Geneva: Office Shortages and New Challenges for the Hotel Market

Photo: JLL

Geneva remains one of Switzerland’s most dynamic real estate markets: companies are competing for increasingly scarce office space, while hotels are dealing with rising tourist flows but still-unstable profitability. According to JLL, it is precisely the combination of limited new construction and the rebound of tourism that is shaping today’s key commercial property trends in the city.

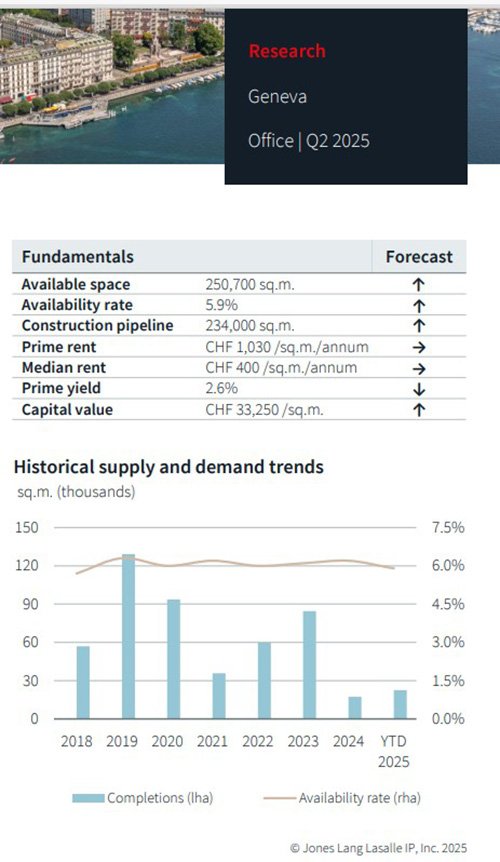

Offices: Declining Supply and Rising Rents

In Q2 2025, Geneva saw a contraction in office availability. The total volume of space fell to 250,700 sq. m, while the vacancy rate decreased from 6.2% to 5.9%. Strong demand in the city center continued to push rental rates upward. JLL reports that new construction will remain muted in 2025, but nearly 200,000 sq. m of new projects are scheduled for completion in 2026–2027, which could significantly shift the market balance.

The sharpest supply reductions occurred in districts where office properties were converted into residential or hotel projects. In the airport area, supply dropped by 5,500 sq. m due to a partial conversion into a serviced-apartment hotel and another building repurposed as housing. In the international sector (–7,400 sq. m), some spaces were taken off the market after acquisitions for owner-occupation. Meanwhile, the CBD recorded an increase of 3,200 sq. m, while Plainpalais/Charmilles (+2,100 sq. m) and Plan-les-Ouates (+2,400 sq. m) also saw gains.

Prime CBD offices on the left bank continued to see rent growth, reaching CHF 1,030 per sq. m annually by the end of Q2 (+8% year-on-year). Average market rents remained stable at CHF 400 per sq. m annually. Yields on prime properties stood at 2.6%, with capital values at CHF 33,250 per sq. m. Notable transactions include Arab Bank and Gonet & Cie announcing plans to relocate headquarters to a new CBD complex in 2028 (8,000 sq. m). The Pont Rouge district continues to show strong demand, with over 1,000 sq. m leased in the last quarter alone.

The outlook is shaped by constrained supply in 2024–2025. Against this backdrop, rental rates are likely to continue rising over the next few quarters until the pipeline of new projects comes online in 2026–2027.

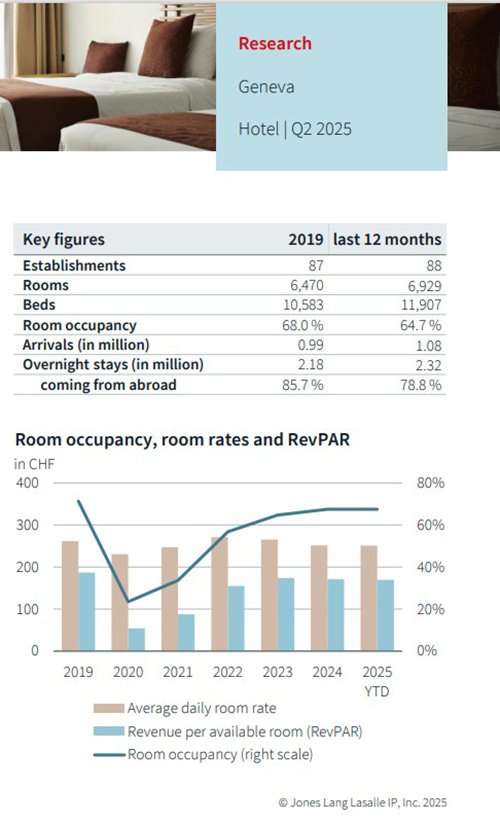

Hotels: Occupancy Growth but Declining Profitability

Geneva’s hotel sector in H1 2025 registered nearly 2% higher occupancy compared to the same period in 2024, but results remain below pre-crisis levels. According to JLL, average daily rates declined by about 5%, while RevPAR (revenue per available room) fell 3.5%. Despite growing tourist numbers and continued market expansion, the industry has not yet returned to 2019 benchmarks.

A major factor was the final cancellation of the Geneva International Motor Show, which had traditionally boosted spring occupancy. After a scaled-down return in 2024, organizers decided to discontinue the event in 2025, negatively affecting hotel revenues. Nonetheless, tourist arrivals continue to climb: 1.08 million visitors over the past 12 months versus 0.99 million in 2019, with total overnight stays reaching 2.32 million.

Operators remain active. In 2024, SV Group and YOTEL entered the Geneva market, while Fassbind Group opened two new hotels. Ruby Group announced plans for a second site in 2028, converting a former bank building into a 124-room property. In February 2025, Auberge Hotels & Resorts took over management of luxury hotel The Woodward, previously under Oetker Collection. Meanwhile, Mercure Geneva Airport Hotel (163 rooms, built in 2020) is up for sale.

Key industry indicators highlight structural shifts: the number of hotels rose to 88, with 6,929 rooms and 11,907 beds. The share of foreign guests decreased from 85.7% in 2019 to 78.8% in the last 12 months. This points to the recovery of domestic demand, though international travelers remain the main driver of Geneva’s hospitality market.

Подсказки: Geneva, Switzerland, real estate, offices, hotels, tourism, investment, JLL, commercial property