New priorities in the U.S. real estate market: from senior housing to data centers

Photo: PwC

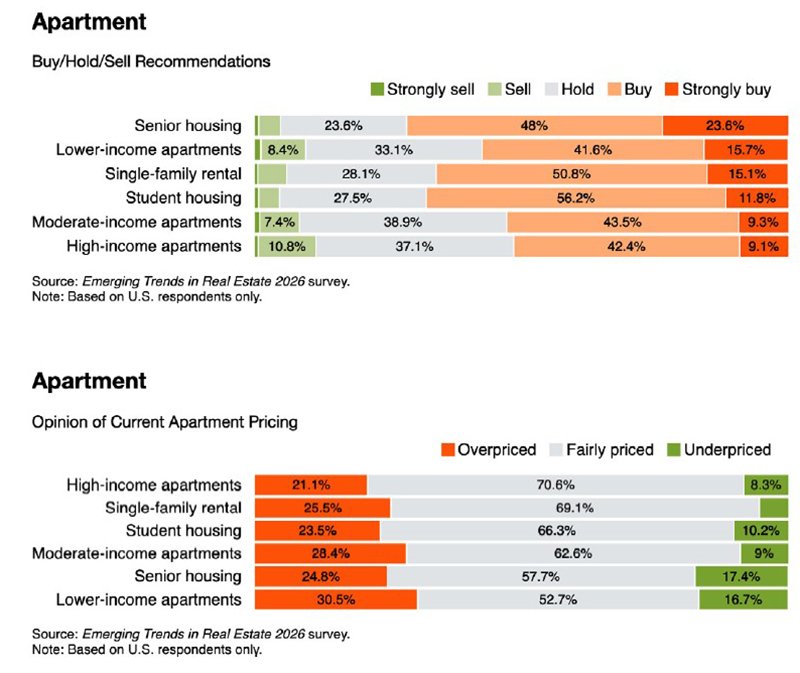

Investors in the U.S. real estate market expect a gradual improvement in conditions but approach new projects with greater selectivity, note PwC analysts. Of 27 subsectors, investment ratings increased in 16, while development positions declined in 18. The most resilient segments are named as data centers and senior housing, which consistently outperform other asset types in demand and returns.

Senior housing

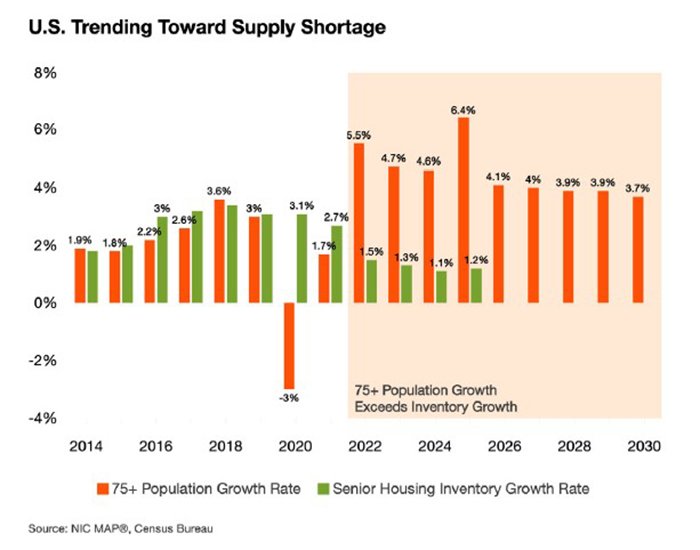

By 2026, the baby boomer generation will reach the age of 80, and demand for age-restricted housing will rise to record levels. It is already near record highs, while supply growth remains minimal – less than 1% per year, according to the National Investment Center (NIC). According to the U.S. Census Bureau, by 2030 the number of Americans aged 75+ will grow by four million, with 8,000 people entering this age group daily. Meanwhile, the number of working-age children able to assist elderly parents is shrinking: in 2010 there were eight per one person aged over 75, but by 2050 only four will remain.

The share of older adults living alone has doubled over the decade and will continue to grow. At the same time, the net worth of older generations is increasing, making housing with additional services more accessible. Active-living formats 55+ are expanding, offering wellness programs, social activities and digital services. Operators are shifting from a care-based model to an active-longevity concept, while technologies help offset staffing shortages.

Supply still lags behind demand. PwC notes that 60% of markets do not have a single project under development, and in some regions the number of retiring facilities exceeds new deliveries. By 2027, the balance is expected to shift from oversupply to shortage. Consumer preferences are diversifying: for active seniors, developers build one-story cottages and small villas, while for less mobile residents they offer care complexes with two- and three-room units. Both upscale projects and affordable options for the middle class are growing simultaneously: by 2033, moderate-income households will account for 44% of all senior households.

Student housing

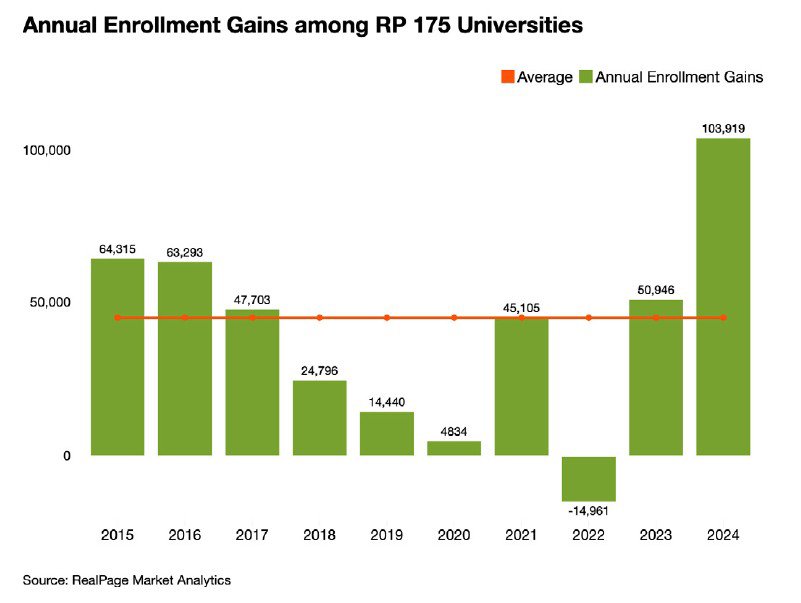

In the 2024–2025 academic year, student housing in the U.S. showed record occupancy and rising rents. The number of students increased by 4.5%, surpassing 19 million, but further expansion is limited by demographic and visa factors. The number of high school graduates peaked in 2024 and will begin to decline by 2026, especially in the Northeast and Midwest, reducing university enrolment.

The situation for international students remains unstable: the number of F-1 visas in the first half of 2025 fell by 22%. For universities where international students make up a third of enrolment, this poses a risk of revenue loss, as they are more likely to pay full tuition. Against this backdrop, U.S. universities are increasingly targeting domestic students, but the reserve is almost exhausted and financial pressure on infrastructure is growing.

In 2024, the market added more than 38,000 new beds – one of the largest totals in a decade – but in 2025 supply is expected to fall to 22,000. This will help balance demand and maintain high occupancy. Meanwhile, rising construction costs, higher prices for metals, insurance premiums and labor make new developments less profitable. In 2024, rents grew another 6% after a 9% jump in 2023. Despite high costs and slowing development, student housing will remain one of the most resilient investment segments: it combines predictable demand, low risk and stable returns.

Data centers

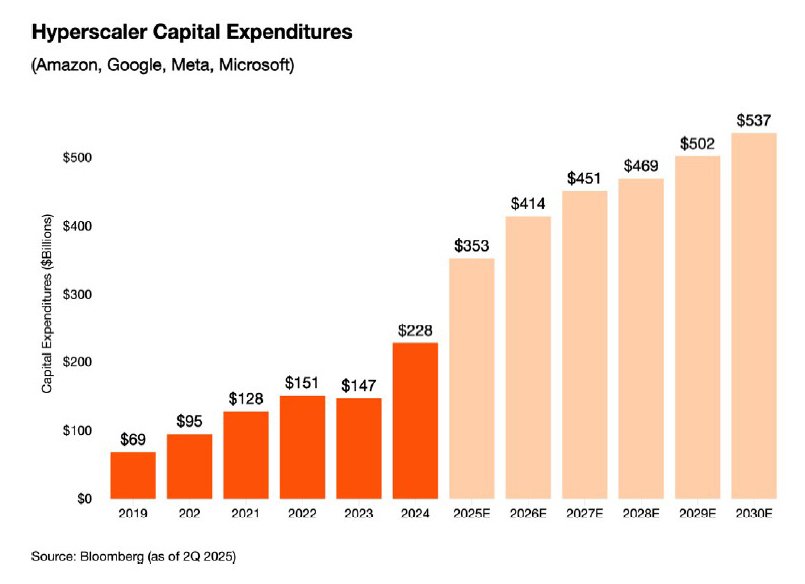

The data center sector is steadily expanding amid the rapid development of cloud technologies and artificial intelligence. It remains one of the most resilient segments of commercial real estate, despite power shortages, limited suitable sites and long equipment lead times. The average cost of constructing major facilities exceeds $10 million per megawatt, while vacancy stays below 2%. Most facilities are leased even before completion, supporting high occupancy and pushing rents up by more than 15% per year.

The main source of demand remains public cloud platforms and major hyperscaler companies, which account for more than half of the global market. Even large-scale infrastructure investment does not meet demand, particularly from AI developers. Training and operating models require ever-greater computing and energy resources, so new sites are designed with a priority on reliable power and future network expansion. Large campuses are emerging in Indiana, Ohio and Louisiana, as well as in more cost-efficient secondary regions.

Development is constrained by power shortages, a lack of engineering personnel and slow construction of transmission lines: in 2023, only 700 miles of new lines were added, compared to 3,500 a decade earlier. To reduce risks, developers are shifting to local generation models, placing their own power sources next to facilities. Even with rising costs and infrastructure limitations, data centers remain one of the most profitable and reliable U.S. real estate segments.

From multifamily to single-family housing

The U.S. housing market in 2025 is undergoing a restructuring phase. High mortgage rates and rising construction costs reduce affordability and push buyers and renters from major metro areas into more affordable regions. This shift redistributes demand: where supply is limited, prices rise; where construction is active, the market cools.

In the multifamily segment, developer activity remains restrained. According to PwC, housing starts fell by more than 40% compared to 2023, and recovery is not expected before 2026. Markets with large development pipelines, such as Phoenix, Austin and Nashville, need time to absorb excess stock. Meanwhile, New York and Chicago continue to face chronic housing shortages. Authorities support affordable housing through tax incentives, expedited zoning and adaptive reuse of buildings.

In the single-family segment, affordability is even more limited. According to PwC, new-home sales fell by around 15% in 2025 despite developers’ efforts to maintain demand with discounts and incentive programs. The average size of a new home dropped to 2,400 sq ft – a nine-year low. Buyers increasingly choose compact homes and lower-cost locations, while developers expand single-family rental formats to offset declining sales and stabilize returns.

Regional dynamics vary. In the South and West, especially Texas and Southern California, there is an oversupply of new homes and rising inventories, while northern and central states face land and labor shortages. Despite slower sales, the single-family segment remains resilient thanks to rental formats and cooperation between developers and municipalities.

PwC expects both segments – multifamily and single-family – to enter a phase of moderate but stable growth by 2026. A key driver of recovery will be lower borrowing costs and further development of affordable housing programs. If rates remain high, the market will stay divided but resilient: renting will continue to play a stabilizing role, and buying activity will recover gradually.

Commercial real estate

The U.S. commercial real estate market is restructuring around new usage models and revenue sources. After a period of volatility, investors focus on redevelopment, mixed-use formats and cost control. Office, industrial and retail assets are transforming most actively.

The office sector is undergoing deep restructuring. Falling occupancy and the shift to hybrid formats have reduced demand for traditional space but stimulated conversion into flexible offices and apartments. In business districts, prices have dropped almost 50% from peak levels, attracting investors again. Suburban locations show more stable dynamics, and developers emphasize quality of environment – infrastructure, sports areas, services. PwC forecasts that by 2026 the office market will reach a stable utilization level with minimal new construction.

Industrial and logistics facilities show steady growth thanks to domestic demand and e-commerce, whose share may reach 30% of retail sales by 2030. New construction is down a quarter from pre-pandemic levels, but demand remains strong in the South and central states, where costs are lower and land is more available. Large facilities over 70,000 sq m remain in short supply, and investors focus on long-term assets – from warehouses to data centers.

Retail real estate is showing cautious recovery: despite a wave of chain bankruptcies, vacancy remains low at 4.3%. Demand is concentrated in food, pharmacies, fitness and pet retail. Average sales growth in 2024 reached 0.7%, yet high-quality spaces up to 5,000 sq ft remain in demand. Developers limit new construction, preferring renovation of existing centers.

By 2026, the sector will stabilize: recovery in commercial real estate will depend on flexibility of formats, technology adoption and the ability to match infrastructure with evolving consumer behavior.

Alternative real estate

Occupancy in medical offices has reached 92.7%, and the average triple-net (NNN) rent has risen to $25.35 per sq ft. Job growth in healthcare and the shift toward outpatient formats support demand, although construction remains costly and constrained. Average cap rates stand at 6.5–7.2%, making long-term leased assets particularly attractive.

Life-science real estate (laboratories, biotech campuses, pharmaceutical facilities) is returning to equilibrium after the post-pandemic surge: vacancy has risen to 6.6% but remains one of the lowest. Major clusters – Boston, San Francisco, San Diego – are nearing saturation, while Philadelphia and Houston expand local production.

Self-storage continues to build its niche. Over two years, net absorption exceeded 150 million sq ft, and vacancy remains low. Rising housing costs stimulate demand for additional space – from standard lockers to 30–190 sq m workshop-storage units with utilities and workspace options. A moderate entry threshold and stable occupancy make the segment attractive for both private and institutional investors.