read also

Denmark Set to Lead Nordic Growth Despite Novo Pressure

Denmark Set to Lead Nordic Growth Despite Novo Pressure

Sweden Urges Citizens to Hold Cash for Emergencies

Sweden Urges Citizens to Hold Cash for Emergencies

Indonesia Faces Growing Credit Rating Pressure

Indonesia Faces Growing Credit Rating Pressure

Poland Rethinks Rate Cuts as Iran War Risks Rise

Poland Rethinks Rate Cuts as Iran War Risks Rise

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Housing Market Enters Moderate Cooling Phase

UAE Housing Market Enters Moderate Cooling Phase

UK Home Sellers Record Lowest Profits in Nine Years

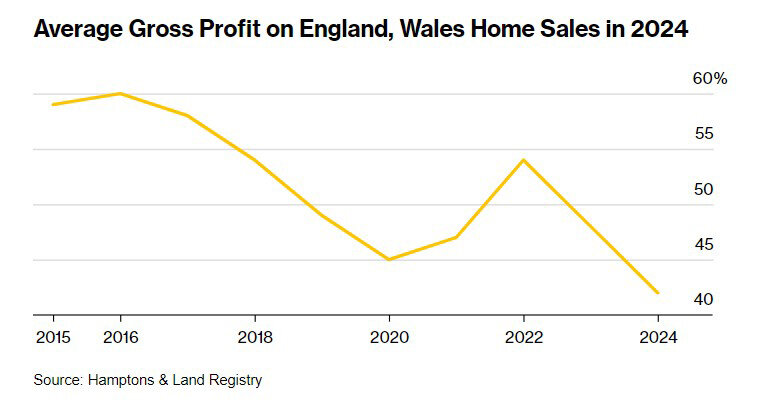

The average gross profit from home sales in England and Wales in 2024 dropped to £91,820 ($112,929), or 42%, according to Bloomberg, citing data from Hamptons International. This represents an 11% decline from £102,650 in 2023, reflecting the impact of government reforms.

"Households faced higher costs for mortgages and transactions, such as stamp duty, making moving more expensive," explained Aneisha Beveridge, Head of Research at Hamptons. "Until house prices recover or transaction and mortgage costs decline, homeowners are likely to stay put longer."

Challenges in the UK Housing Market

The UK housing market had a difficult 2024 as higher mortgage rates dampened housing demand and limited sellers’ ability to raise asking prices. A decline in five-year swap rates last week drove borrowing costs to their highest levels since May, increasing the likelihood of further mortgage rate hikes.

Hamptons reported that the average gross profit margin for sellers in England and Wales decreased from 48% in 2023. The sharpest declines were observed in London, where high transaction costs and weak house price growth have discouraged frequent relocations.

In 2024, only 25% of London home sellers had bought and sold within five years, compared to 34% nationwide. The average London seller earned £172,350 in 2024, roughly £32,000 less than in 2023. This marks the first time in nine years that average profits in the capital have fallen below £200,000. Nevertheless, 91% of households in England and Wales sold their homes profitably, with nearly a third securing six-figure profits.

Outlook for House Prices

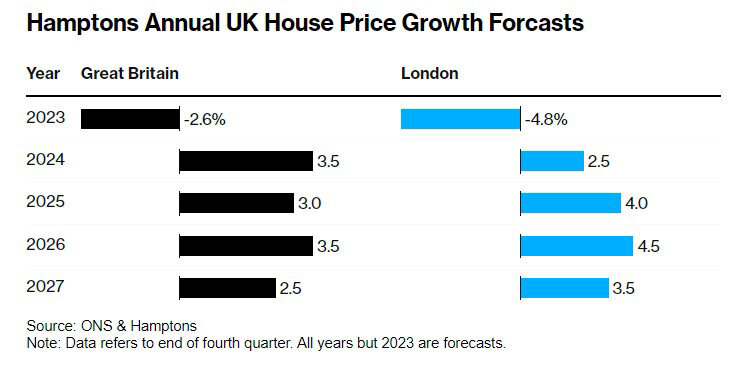

A separate report from Hamptons in November forecasted that UK house prices would rise by 3% in 2025 and 3.5% in 2026. This growth is partially driven by a long-term decline in housing construction, which reduces supply and supports high prices. However, this trend has made it increasingly difficult for new buyers to enter the housing market, with more Britons opting to rent instead.

"Homeowners often have to invest thousands of pounds from their own pockets to make a move financially viable," Beveridge noted. "This frequently deters many potential sales."

Hamptons warned that policies introduced by the Labour government, such as higher employer contributions to national insurance and increased taxes on second homes, could hinder the housing market’s recovery.

Regional and Long-Term Trends

Hamptons predicts that London may outpace other regions in house price growth for the first time since 2015, with a projected annual increase of 4% in 2025. Recovery is expected to begin in outer London areas, which have been hit hardest by higher taxes. However, fluctuations in interest rate expectations remain a critical risk to the housing market. The combined effects of ongoing rate hikes and slow economic growth are likely to suppress long-term house price growth compared to previous cycles.

Declining Construction Activity

In December, the UK’s housing construction PMI index fell for the sixth consecutive month, reflecting persistent declines in the sector. The Labour government’s ambitious plan to build 1.5 million homes over five years has slowed as private developers scaled back projects in response to reduced demand and higher interest rates. Analysts warn that the real estate market could face additional challenges in spring 2025 when further reforms are implemented.