Yuan Falls to Lowest Level Since 2007 Amid New U.S. Tariffs

The trade tensions between the U.S. and China have reached new heights in 2025, with both sides launching their most aggressive tariff measures in years. The fallout is reverberating across global markets, pressuring emerging-market currencies and shaking investor confidence.

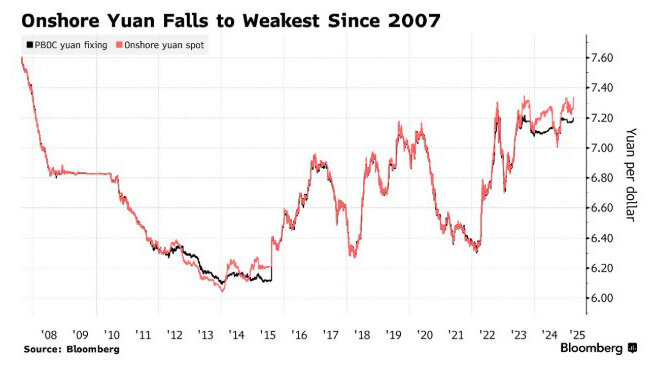

Yuan Hits Multi-Year Lows

The Chinese yuan fell to 7.3498 per dollar on the domestic market—its lowest level since December 2007. Offshore trading saw the currency briefly hit a record low of 7.4288 per dollar. Against a broader basket of trading partner currencies, the yuan also weakened, with the Bloomberg CFETS RMB Index hitting a 15-month low.

This decline follows the new U.S. tariff package introduced in April, which includes duties of up to 104%, and as high as 125% for certain goods, according to Reuters and Bloomberg.

In response, China has imposed 84% tariffs on all U.S. imports and has vowed to "[fight to the end]" against what it calls unjust American restrictions.

China’s Currency Strategy

The People’s Bank of China (PBOC) has been lowering the yuan’s daily reference rate—known as the "fixing"—for six consecutive sessions. This fix guides onshore trading and signals the central bank's tolerance for a weaker yuan to support exports. However, authorities are wary of triggering capital flight, financial system stress, and a loss of investor confidence.

“The PBOC is trying to stabilize sentiment by maintaining the USD fix, while weakening the yuan basket to boost competitiveness versus non-U.S. partners,” said Ken Cheung, chief Asian FX strategist at Mizuho Bank Ltd. “Massive U.S. tariffs are likely to suppress bilateral trade, and China will respond by managing the yuan basket lower.”

Domestic Stimulus in the Pipeline

Beijing is preparing a new round of stimulus to support domestic demand and stabilize the economy:

- Increased infrastructure investment

- Expansion of transportation, housing, and energy sectors

- Tax relief for businesses

- Subsidies for automobiles, appliances, and durable goods

- Support for small and medium-sized enterprises (SMEs), especially in retail, services, and innovation sectors

- Employment programs to boost household incomes

Global Trade Outlook & Risks

According to Capital Economics, the new tariffs could halve China’s exports to the U.S. over several years, potentially cutting 1–1.5% off China’s GDP. Diversifying trade relationships—especially with Southeast Asia, Africa, and Latin America—is seen as key to mitigating losses.

Still, the global market impact is intensifying. Emerging market currencies are under pressure, and investor flows are shifting toward safe havens like the U.S. dollar and gold. Former U.S. President Donald Trump again accused China of currency manipulation, and U.S. Treasury Secretary Scott Bessent labeled Beijing the “worst violator of global trade rules.”

Will China Devalue the Yuan Further?

Most analysts believe aggressive devaluation is unlikely:

“A sharp devaluation would alarm China’s global partners and financial markets. It’s not a probable scenario,” said Wei-Liang Chang, strategist at DBS Bank. “China needs to maintain stable trade ties in an increasingly fragmented global landscape.”

Conclusion

The U.S.–China trade war is entering a new and more volatile phase, with significant implications for global trade, currencies, and economic stability. A prolonged conflict could further disrupt supply chains and push global investors into risk-off mode, hurting liquidity in emerging markets.

Подсказки: yuan, China, trade war, US tariffs, currency markets, PBOC, Chinese economy, global trade, RMB exchange rate, economic sanctions, FX markets, Bloomberg, Reuters