read also

Flight Delays and Cancellations at Boston Logan Airport: 145 Disruptions in One Day

Flight Delays and Cancellations at Boston Logan Airport: 145 Disruptions in One Day

Norway Keeps Capital Buffer. Norges Bank decision in January 2026

Norway Keeps Capital Buffer. Norges Bank decision in January 2026

Key International Real Estate News Overview | February 18–25

Key International Real Estate News Overview | February 18–25

Lithuanian Conservatives Propose Property Restrictions

Lithuanian Conservatives Propose Property Restrictions

Norway Earned €36,000 Per Resident in 2025

Norway Earned €36,000 Per Resident in 2025

Tomorrowland Launches in Thailand

Tomorrowland Launches in Thailand

UK Mortgage Approvals Drop Sharply

The number of mortgage approvals in the UK fell in November 2024 to its lowest level since August, Bloomberg reports. Approvals decreased from 68,129 in October to 65,920 in November. Economists had predicted an increase to 68,700 approvals, but the rising cost of borrowing appears to be dampening housing demand.

Following the Labour Party’s announcement of an economy-boosting budget on October 30, mortgage rates rose, leading to a decline in applications. Consumer borrowing also fell to its lowest level since June.

“The rise in interest rates has undoubtedly had a significant impact on the housing market,” said Nathan Emerson, CEO of Propertymark. “Consumers need to feel confident in their financial situation before they engage in the buying and selling process.”

Impact of Rising Interest Rates

Higher interest rates have placed significant pressure on UK homeowners, particularly those with short-term fixed-rate mortgages. According to a Bank of England study, UK borrowers are more vulnerable than those in countries like the US, where households often secure fixed mortgage rates for decades. In the UK, fixed rates typically apply for just two or five years.

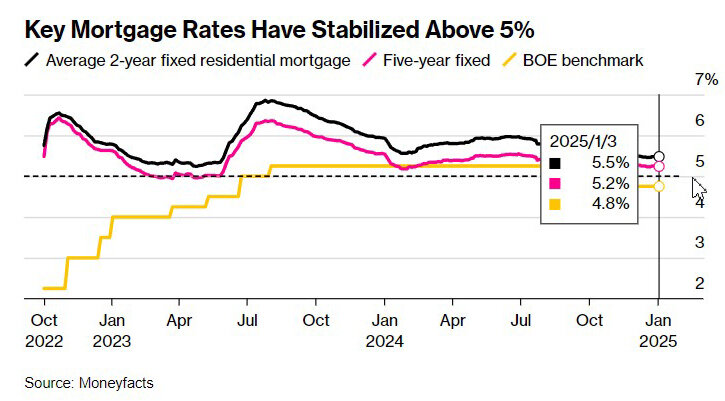

Data from Moneyfacts revealed that the average two-year fixed mortgage rate reached nearly 7% in summer 2023 before falling to around 5.5% by late 2024. This has had a particularly strong impact on households relying on short-term fixed-rate deals.

Short-term fixed-rate mortgages are often chosen under the influence of brokers. The Bank of England's research found that the share of mortgages arranged through brokers rose from 57% in 2013 to 81% in 2020 among first-time buyers. This increase partly stems from stricter regulations requiring qualified advisers for mortgage products. In areas where broker services expanded by 10 percentage points, the share of short-term fixed-rate mortgages increased by 1.8 to 2 percentage points.

Mortgages as a Monetary Policy Tool

Mortgages play a critical role in monetary policy, encouraging households to reduce spending during periods of higher rates. Elevated interest rates lower economic demand, incentivize savings, and influence asset prices. However, increased flexibility in the mortgage market could mitigate the impact of rate hikes. Some borrowers have managed to extend loan terms or leverage home equity to soften the blow, especially given rising property values.

In 2024, the average gross profit from home sales in England and Wales was £91,820 ($112,929), or 42% of the sale price. This marks an 11% decline from £102,650 in 2023, according to Hamptons International. Housing construction activity has also been declining for several months.

Resilience Amid Challenges

Despite these pressures, the UK real estate sector has demonstrated resilience. A report from Nationwide showed that house prices approached record highs, rising 4.7% year-on-year by the end of 2024.

Market dynamics may shift in the spring as new tax regulations take effect in April. Buyers will face lower thresholds for stamp duty and higher rates for second homes. This has temporarily stimulated activity, with many sellers and buyers rushing to close deals before the tax changes. However, analysts warn that demand may drop sharply following this initial surge.

The UK housing market remains in a delicate balance, with both short-term opportunities and long-term challenges shaped by interest rate pressures and tax policy changes.