Smart investments in real estate with a guaranteed return in Israel

Investigation. Return on investment in the residential real estate in Israel. Overview of property prices and rental prices by region and city.

How to invest in real estate in Israel without fear of a collapse in prices?

Editor's note: The end of 2017 and the beginning of 2018 was marked by a turning point in the Israeli real estate market. The market, which demonstrated price growth for decades and thus attracted real estate investors by capitalization of assets, suddenly changed the trend. Instead of rising prices, statistics showed not only stagnation but also a small (yet) decline in the value of real estate in Israel.

However, the Israeli real estate market retains its attractiveness for domestic investors, or at least for that part of them that for various reasons does not consider more profitable versions of investing in real estate abroad. For such private investors, the comparative study of our colleague, expert Alexander Sorkin, conducted especially for International Investment magazine, will be extremely useful. It will also bring considerable benefits to those who are not even an investor, in one way or another connected with the real estate market of Israel - as a potential buyer of real estate for their own residence or as a tenant, as it examines and compares the price level for square meters of real estate in various regions of Israel for various types of housing, as well as the cost of renting.

Usually, you can distinguish two main types of investment in real estate: one is speculative, the other is long-term. Speculative investment (also called "Exit") is aimed at buying a property at a low price and then selling it at a high price. Long-term investment, based on the fundamental value of the asset and is focused on the revenues that this asset will bring within a certain time, which is usually calculated in decades.

If you apply these types of investment to investing in real estate in Israel, with today's realities, when the market is uncertain and prices are clearly overstated, speculative investment looks rather risky. Oil in the fire adds legislation that invests the investor in real estate with a tax at the entrance (for foreign investors this tax is higher) and at the output and limits the leverage (LTV) to 50% for the purchase of a second apartment and higher.

At the same time, the second way of investing in real estate, based on a fundamental value, can be of interest even in case of low profitability. The fact is that low interest on a mortgage in case of using a financial leverage can contribute to a low monthly return, which will pay itself by means of a rent, on the one hand. On the other hand, the loan will be cheaper, thus there will be low-interest costs, which will allow you to repay the debt on the asset in a relatively short time.

To understand how this works, ask yourself a simple question - what is more expensive: a loan for a million at 2%, or a loan of 500 thousand for 8% with a return period of 30 years? Let me put the question in another way. What would you choose - to buy an apartment for a million and pay a mortgage at 2% or buy an apartment for 500 thousand and pay a mortgage at 8%?

In fact, in both cases, given above (million under 2% or 500 thousand under 8%) have a similar monthly return on mortgages (3,669 and 3,697, respectively) and the bank is paid almost the same amount (1,320,776 and 1,330,630 respectively).

In other words, an investor buying real estate in Israel as a long-term asset pays a high price for the asset itself, but low interest on the mortgage and at the same time has the potential for growth in the future. So today you can get a mortgage for a constant percentage without reference to the price index in the area of 2.5-4.5%. And this percentage can be reduced with the proper planning and negotiation with the bank. In this case, interest will not have time to run up and most of the loan can be paid relatively quickly.

In addition, this kind of investment has some potential, which was mentioned above. The fact is that rents have recently grown very slowly relative to property prices and, based on the logic of the market, will catch up in the future. This is due to the excess of speculative investors in real estate, who today also rent an apartment. Thus, the supply exceeds demand and the prices do not grow as fast.

I believe that if the market collapses and speculative investors flee (and this is happening today), the offer of rented apartments will decrease and the prices for housing will creep up. Of course, at this stage, it is only an assumption. Thus, if the investment objective is long-term, an important element will be to find the most cost-effective investment. And this can be done by choosing the right market (as Kiyosaki once wrote about it).

In order to choose a market, it is necessary to understand the difference in profitability in one region of Israel from another. And this is the purpose of this comparative analysis. You will find the analysis of the real estate market in Israel according to the latest official data for the fourth quarter of 2017 below. The data will be indicated in shekels at today's rate of ≈3.5 shekel per dollar.

The average profitability of rental property in Israel

On average, real estate in Israel costs 1,442,600 shekels, with an average monthly lease of 3,799 shekels. According to these data, the average yield (annual rent/price) is 3.16%. That is, 3.16% of the asset price returns in a year. Of course, in calculating this yield, such expenses as interest on the mortgage loan and related costs (realtor services, an opening of the case in the bank, primary investments, registration of real estate, mortgage insurance, etc.) are not included in the calculation.

The average cost (price) of apartments by the number of rooms in Israel is:

Apartment 1,5-2,5 rooms - 1 072 600 shekels;

Apartment 2,5-3 rooms - 1 147 000 shekels;

Apartment 3,5-4 rooms - 1 455 400 shekels;

Apartment 4,5-5 rooms - 1 904 200 shekels;

The average cost of renting apartments by the number of rooms in Israel is:

Apartment 1,5-2,5 rooms - 36 035 shekels per year - 3 003 shekels per month;

Apartment 2,5-3 rooms – 40 982 shekels per year - 3,415 shekels a month;

Apartment 3,5-4 rooms – 50 382 shekels a year - 4,198 shekels a month;

Apartment 4,5-5 rooms – 65 862 shekels a year - 5,488 shekels a month;

If we consider the yield from rent by the number of rooms, the data looks as follows:

As you can see from the table, the average yield for apartments with different rooms does not differ much from each other. While large flats require higher capital. Nevertheless, we are talking about the average values for the country. This information shows only the total profitability.

The average cost (price) of apartments depending on the number of rooms and the region (city) in Israel is:

North of Israel 1,5-2,5 rooms — 464 700 shekels;

North of Israel 2,5-3 rooms - 674 200 shekels;

North of Israel 3,5-4 rooms — 968 200 shekels;

North of Israel 4,5-5 rooms - 1 370 100 shekels;

Haifa 1,5-2 rooms - 651 600 shekels;

Haifa 2,5-3 rooms - 841 300 shekels;

Haifa 3,5-4 rooms - 1 253 300 shekels;

Haifa 4,5-5 rooms — 1 899 200 shekels;

The outskirts of Haifa 1,5-2,5 rooms — 449 100 shekels;

The outskirts of Haifa 2,5-3 rooms - 710 900 shekels;

The outskirts of Haifa 3,5-4 rooms - 1 464 100 shekels;

The outskirts of Haifa 4,5-5 rooms — 1 860 800 shekels;

Hasharon 1,5-2 rooms - 1 119 900 shekels;

Hasharon 2,5-3 rooms - 1 322 300 shekels;

Hasharon 3,5-4 rooms - 1 860 800 shekels;

Hasharon 4,5-5 rooms - 2 117 100 shekels;

Tel Aviv 1,5-2 rooms - 2 048 100 shekels;

Tel Aviv 2,5-3 rooms - 2 473 500 shekels;

Tel Aviv 3,5 - 4 rooms - 3 457 800 shekels.

Tel Aviv 4,5-5 rooms - 3 951 800 shekels;

Gush Dan district 1,5-2 rooms - 1 251 200 shekels;

Gush Dan district 2,5-3 rooms - 1 455 300 shekels;

Gush Dan district 3,5-4 rooms - 2 015 900 shekels;

Gush Dan district 4,5-5 rooms - 2,674,200 shekels;

Jerusalem 1,5-2 rooms - 1 283 500

Jerusalem 2,5-3 rooms - 1 621 100 shekels;

Jerusalem 3,5-4 rooms — 2 164 200 shekels;

Jerusalem 4,5-5 rooms — 2 950 700 shekels;

Center and the outskirts of Jerusalem 1,5-2 rooms - 975 700 shekels;

Center and the outskirts of Jerusalem 2,5-3 rooms 1 260 800 shekels;

Center and the outskirts of Jerusalem 3,5-4 rooms - 1 592 200 shekels;

Center and the outskirts of Jerusalem 4,5-5 rooms — 1 992 000 shekels;

South of Israel 1,5-2 rooms - 593 900 shekels;

South of Israel 2,5-3 rooms — 774 000 shekels;

South of Israel 3,5-4 rooms - 1 087 100 shekels;

South of Israel 4,5-5 rooms - 1 428 600 shekels;

The average cost of renting apartments depending on the number of rooms and the region (city) in Israel is:

North of Israel 1,5-2,5 rooms — 22 706 shekels a year — 2 012 shekels a month;

North of Israel 2,5-3 rooms - 27 044 shekels a year - 2 253 shekels a month;

North of Israel 3,5-4 rooms — 34 716 shekels a year — 2 893 shekels a month;

North of Israel 4,5-5 rooms — 44 894 shekels a year — 3 741 shekels a month;

Haifa 1,5-2 rooms — 23 941 shekels a year — 1 995 shekels a month;

Haifa 2,5-3 rooms - 29 507 shekels a year - 2 458 shekels a month;

Haifa 3,5-4 rooms — 37 867 shekels a year — 3 155 shekels a month;

Haifa 4,5-5 rooms — 50 018 shekels a year — 4 166 shekels a month;

The outskirts of Haifa 1,5-2,5 rooms — 22 946 shekels a year — 1 912 shekels a month;

The outskirts of Haifa 2,5-3 rooms - 26 574 shekels a year - 2 214 shekels a month;

The outskirts of Haifa 3,5-4 rooms - 45 324 shekels a year - 3 777 shekels a month;

The outskirts of Haifa 4,5-5 rooms — 55 578 shekels a year — 4 631 shekels a month;

Hasharon 2,5-3 rooms — 43 282 shekels a year - 3 606 shekels a month;

Hasharon 1,5-2 rooms - 35 563 shekels a year - 2 953 shekels a month;

Hasharon 3,5-4 rooms — 55 578 shekels a year — 4 631 shekels a month;

Hasharon 4,5-5 rooms — 73 872 shekels a year — 6 156 shekels a month;

Tel Aviv 1,5-2 rooms — 52 613 shekels a year — 4 384 shekels a month;

Tel Aviv 4,5-5 rooms — 104 116 shekels a year — 8 676 shekels a month;

Tel Aviv 2,5-3 rooms — 64 308 shekels a year — 5 359 shekels a month;

Tel Aviv 3,5 - 4 rooms - 78 874 shekels a year - 6 572 shekels a month.

Gush Dan district 1,5-2 rooms — 38 306 shekels a year — 3 192 shekels a month;

Gush Dan district 2,5-3 rooms - 43 565 shekels a year - 3 630 shekels a month;

Gush Dan district 3,5-4 rooms — 54 922 shekels a year - 4 576 shekels a month;

Gush Dan district 4,5-5 rooms — 65 855 shekels a year — 5 487 shekels a month;

Jerusalem 1,5-2 rooms — 38 164 shekels a year - 3 180 shekels a month;

Jerusalem 2,5-3 rooms - 46 199 shekels a year - 3 849 shekels a month;

Jerusalem 3,5-4 rooms — 56 867 shekels a year — 4 783 shekels a month;

Jerusalem 4,5-5 rooms - 71 890 shekels a year - 5 990 shekels a month;

Center and the outskirts of Jerusalem 1,5-2 rooms — 32 454 shekels a year — 2 704.5 shekels a month;

Center and the outskirts of Jerusalem 3,5-4 rooms — 48 979 shekels a year - 4 081 shekels a month;

Center and the outskirts of Jerusalem 2,5-3 rooms - 38,689 shekels a year — 3 224 shekels a month;

Center and the outskirts of Jerusalem 4,5-5 rooms - 60 240 shekels a year — 5 020 shekels a month;

South of Israel 1,5-2 rooms — 25 072 shekels a year — 2 089 shekels a month;

South of Israel 2,5-3 rooms — 29 929 shekels a year — 2 492 shekels a month;

South of Israel 3,5-4 rooms — 37 340 shekels a year - 3 111 shekels a month;

South of Israel 4,5-5 rooms — 49 285 shekels a year — 4 107 shekels a month;

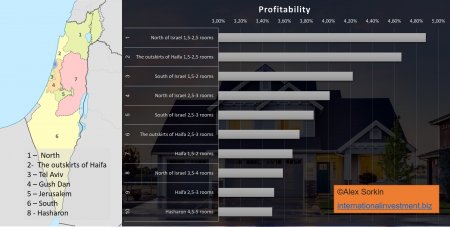

In order to determine where the yield is higher, the rating of profitability by region and number of rooms is compiled. The rating is shown below.

Based on this rating, you can deduce the 10 most profitable investments in real estate by profitability.

Top Ten

As can be seen from the graph above, the top ten with high profitability is located mainly on the periphery of Israel (except Hasharon) and they are mostly small and relatively cheap apartments. Which is quite logical. We are talking about regions with a large number of state employees and high unemployment. While the government will subsidize these regions (tax breaks, subsidies for housing, subsidies of municipal tax, etc.), the demand for renting real estate in them is likely to remain high. On the other hand, as you can see, the prices on the periphery are much lower than in the center of the country, which means that this kind of investment is available to more investors, some of which were guided by the speculative type of investment. If these investors leave the periphery (as mentioned above, this trend is already taking place), the prices for a shot can grow even more (the offer will decrease), and property prices will fall on the contrary.

These circumstances potentially turn the regions of the periphery into places where it is profitable to invest in the long term. With a lower investment, you can get a higher return.

With regard to the center of the country (Gush Dan, Hasharon, Tel Aviv), although these regions are quite profitable for speculative investments, in the long term these areas may show a lower profitability compared to the periphery. Moreover, real estate in these regions is very expensive, which means that to invest in them in real estate you need to have a higher initial capital, for which there may be more favorable investment alternatives.

Conclusions and limitations of the analysis

Based on a simple economic analysis, the purpose of this comparison is to give a basis for choosing a market. Nevertheless, it is important to remember that this is an analysis of aggregated data for 3 months. These data show some general picture only in this period of time and do not indicate the dynamics of prices. Moreover, when buying a property, it is necessary to take into account all related costs, including interest on the mortgage and the unique data and circumstances of each asset.

Nevertheless, today, this type of investment within Israel can turn out to be the most profitable among passive investments. This way of investing can become an alternative to pension savings. After all, the cost of rent will change over time and thereby reflect monetary inflation.

If you take into account the low cost of a mortgage loan, such an investment can be more than profitable in the long term. So, the high cost of housing will be offset by a low percentage of financial leverage. And income in the form of rent with the potential for growth can contribute to the relatively quick payback of the project.