instead, it faces competing priorities, including stimulating growth and stabilizing the yuan. Amid increasing pressure on the Chinese currency in recent weeks, the central bank has avoided easing monetary policy and allowed liquidity to contract.

Unlike other major economies, consumer prices in China did not rise after the country reopened post-pandemic. Over the past two years, economists consistently overestimated inflation, as the real estate crisis and a weakening labor market restrained consumer spending.

The government has pledged to prioritize boosting consumption in 2025, but its efforts have so far produced only temporary results. According to a median forecast from a Bloomberg survey, consumer inflation in China is projected to reach 0.8% by the end of the year.

While top policymakers have recently focused more on deflation concerns, stimulus measures still primarily aim at achieving real GDP growth adjusted for price changes. China’s GDP target for 2025 is expected to remain around 5%, based on growth goals set by key provinces. However, it remains unclear whether authorities will treat the new inflation target seriously and take additional steps to restore consumer prices.

Regional Variations in Inflation Targets

Among the four provinces that differ in their inflation forecasts:

- Tibet has set a 3% target

- Yunnan has not announced a specific goal

- Shandong aims for a "reasonable level" of consumer price growth

- Hunan has aligned its target with the national forecast

If China lowers its national inflation target to 2%, but continues to treat it as a ceiling, Goldman Sachs economists, including Andrew Tilton, believe it may have little to no market impact—or even a negative effect, given that consumer price inflation remains below 1%.

"If the shift from 3% to 2% reflects a move toward a ‘target’ rather than a ‘ceiling,’ it would signal additional policy measures to boost demand and inflation," the report states.

Earlier, analysts warned that China is experiencing its longest deflationary streak since the 1960s, forecasting further price declines. Economic challenges have led households to save rather than spend.

Despite optimistic forecasts for real GDP growth by the end of 2024, concerns remain about hidden structural problems. The housing market crisis, which has significantly impacted household wealth, is one of the main reasons for prolonged deflation. While there have been some signs of recovery in housing sales and retail trade, these improvements are not enough to reverse the overall downward price trend.

Frederic Neumann of HSBC argues that combating deflation effectively will require stronger and more consistent measures. Overall, despite some signs of economic recovery, risks remain significant. Weak consumer demand, the ongoing real estate crisis, and global trade uncertainties—including a potential trade war with the U.S.—posserious challenges fnot addressed with decisive and sustained policies,risks prolonged deflation, whicbusiness investments, consumer spending, and overall economic growth.