Gold Hits New Record as Dollar Weakens and Trade War Tensions Escalate

Gold has reached a new all-time high, exceeding $3,435 per ounce, as investor demand for safe-haven assets continues to grow. The surge in gold prices comes amid a sharp decline in the US dollar, political pressure on the Federal Reserve, and rising fears over a global trade war.

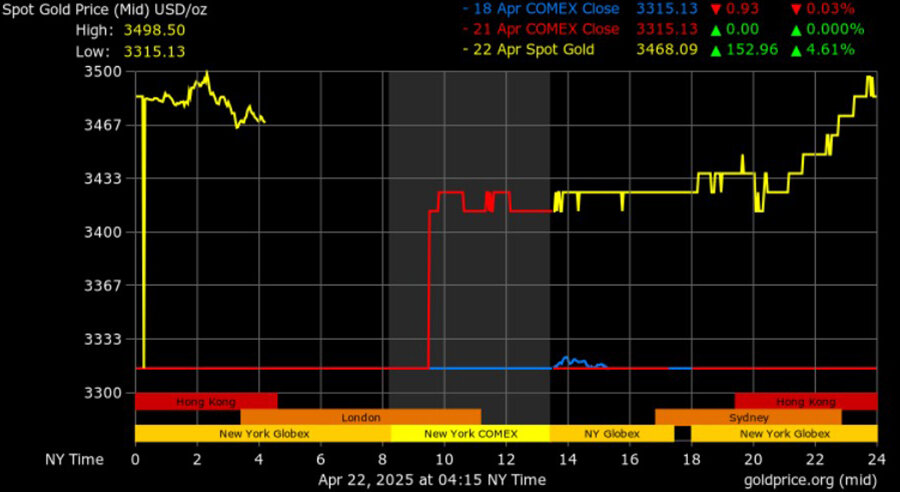

According to Bloomberg, the price of gold peaked at $3,436.01 per ounce on April 22, 2025 – a historic record. The day before, it climbed by 2.9% following a significant drop in the dollar, which hit its lowest level since late 2023.

Adding to the tension, US President Donald Trump is reportedly considering firing Fed Chairman Jerome Powell while simultaneously pushing for interest rate cuts. Chicago Fed President Austan Goolsbee has warned against political interference, emphasizing that dismissing Powell could undermine the independence of the central bank and destabilize markets. Christopher Wong of OCBC notes that such a move could erode confidence in the Fed and accelerate capital outflows into safe-haven assets like gold.

Gold has been steadily setting records throughout 2025. Escalating trade tensions are rattling risk markets and driving investors toward gold and other non-risk assets. ETF inflows backed by gold have risen for 12 consecutive weeks — the longest streak since 2022. Central banks are also boosting their reserves, fueling strong global demand.

Amid growing tensions, China has issued a warning to other nations against signing trade deals with the US that could harm Chinese interests. The Ministry of Commerce stated that Beijing would "resolutely retaliate with mirrored countermeasures" and urged for unity against unilateral pressure.

The US has temporarily suspended tariffs on about 60 countries and is reportedly offering to remove them in exchange for limits on trade with China. Bloomberg reports that "secondary tariffs" — essentially sanctions — on countries with deep trade ties to China are under consideration. Washington is also urging its allies to avoid importing Chinese oversupply.

Countries are already responding. Vietnam is preparing to tighten oversight of Chinese goods transiting to the US. Japan and the US have started a new round of trade talks. Taiwan described its discussions with Washington on export controls as "intensive." Meanwhile, South Korea's top trade representative is heading to the US this week.

China, in turn, is bolstering diplomatic efforts across Asia and Europe. President Xi Jinping recently visited Vietnam, Malaysia, and Cambodia, promoting the idea of an "Asian family" to respond collectively to trade-related threats.

In the past, China has retaliated strongly. When South Korea agreed to deploy the THAAD missile system in 2016, Beijing imposed restrictions on tourism and Korean businesses. More recently, China has used export controls as leverage. In response to new US tariffs, Beijing limited exports of gallium and germanium – rare earth metals essential for telecom and defense. These shipments have effectively halted due to new licensing hurdles.

Amid these geopolitical risks, analysts are increasingly bullish on gold. Goldman Sachs projects that gold could reach $4,000 per ounce by mid-2026. On Tuesday, spot gold gained another 0.4%, hitting a new peak at $3,436.01 in early Asian trading. Silver and platinum also edged higher, while palladium slightly declined.

Подсказки: gold, dollar, trade war, Fed, Powell, Trump, inflation, investment, safe haven, China, tariffs, markets, geopolitics