Cyprus Real Estate Market: Rising Prices and Declining Yields in Q2 2025

In Q2 2025, property prices in Cyprus rose across residential, logistics, and office segments. Holiday homes and apartments grew moderately, while retail declined. Rental rates increased in the residential and warehouse sectors, but yields fell almost everywhere according to the report by the Royal Institution of Chartered Surveyors (RICS) and audit-consulting group KPMG. Retail remains the weakest link in the market.

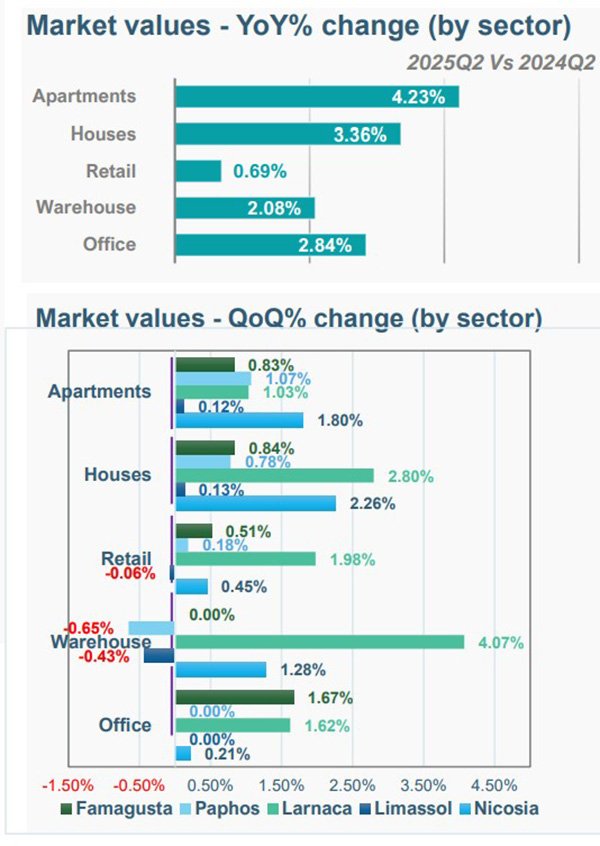

The Cyprus Property Index shows housing remains the main growth driver. Apartments rose 4.23% year-on-year, houses 2.84%, and offices 3.36%. Warehouses gained 2.08%, while retail barely moved at 0.69%, reinforcing its status as the least attractive asset class. Quarterly dynamics were more moderate: in April–June 2025, houses grew 2.26%, warehouses 1.80%, apartments 1.28%, and retail only 0.45%. Offices stayed almost flat at +0.21%.

Regional Breakdown

Larnaca: warehouses up 4.07%, houses +2.80%, retail +1.98%, offices +1.62%, apartments +1.03%.

Nicosia: houses led (+2.26%), followed by apartments (+1.28%) and offices (+0.21%).

Limassol: modest moves — offices +1.67%, apartments +1.07%, retail +0.45%, houses +0.13%, warehouses flat.

Paphos: minimal growth — apartments +0.12%, houses +0.78%, retail –0.18%, warehouses –0.43%.

Famagusta: housing rose by 0.83–0.84%, retail +0.51%, offices unchanged, warehouses –0.65%.

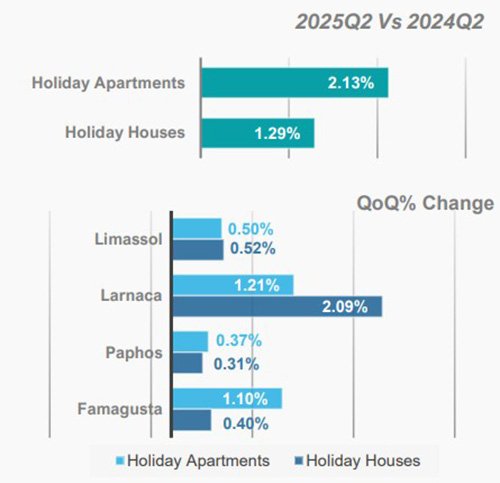

Holiday apartments increased slightly (+2.13% YoY, +1.21% QoQ). Holiday houses rose 1.29% annually and 0.50% quarterly, with Larnaca outperforming again.

Rental Market

Rents rose mainly in residential and warehouse segments. Apartment rents grew 1.33% YoY, warehouses 1.16%, offices 0.85%, houses 0.77%. Holiday rentals edged up less than 1%. Retail was the only sector with negative rental dynamics, down 0.02%, highlighting the fragility of this asset class.

Yields

Yields declined in almost all segments in Q2 2025:

Apartments: 5.41% (down from 5.43%).

Houses: 2.97% (from 3.00%).

Warehouses: 4.24% (from 4.25%).

Retail: 5.75% (from 5.80%).

Offices: stable at 5.61%.

Holiday apartments: 5.75% (from 5.77%).

Holiday houses: slight rise from 2.78% to 2.79%.

Long-Term Trends

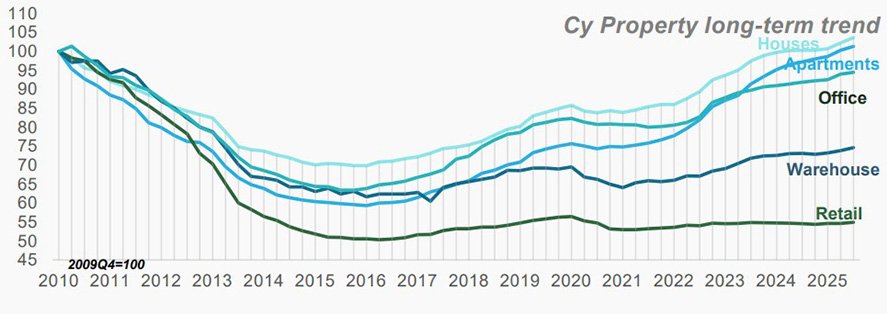

Charts show a steep fall between 2012–2015 followed by recovery. By 2018, the market had returned to a growth path. Housing has since outperformed, with prices surpassing 2009 levels by mid-2025. Offices and warehouses also advanced, though more slowly. Retail lags far behind, with its index still around 55–60 points, well below the base level.

The broader economy remains resilient. The European Commission expects Cyprus’ GDP to expand about 3% in 2025 with a budget surplus of 3–3.5% of GDP. The IMF projects slower growth of 2.5% in 2025 and about 3% in 2026, pointing to reliance on investment and reforms.

Подсказки: Cyprus real estate, property index, RICS, KPMG, housing prices, rental market, offices, warehouses, retail, investment yields