Вusiness / Investments / Analytics / Research / Denmark / Norway / Switzerland / Sweden / Germany / Finland / Belgium / USA / United Kingdom / France / Greece / Ireland / Armenia / Russia / United Arab Emirates 06.05.2025

FM Resilience Index 2025: The Most Resilient Countries for Business and Investment

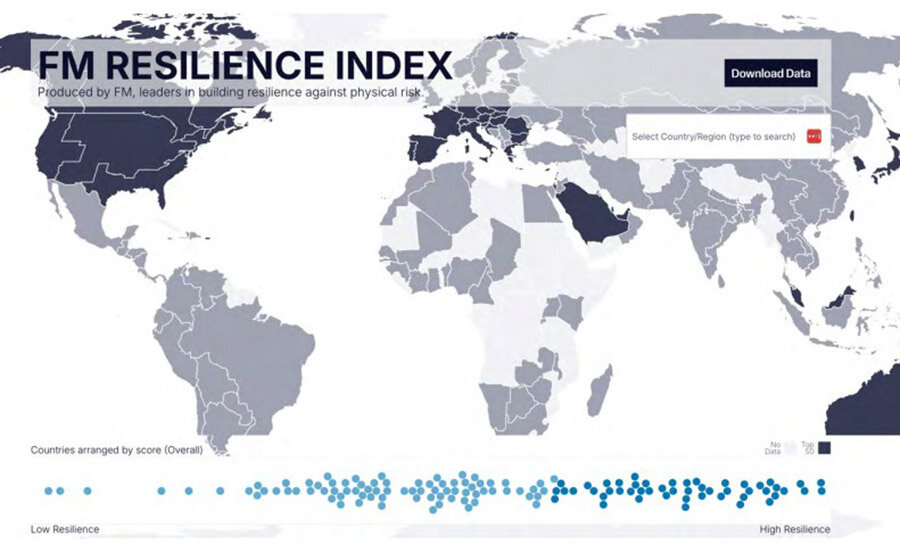

FM Global has released the 12th annual FM Resilience Index 2025, an analytical ranking of 130 countries and territories evaluating their ability to withstand a broad range of risks—from inflation and political instability to climate threats and cyber risks. In today’s era of volatility, the index has become an essential tool for insurers, investors, and corporate risk managers.

The index methodology includes 18 indicators grouped into three categories:

- Macroeconomic risks (inflation, political instability, corruption levels)

- Physical risks (infrastructure, climate risks, fire safety)

- Digital resilience (cyber risks, regulatory measures, IT preparedness)

In 2025, FM Global emphasizes the growing influence of geopolitical conflicts, technological shifts, and uneven progress in tackling inflation. Incorporating proprietary engineering and analytical data in the cyber risk area has made the index an even more accurate assessment tool.

Top-performing countries

European nations dominate the top of the ranking. Denmark secured first place, reinforcing its position as the world’s most resilient country thanks to high education levels, stable labor productivity, and continuous improvements in cybersecurity. Luxembourg ranked second, followed by Norway. Completing the top 10 are Switzerland, Singapore (the only Asian country in the top ten), Sweden, Germany, Finland, Belgium, and the Central U.S. region. This lineup shows that high resilience is possible both in developed European economies and select regions outside Europe with balanced macroeconomics and robust infrastructure.

The UK and France also made notable gains in 2025, improving their rankings thanks to better macroeconomic conditions and easing inflationary pressures.

Significant shifts were observed in some countries over the past four years. Ghana climbed 17 positions, Nigeria rose by 10, and Rwanda by 8—mainly due to infrastructure investments and more stable macroeconomic environments. On the downside, Lebanon dropped 23 spots, Argentina fell 22, while Armenia and Russia each declined 9 positions. Russia continues to struggle with high inflation, a challenge also seen in parts of Latin America like Brazil and Mexico.

Physical and digital risk management

Special attention was given to managing physical risks. For example, Ireland improved its fire safety rating by updating building codes and mandating automatic fire suppression systems in more buildings. While this didn’t change Ireland’s overall ranking, it significantly boosts real-world resilience.

Updated data on cyber risks enabled more precise evaluations. Countries with the highest digital resilience include Qatar, Singapore, Greece, UAE, and the Western U.S.. The most vulnerable in cyber terms are Nicaragua, Haiti, and Tajikistan, making them particularly exposed to cyber insurance risks.

According to FM Global, countries in the top half of the ranking recover from property losses over 30% faster than those in the lower half. This makes the index a critical tool for assessing potential losses in global logistics, construction, investments, and insurance. It’s used to calculate premiums, select asset locations, and design supply chains.

As FM’s VP Leo Kushner noted, risks keep evolving—but so do opportunities for boosting resilience. The index, he says, lets FM clients “see what others cannot” and make better-informed decisions amid rising uncertainty.

The FM Resilience Index 2025 reinforces that resilience today is not just a function of economic stability but also the outcome of systemic investments in cybersecurity, regulation, and climate adaptation. Countries that proactively implement these measures gain not only lower insurance premiums but also a competitive edge in the global economy.

While FM Global focuses on risk management capacity, understanding economic growth rates is also vital for a full picture. Resilience without growth risks stagnation; rapid growth without resilience risks shocks. Combining resilience rankings with GDP trends provides deeper insights into countries with both robust economic foundations and high development potential.

According to the IMF, in 2024, top GDP growth performers were India, China, and Turkey, driven by expanding manufacturing and technology sectors. India posted the highest growth among major economies at 6.8%. The US maintained global GDP leadership at $28.78 trillion (+2.7%), while China ranked second with $18.53 trillion (+4.6%).

Interestingly, countries like Russia, Mexico, South Korea, Spain, and Australia also sustained positive momentum despite inflationary and geopolitical headwinds. Georgia stood out: the IMF ranked it second globally for per capita GDP growth in 2024, fueled by a construction boom, infrastructure development, and transit capacity expansion.

Thus, combining the FM Resilience Index with real GDP growth figures offers a nuanced understanding of which nations combine strong economic architecture with scalable development potential. In a world of growing complexity, it is this mix of resilience and growth that forms the foundation for long-term success.