Вusiness / Real Estate / Investments / Analytics / Reviews / News / France / United Kingdom / Germany / Sweden / USA 10.08.2025

European Real Estate Investment Activity Slows Amid U.S. Tariff Threats

The recovery plans for the European real estate market have slowed following U.S. President Donald Trump’s threat to impose sweeping tariffs. In Q2 2025, the volume of commercial property transactions fell by 10%, and by 7% over the first half of the year. The number of active market participants hit its lowest level in more than a decade, Bloomberg reported, citing MSCI Inc. data.

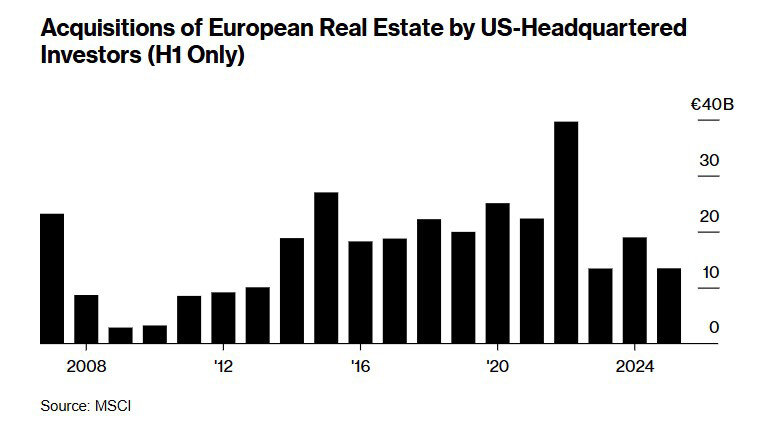

U.S. Investors Pull Back

American investors sharply reduced their activity, concluding 29% fewer deals between January and June compared to the same period in 2024. Previously, funds such as TPG, Starwood, KKR, and Ares were among the largest buyers of European assets, but in 2025, they were overtaken by other players. Blackstone, often the market leader, dropped to sixth place, yielding to Singapore’s GIC, Norges Bank Investment Management, and LondonMetric Property Plc.

Asian and Australian Capital Steps In

Japanese investors reached a record number of deals in Europe while cutting U.S. investments by 45%. Australian pension funds also became more active: Aware Super invested around £500 million ($664 million) in London offices via a joint venture with Delancey.

Country-Level Trends

The UK remained Europe’s largest market despite the slowdown. Deal volumes fell 14% year-on-year in H1 2025. In contrast, Germany recorded a 15% increase and Sweden 11%. The French market stayed largely stable, with signs of a rebound in the office sector — sales reached €3.1 billion in the first half, mainly in Paris. La Défense saw over €600 million in transactions, up from under €200 million in 2023–2024. Blackstone plans to buy the Trocadéro office building for about €705 million, while Gecina SA acquired the Solstys complex from DekaBank for €433 million.

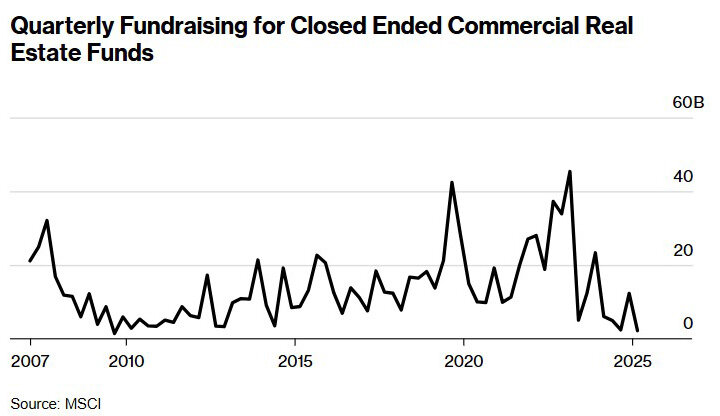

Financing Challenges Persist

According to MSCI Private Capital Solutions, Q1 2025 saw minimal fundraising for new private equity real estate funds. Tom Leahy, Head of EMEA Real Estate Research at MSCI, noted that the property sector lagged behind other private assets and that the slow deal flow meant investors were not receiving significant returns from previous fund vintages.

Leahy added that U.S. tariff announcements prompted many investors to delay transactions, awaiting clarity. Unlike the stock market, where reactions are immediate, the first sign of stress in real estate is a drop in deal volumes.

The Tariff Timeline

As The Guardian recalls, the shift in trade relations began on April 2, 2025, when Trump announced a universal 10% import tariff and targeted duties of up to 50% on several countries, including the EU. On April 9, he introduced a 90-day pause for most nations.

On May 23, the U.S. president reiterated his plan to impose a 50% tariff on all EU imports from June 1, citing a $250 billion trade deficit and accusing the EU of protectionist measures. He urged companies to relocate production to the U.S. to avoid restrictions.

In June, the White House offered to lower the rate to 30%, Reuters reported. On July 27, the U.S. and EU signed a framework trade deal setting a 15% tariff on most goods — including cars, pharmaceuticals, and semiconductors — while keeping 50% duties on steel and aluminum. The EU agreed to invest around $600 billion in the U.S. economy and increase energy and defense imports.

In early August, the EU suspended its planned $93 billion in retaliatory tariffs for six months to finalize the deal and reduce business risks.

However, many in Europe still view 15% as too high compared to the hoped-for zero-tariff agreement. Bernd Lange, Chair of the European Parliament’s Trade Committee, called the tariffs unbalanced and warned that EU investments in the U.S. would likely come at the bloc’s own expense. The U.S. administration has also signaled potential rate hikes if commitments are not met.

Outlook

EU–U.S. trade relations remain strained, with high risk of future tariff disputes. Persistent uncertainty could further dampen investor sentiment toward European real estate.