U.S. Housing Trends: Young Adults Choose Renting

Photo: Unsplash

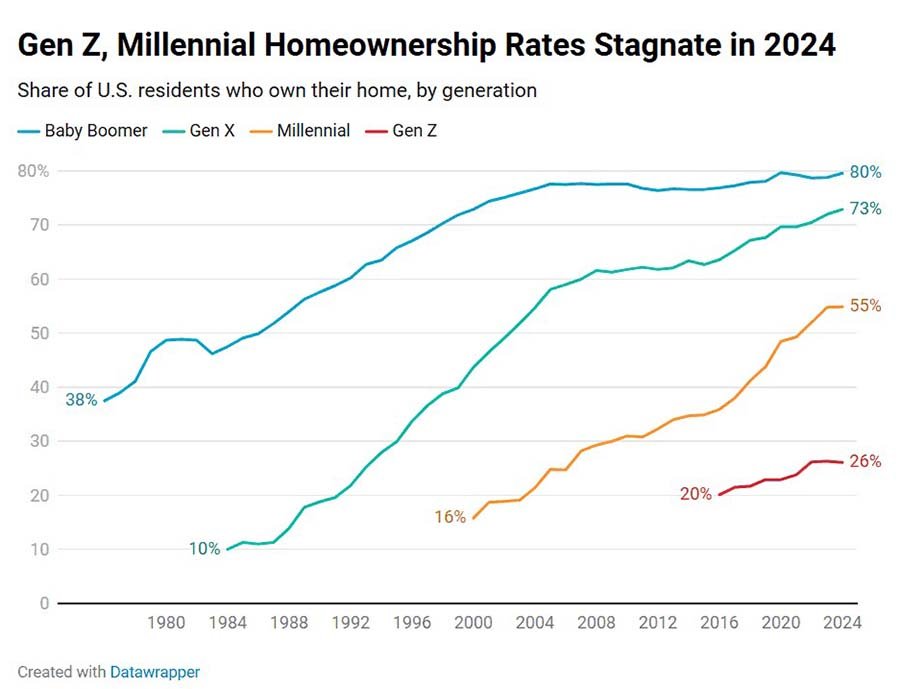

For young Americans, homeownership has lost its status as a must-have life goal. Rising prices and expensive mortgages have made buying difficult, while the pandemic cemented a preference for mobility and renting. A Redfin study notes that homeownership growth among Gen Z and Millennials has stalled, while older cohorts continue to see positive momentum.

Not long ago it seemed that younger buyers were slowly catching up. Among Gen Z—those born after the mid-1990s—the share of homeowners had risen every year since 2017, except in 2022 when growth halted at 26.2%. In 2023 the figure reached 26.3%, but in 2024 it slipped to 26.1%. For Millennials (1981–1996), gains had continued uninterrupted since 2012: the rate reached 54.8% in 2023, rising only to 54.9% in 2024—effectively flat.

Older groups kept their momentum. Generation X (1965–1980) had a homeownership rate of 72% in 2023 and 72.9% in 2024. Among Baby Boomers (1946–1964), the figure rose from 78.8% to 79.6%. For these cohorts, even small changes are meaningful since most already own homes.

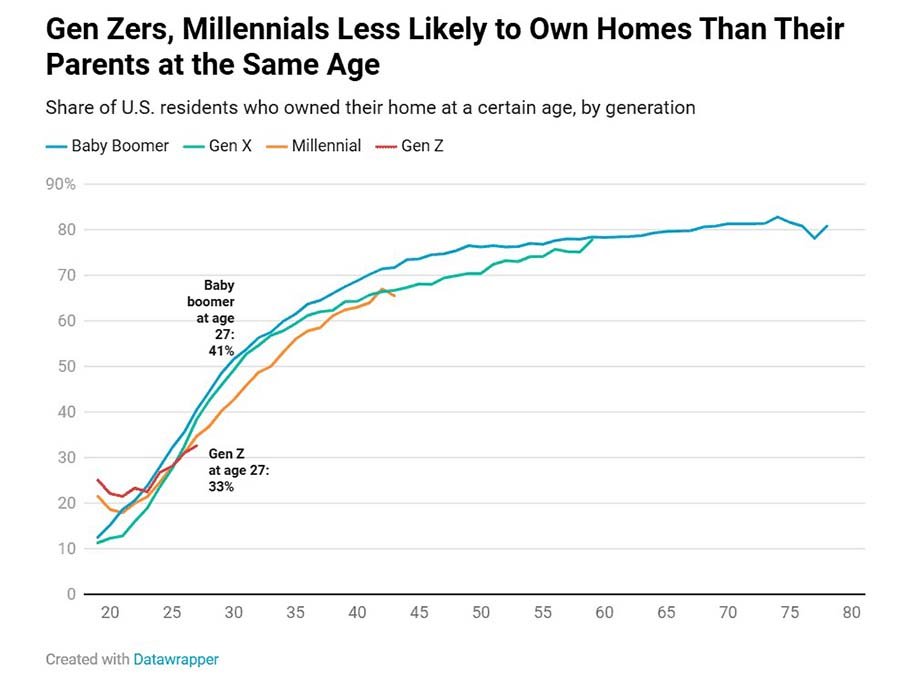

The contrast is particularly stark when comparing same-age peers across eras. Among 27-year-old Gen Zers in 2024, 32.6% owned a home. Generation X at the same age stood at 38.4%, and Baby Boomers at 40.5%. Among 35-year-old Millennials in 2024, the homeownership rate was 56%; for Gen X at that age—59.4%; for Boomers—61.5%.

A sharp rise in mortgage rates has been the main barrier for young buyers. After years of record lows, borrowing costs began climbing in 2022: the average rate rose from 3% early that year to 7% by its end. In 2024, rates hovered between 6% and 7%. High mortgage costs combined with scarce inventory kept home prices elevated. In spring 2024, a typical buyer paid about $2,800 per month—an all-time high.

Wage growth in recent years hasn’t offset housing inflation. Incomes increased, but far more slowly than home prices and mortgage costs. Young people are in a particularly tough spot since they lack accumulated capital or existing property to leverage into a move-up purchase.

Limited supply aggravates the problem. Many older Americans are in no rush to sell homes financed at ultra-low rates, reducing options on the market—especially in desirable neighborhoods. Meanwhile, rents have been relatively stable, making leasing more attractive compared with the growing cost of buying.

Financial pressures are compounded by social barriers. Many young adults carry student debt, hindering down-payment savings. Economic uncertainty—risk of slower growth, tariff disputes, rising living costs, and job instability—makes long-term commitments feel riskier. Post-pandemic, mobility has become a priority: Gen Z and Millennials more often choose short-term rentals, location-flexible work, or living with family over buying.

Demographics matter, too. Young Americans are reaching traditional life milestones later: the average age of first-time mothers rose from 24.9 two decades ago to 27.5 in 2024. That means many delay home purchases alongside starting families.

Redfin Chief Economist Daryl Fairweather notes that a home still symbolizes success and stability for many Americans, but economic realities are reshaping priorities. Young adults increasingly opt for flexibility—short leases, remote work, and the freedom to move. Many also rent simply because buying is unaffordable. Fairweather emphasizes that purchasing a home can still be a solid investment, but those not ready for a large down payment have alternatives—investing in education, a business, or the stock market.

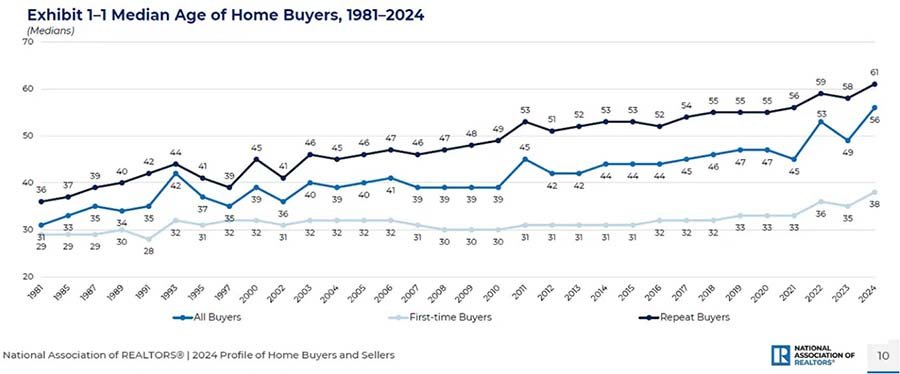

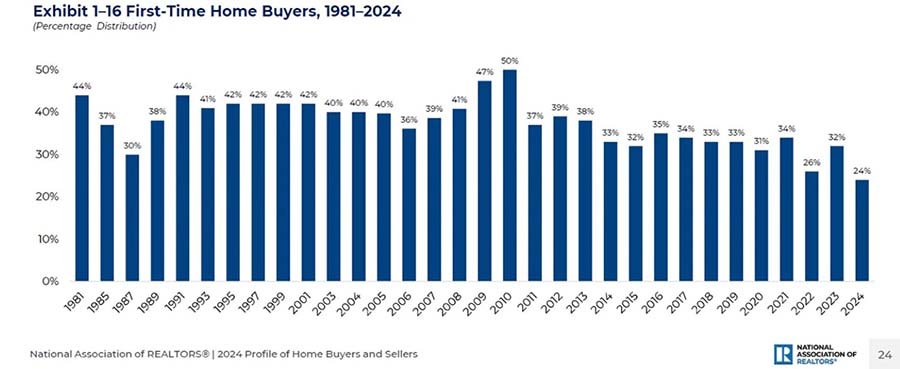

According to the National Association of Realtors, the share of first-time buyers in 2024 fell to 24%—the lowest since tracking began in 1981. The median age of a first-time buyer reached 38, and of repeat buyers—61, both records.

Most purchases were made by married couples (62%). Single women accounted for one-fifth of buyers, single men about 8%, and unmarried partners 6%. Nearly three-quarters of new owners had no children under 18.

Single-family homes still dominated—about 75% of transactions. Only 15% opted for new construction, mainly to avoid renovations. When choosing an area, neighborhood quality and proximity to friends and family mattered most. Affordability remained the key factor.

The typical home search took ten weeks. During that time, buyers viewed about seven properties, two of them entirely online. Cash usage became more common, but among first-timers 9 out of 10 still used mortgages.

You may also like:

Marilyn Monroe’s House May Be Demolished: Owners Contest Landmark Status

New York Rents Are Rising Again: New Rates for Stabilized Apartments

U.S. Real Estate Pulls Down Inflation: Biggest Drop in 15 Years

Florida Home Prices Fall to a 13-Year Low

Global Economy Is Recovering but Remains Vulnerable — IMF Outlook

Подсказки: housing, real estate, homeownership, renting, Gen Z, Millennials, mortgage rates, affordability, NAR, Redfin, United States, demographics, first-time buyers