Global Real Estate Outlook: Investors Compete for Top Locations

Photo: JLL

The global real estate market remained resilient in the first half of 2025 despite rising geopolitical and economic uncertainty, according to JLL’s Global Real Estate Outlook. Trade policies in the U.S., rapid tax and regulatory shifts, and ongoing conflicts shaped market dynamics. In the months ahead, slowing economic growth and high construction costs are expected to play an even greater role.

Key Transactions and Investment Structure

Some companies paused projects or adjusted plans, yet several large deals were recorded. In Q2, Panattoni leased 885,000 sq. ft. (~82,000 m²) to GXO Logistics in the UK. LXP Industrial signed a 1.1 million sq. ft. (~102,000 m²) deal in Greenville, South Carolina. BroadRange Logistics secured a preliminary lease for 309,000 sq. ft. (~29,000 m²) in Atlanta.

In Europe, growing defense spending—particularly in Germany—has increased demand for production sites. Residential property remains supported by asset base expansion and demographics, while supply in the data center sector struggles to keep pace with demand.

JLL data shows regional differences: residential and logistics lead globally (37% and 26% of total investment respectively), while office investment is concentrated in Asia (38%).

[img]https://internationalinvestment.biz/uploads/posts/2025-08/jll-2025-real-estate-investment.jpg[/img

]

]

By mid-2025, real estate retained its buffer capacity. Price corrections had already occurred, with minimal risk of further declines. In North America and EMEA, lower construction volumes reduced oversupply risks but also tightened availability for tenants seeking high-quality space. Residential property remained stable, logistics retained growth potential, and cheaper borrowing costs added support.

Occupiers and Office Demand Transformation

Weak growth expectations and pricing volatility drove stronger focus on cost control. According to JLL’s Occupier Pulse, 40% of U.S. firms, 54% in Asia-Pacific, and 57% in EMEA implemented measures to reinforce positions.

Some tenants delayed expansion, but JLL expects 2025 leasing volumes to exceed last year, supported by demand in central business districts. In H1, KPMG leased 33,000 m² in Frankfurt, moving its office from the airport district to the city center.

Flexibility is becoming crucial: occupiers are favoring managed and short-term lease structures, shifting goods to free trade zones, and renewing contracts instead of committing to new space. In EMEA, 34% of firms postponed deals; in Asia 20%; in the U.S. only 6%.

Investment Cycle and Cost of Capital

JLL’s January forecasts largely held. Shortages of quality space in North America and Europe deepened, with projects delayed by inflation and high construction costs. Borrowing costs eased, but less than expected in the U.S.

Data centers remain an exception. In Q2, Blackstone secured approval for a £10 billion initiative in Northeast England, while the UK’s USS pension fund pledged up to £250 million. In the U.S., JLL Capital Markets arranged $1.2 billion in construction financing for The BlackChamber Group’s Northern Virginia campus. Efficiency upgrades in mechanical, electrical, and plumbing (MEP) systems cut operating costs by over $118/m², far surpassing other property types.

[img]https://internationalinvestment.biz/uploads/posts/2025-08/jll-2025-real-estate-data-center.jpg[/img]

The new investment cycle is still at an early stage, offering opportunities for higher long-term returns. Historically, deals made after major repricing deliver the best five-year yields. In 2025, cycle maturation is slower, but credit markets remain open. Europe and Australia already saw rate cuts, with U.S. easing under consideration. The optimal entry window will extend through 2025–2026.

Japan illustrates early-cycle recovery. Low borrowing costs, rising rents, and tight vacancy drove foreign investors to push Q1 real estate investment past ¥2 trillion—a 23% YoY increase.

Modernization and Technology

High costs and energy security concerns highlight the need for modernization. Retrofits now serve both sustainability goals and cost-reduction strategies. Energy audits and feasibility studies are prioritized to cut operational costs and meet net-zero targets.

Aging office stock is at risk: between 322–425 million m² across 66 key markets require major upgrades. Costly fit-outs and construction delays may hinder relocations, but rising demand for efficiency is accelerating repositioning. AI integration in building management and portfolio planning is increasingly evaluated by investors and tenants.

Outlook and Regional Divergence

In H2 2025, resilience and flexibility remain the market’s themes. With limited oversupply risks and cheaper financing, investor and occupier activity will be supported by strong demand for prime assets. Early entry opportunities are likely to deliver above-average returns.

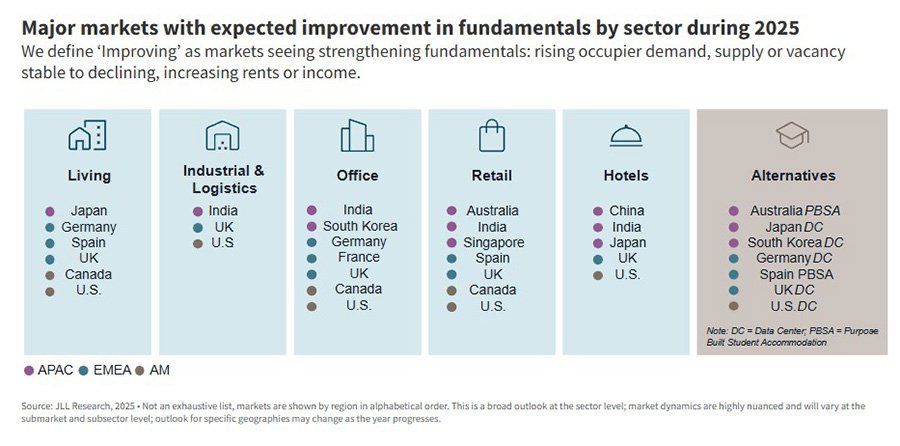

JLL expects housing and office demand growth in Asia and Europe, logistics to remain a driver in the U.S., UK, and India, and recovery across retail, hospitality, student housing, and data centers.

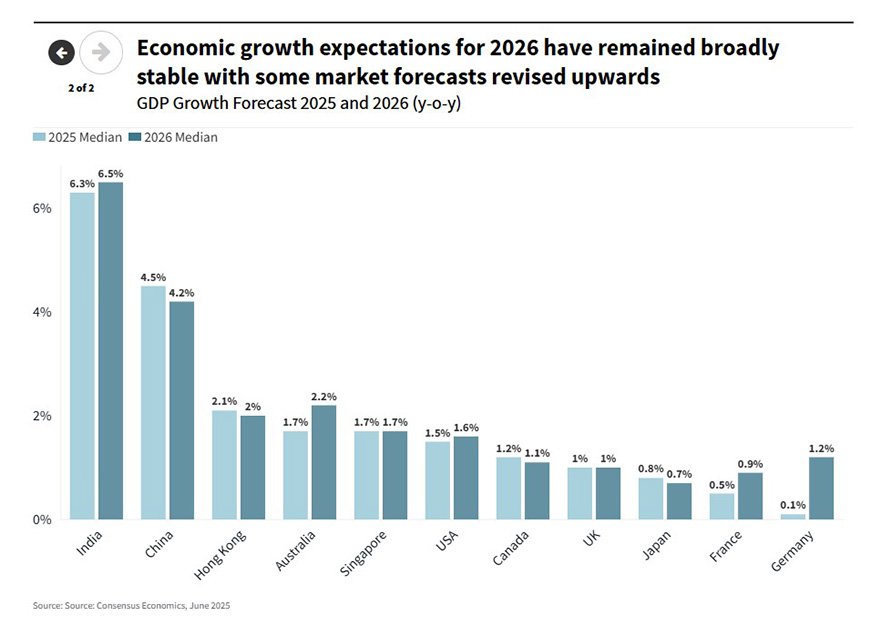

However, macroeconomic performance will diverge. India is projected to grow from 6.3% in 2025 to 6.5% in 2026, China from 4.5% to 4.2%. In advanced economies, growth expectations are modest: U.S. ~1.5–1.6%, Germany 0.1% to 1.2%, France 0.5% to 0.9%, while the UK and Japan remain near zero.

These differences will shape regional strategies, reinforcing the importance of selectivity and flexibility in investment decision-making.

Подсказки: real estate, global property, JLL, investment, housing, logistics, offices, data centers, modernization, real estate trends 2025