read also

Вusiness / Real Estate / Investments / Analytics / Research / Ireland / Real estate Ireland 25.08.2025

Ireland’s Real Estate Market: Warehouses and Retail Spaces Lead

Photo: JLL

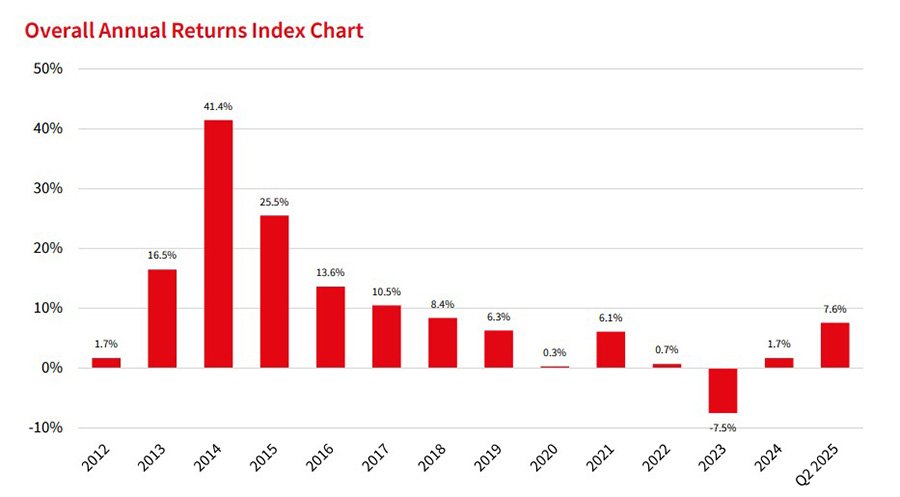

Ireland’s commercial property market is showing accelerated recovery. In Q2 2025, overall returns grew by 7.6% compared to the same period of 2024, and by 2.65% against January–March, according to JLL. Industrial and retail sectors drove the momentum, while offices remained stagnant.

Market dynamics

After a 16.1% drop in capital values in Q3 2023, the trend reversed by mid-2025. April–June marked the fifth consecutive quarter of growth, confirming sustained recovery and investor interest.

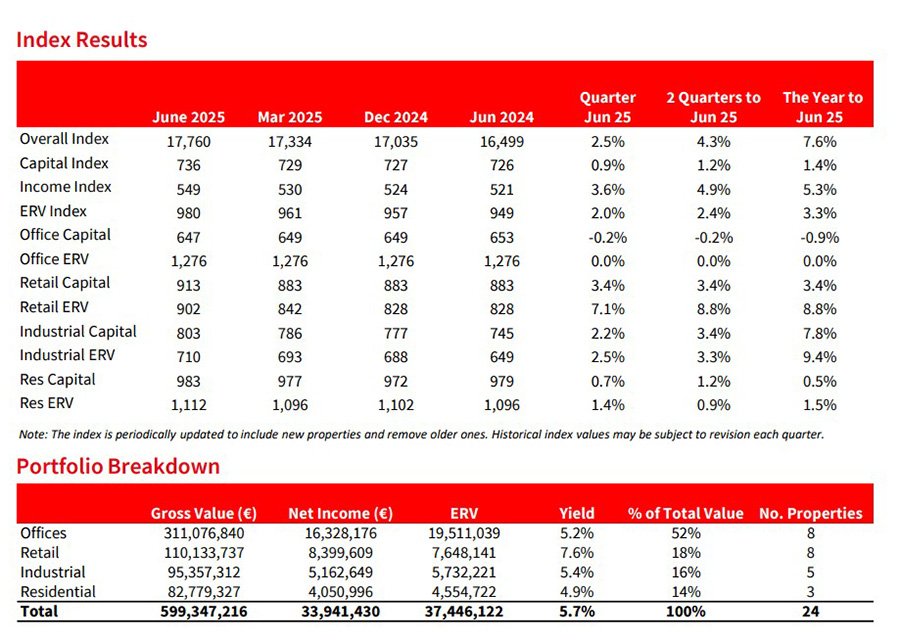

The total portfolio is valued at €608 million, including 24 assets: eight offices (51%), eight retail units (19%), five industrial complexes (16%), and three residential buildings (14%). Net rental income stood at €33.9 million, with an assessed value of €37.4 million. The average yield is stable at 5.7%, underlining Ireland’s attractiveness for institutional investors.

Capital values rose 1.4% year-on-year and 0.9% quarter-on-quarter. The income index gained 5.3% year-on-year and 3.6% in Q2. The rental index climbed 3.3% annually and 2% over the quarter — clear evidence of steady recovery.

Industrial property: top performer

Industrial real estate posted the strongest growth. Over the year, capital values rose 7.8%, while rents grew 9.4%. In Q2 alone, increases were 2.2% and 2.5% respectively. Yields held firm at 5.4%. Tight supply and resilient tenant demand continue to drive this performance.

Retail: high yields

Retail ranks second in growth pace but leads in profitability. Capital values climbed 3.4% year-on-year and quarter-on-quarter, while rents surged 8.8% annually and 7.1% in Q2. Yields hit 7.6% — the highest across all segments. The rebound reflects consumer demand recovery and stronger tenant positions.

Offices: weak link

Offices, which make up over half the portfolio, remain under pressure. Capital values slipped 0.9% year-on-year and 0.2% in Q2. Rents stayed flat in both annual and quarterly terms. Yields stand at 5.2%. This stagnation highlights structural changes in workspace use and ongoing headwinds in the office sector.

Residential: moderate stability

The residential segment showed modest results: capital values grew 0.5% year-on-year and 0.7% quarterly, while rents rose 1.5% and 1.4% respectively. Yields were 4.9%. Despite modest growth, housing remains a stabilizing factor in a supply-constrained market.

Outlook and investor sentiment

JLL’s portfolio reflects both segment-specific dynamics and an attractive income profile overall. The index grew 3.6% in three months, showcasing strong rental income potential. A combination of steady capital growth and stable cash flows provides a foundation for long-term investments.

Portfolio composition is updated regularly, with new assets added and outdated ones removed — ensuring the index reflects market reality. While methodology influences results, the overall trend is clearly positive.

The Bank of Ireland forecasted

2025 housing prices and construction investments to grow by 5% and 11.9% respectively. Analysts at CBRE expect limited office completions (62,000 sq m), which could reduce vacancies and support rental growth into 2026.

Annual investment deals could exceed €3 billion versus €2.4 billion in 2024, according to CBRE, supported by ECB rate cuts easing financing conditions.

Experts at SCSI predict potential capital value growth of 15% and rental increases of 19% in 2025, particularly in the industrial sector (+3.2% and +3.1%). Offices, by contrast, are expected to grow modestly at 1% and 1.4%.

Подсказки: Ireland, real estate, commercial property, warehouses, retail, offices, residential, investment, JLL, CBRE