read also

Europe’s Economy 2025: ECB Records Service-Sector Growth and Export Decline

Photo: Unsplash

The eurozone ends 2025 in a rare state for recent years: inflation is nearly at the 2% target, the economy is growing, and Central Bank rates are unchanged. Yet stability remains superficial: the ECB avoids long-term signals and acts “meeting by meeting,” as uncertainty persists — from trade restrictions to climate-related risks.

Services Are Growing, Industry Is Struggling

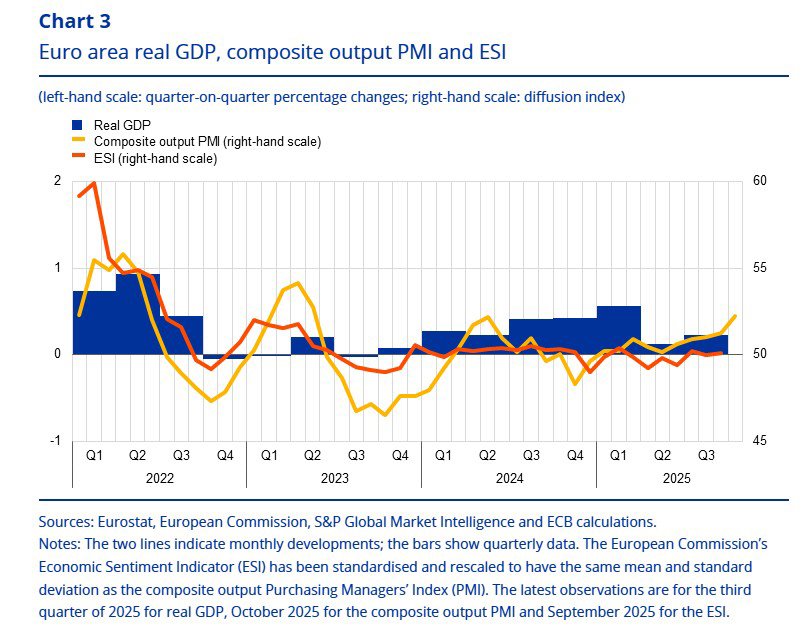

In Q3, eurozone GDP grew by 0.2% q/q. The expansion was driven by services — tourism, digital solutions, and the AI segment. Companies continue upgrading IT infrastructure, sustaining business activity. Industry looks weaker: a stronger euro, new tariff barriers, and declining external demand are weighing on exports and order books.

Domestic demand remains resilient. Real incomes are rising, and unemployment of 6.3% is near historic lows. Households maintain high savings, forming potential for future consumption. Investment is supported by government spending — especially defense and infrastructure — as well as previously implemented rate cuts. Exports, meanwhile, have been declining for several months, making the downturn a steady trend.

The labor market prevents the economy from slowing further. Vacancy rates are falling and job creation is moderating, yet conditions remain comfortable for employers. Wages are rising, but more slowly — which helps reduce inflation risks without triggering unemployment.

Inflation, Interest Rates and Market Response

Inflation in September stood at 2.2% after 2.0% in August. Energy prices stopped being a drag, while food prices eased slightly; however, services accelerated to 3.2%, keeping core inflation above target. The ECB sees this not as a new wave but as inertia: long-term expectations remain anchored near 2%.

On 30 October, the Governing Council again kept rates unchanged: the deposit rate at 2%, the refinancing rate at 2.15%, and the lending rate at 2.40%. Asset purchase programmes are shrinking naturally — without reinvesting maturing bonds. This gently tightens financial conditions without creating shocks. Business loans are issued at roughly 3.5%, mortgages at 3.3%. Risk-assessment standards are tightening, but loan demand is rising in line with economic recovery. Money supply (M3) growth continues to slow — an outcome the ECB has been targeting since 2023.

Financial markets are responding calmly. Eurozone sovereign yields have dropped by around 6 bps, and spreads to risk-free benchmarks have narrowed. European equities gained around 5%, with tech stocks outperforming. Investment-grade corporate spreads narrowed by 3–6 bps, and high-yield by almost 10 bps. The euro weakened against the dollar, though volatility remains minimal. The fiscal stance appears stable: total public debt at roughly 88% of GDP and deficits near 3%.

Investments Shift Toward the Digital Sector

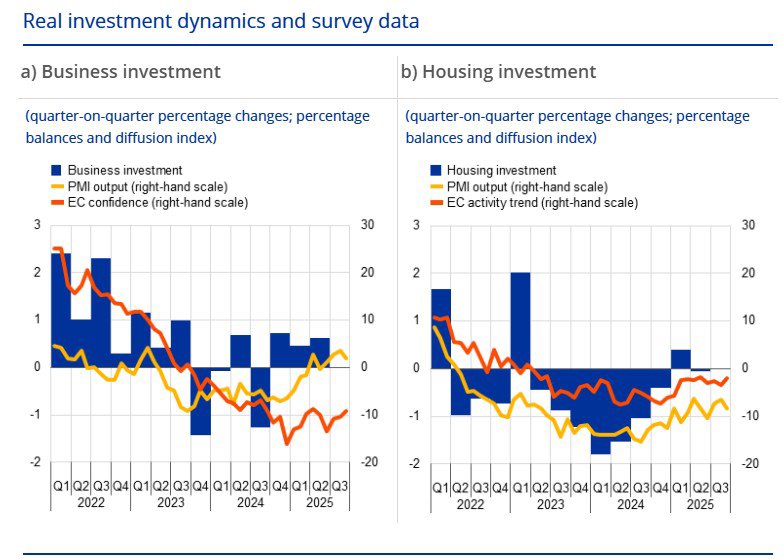

Investment patterns show a persistent divergence: spending on equipment is falling, while investment in intangible assets is rising. In Q2, the overall investment indicator fell by 3.3%, but adjusted for Ireland’s IP flows, it grew by 0.6% q/q. PMI and business surveys confirm: equipment manufacturers and the automotive industry face uncertainty, rising costs, and declining competitiveness — modernization is being postponed.

At the same time, investment in software, data processing, and AI solutions is expanding. Production of related digital services grew until July, and surveys show continued demand. According to the ECB, corporate cash flow and profitability are improving, but recovery will initially occur in the intangible segment — capital expenditure in physical production will remain a weak link.

Corporate Assessment

ECB contacts with executives of 71 large companies show: business conditions have slightly improved but remain weak. Manufacturing faces cost pressures and tariffs, construction is emerging from contraction, and services are expanding thanks to tourism, hospitality, and digital projects. A two-speed model is forming: physical production slows while the digital economy expands.

Price dynamics remain uneven. Core inflation has fallen significantly compared to 2023, but services keep it above headline levels. The transmission of monetary policy into household credit also varies: mortgage and consumer-loan availability depends on income and risk profile, complicating assessments of financial-conditions tightness.

Meanwhile, support for the euro has reached an all-time high: 83% of eurozone residents back the single currency. The euro is not only a transactional tool but a political anchor of integration — a factor of strategic stability.

Key Partners and Risks

Europe’s three main external markets — the U.S., China, and the UK — are slowing simultaneously. U.S. GDP growth has dropped to 0.4% q/q — consumers are cautious, investment is stagnating. China grew 1.3% q/q, driven almost entirely by government stimulus while real estate remains weak. The UK grew just 0.3% q/q: expensive credit and weak productivity point to structural stagnation rather than lingering Brexit effects. For the eurozone, this means weaker external demand — but also softer price pressure: commodities and energy are cheaper, supporting real incomes. Growth increasingly relies on domestic drivers as the external environment stops being a catalyst.

Yet the balance of risks remains mixed. The EU–U.S. trade deal and renewed U.S.–China dialogue ease tension, but a strong euro and falling exports accelerate disinflation, while climate shocks, defense spending, and supply-chain disruptions could reignite inflation. Hence the ECB’s logic: price stability can no longer rely solely on interest rates. The regulator explicitly calls for accelerating capital-market integration, completing the banking union, and implementing the digital euro.

Formally, the picture looks stable: inflation near target, the economy expanding, rates on pause. But beneath the surface lies a “fog of uncertainty.” That is why the ECB avoids forward guidance and acts situationally: policy will change only once inflation is anchored at 2% sustainably and unequivocally.

Подсказки: Europe, economy, ECB, inflation, exports, services sector, EU markets, investment, GDP, monetary policy, International Investment