Gulf Conflict Disrupts Nordic Corporate Supply Chains

Gulf Conflict Disrupts Nordic Corporate Supply Chains

Why Great Airlines Fail at Luxury

Why Great Airlines Fail at Luxury

Victoria Moves to Guarantee Work-From-Home Rights

Victoria Moves to Guarantee Work-From-Home Rights

Georgian Airports 2025: Record Passenger Traffic of 8.5 Million

Georgian Airports 2025: Record Passenger Traffic of 8.5 Million

Dubai skyscraper catches fire after drone attack

Dubai skyscraper catches fire after drone attack

How Much Does Evacuation from the Middle East Cost

How Much Does Evacuation from the Middle East Cost

Apartment rents in Tbilisi: rates fell by 11% — TBC Capital report

Analysts forecast further declines

The rental housing market in Tbilisi has begun to shift after a period of record highs. In 2025, the average rental rate was 11% lower than in 2024, reaching $10.4 per sq. m, according to a report by investment bank TBC Capital. Analysts attribute this trend to the gradual stabilization of the real estate market and expect further reductions in rental rates.

Tbilisi real estate market: stabilization after a period of growth

The Tbilisi real estate market remains the largest in the country and accounts for the majority of residential transactions. Following a sharp increase in activity during the post-pandemic period, the market is now gradually stabilizing. In 2021, a total of 51,143 transactions were recorded, rising to 66,192 in 2022. Growth continued at a more moderate pace thereafter, reaching 70,128 in 2023, 74,082 in 2024, and 78,547 in 2025.

The secondary segment continues to dominate, with 49,226 transactions recorded in 2025. At the same time, the primary market has shown stronger expansion, with new apartment transactions increasing to 29,321 compared to 18,198 in 2022.

New developments in Tbilisi: fourfold expansion

The primary real estate market in Tbilisi continues to expand rapidly. The total value of new housing reached $2.497 billion in 2025, more than four times higher than the $610 million recorded in 2020. This reflects strong demand and active development across the capital.

Developer activity remains high. In 2023, the number of apartments granted construction permits reached 20,895, followed by 19,473 in 2024 and 19,779 in 2025. Project scale is also increasing: the average number of apartments per residential building rose from 80 in 2022 to 106 in 2025, while the average land plot size increased from 3,800 to 5,400 sq. m.

Housing prices in Tbilisi: slowing growth

Housing prices in Tbilisi continue to rise, although the pace of growth has slowed. In 2019, the average price stood at $830 per sq. m, remaining largely unchanged in 2020 and 2021 at $842. A more significant increase began in 2022, when prices rose to $975 per sq. m.

Growth continued at a more moderate pace thereafter, reaching $1,207 per sq. m in 2023, $1,260 in 2024, and $1,312 in 2025. Despite reaching a new high, the trend indicates a transition toward more sustainable growth without sharp spikes.

Overall, the Tbilisi real estate market demonstrates stable long-term growth. The average annual increase in housing prices between 2019 and 2025 was approximately 8%.

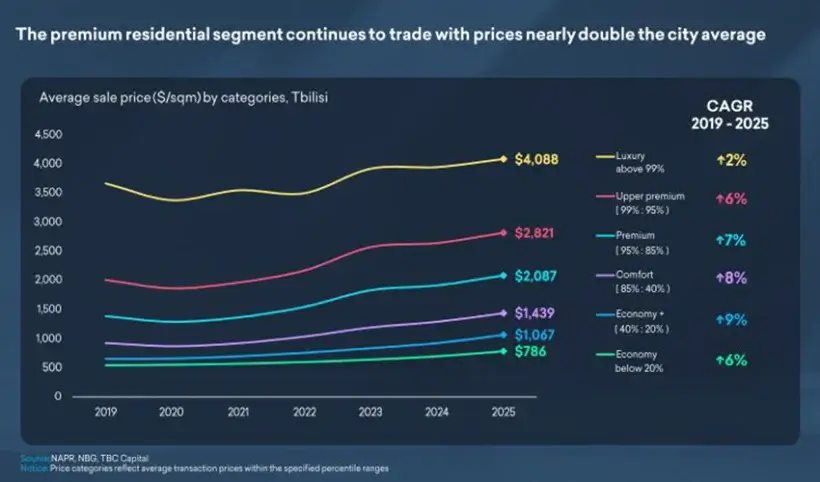

Premium real estate in Tbilisi: widening price gap between segments

Housing prices in Tbilisi vary significantly depending on the segment. In 2025, the average price in the luxury segment reached $4,088 per sq. m, substantially exceeding the citywide average. However, growth in this segment remains moderate, with an average annual increase of about 2% since 2019.

In the upper premium segment, the average price reached $2,821 per sq. m, while the premium segment recorded $2,087. These categories show stronger growth, reflecting steady demand for high-quality modern developments.

More affordable segments remain significantly cheaper but are growing faster. The average price reached $1,439 per sq. m in the comfort segment, $1,067 in economy+, and $786 in economy. This trend indicates rising demand for more affordable housing.

Rental market correction in Tbilisi: declining rates and stabilizing yields

Apartment rental rates in Tbilisi began declining after several years of rapid growth. The average rate was $5.4 per sq. m in 2021, rising to $8.7 in 2022 and peaking at $12.7 in 2023. A correction followed, with rates falling to $11.7 in 2024 and $10.4 in 2025.

Rental yields also adjusted. After exceeding 12% during peak market activity, yields declined to around 8.2% by the end of 2025. This reflects a transition to a more stable rental market environment.

Despite lower rates, the segment remains attractive for investors. Rental yields continue to exceed government bond returns in developed economies, supporting investor interest in residential real estate.

Comparison with other capitals

The Tbilisi real estate market remains competitive compared to other regional capitals. As of January 2026, the average price of a one-bedroom apartment in the city center was $2,459 per sq. m. This is lower than in Sofia ($4,272), Bucharest ($4,124), Yerevan ($3,262), and Chisinau ($2,760).

At the same time, Tbilisi offers higher rental yields. The average yield stands at 6.5%, exceeding Chisinau (5.6%), Baku (5.2%), and Yerevan (4.9%). In Sofia and Bucharest, yields are lower at 4.0% and 3.7%, respectively.

This combination of relatively affordable purchase prices and strong yields supports the investment appeal of Tbilisi real estate.

Demand drivers in the Tbilisi real estate market

Long-term demand is driven by demographic and structural factors. The average household size is 3.2 people, increasing demand for separate housing units.

Urbanization has reached 61% and continues to rise, driving population growth in the capital and sustaining housing demand.

The condition of the existing housing stock is another factor. About 77% of residents live in buildings constructed before 1990, creating strong demand for new developments.

Tourism growth also supports the market. A 6% increase in visitor numbers strengthens rental demand and enhances investment attractiveness.

Tbilisi real estate market outlook for 2026

The Tbilisi real estate market is expected to continue developing in a more stable phase. The number of transactions is forecast to increase by approximately 4.5%, while housing prices are projected to grow by around 3.2%.

Rental rates are expected to continue adjusting, with a projected decline of about 2.1%. At the same time, rental yields are expected to remain at around 8%, confirming the stability and investment appeal of the market.

Hotel real estate in Georgia: higher yields and greater investment stability

Analysts at International Investment note that declining rental rates and stabilizing housing prices highlight the differences between residential and hotel real estate returns. While reported residential yields remain high, actual investor profits are often lower due to maintenance costs, taxes, management fees, and vacancy periods. As price growth slows, the potential for significant resale gains becomes more limited.

In contrast, the hotel sector offers a more stable income model. Professional management companies ensure consistent occupancy and predictable cash flow. Premium and luxury hotel segments show particularly strong performance, driven by rising demand for higher-quality accommodations and expanded services, making this segment especially attractive for investors.