Housing Oversupply May Limit Property Price Growth in Hong Kong

Hong Kong’s residential property market may begin to recover after a three-year decline, as lower interest rates attract more buyers, Bloomberg reports. However, experts warn that a significant price surge is unlikely.

Last year, signs of recovery emerged in the housing market following a series of tax cuts, relaxed mortgage rules, and the start of an interest rate reduction cycle. According to Centaline, real estate transactions in 2024 hit a three-year high, reflecting improved sentiment. However, an oversupply of housing is likely to keep price growth in check.

In the first nine months of 2024, Hong Kong’s GDP grew by 2.6%, close to the lower end of the official forecast range of 2.5% to 3.5%. However, economic slowdowns in key sectors, including real estate, persisted. The property crisis weakened consumer confidence and spending, while global geopolitical tensions negatively impacted trade. Additionally, economic challenges in China contributed to uncertainty.

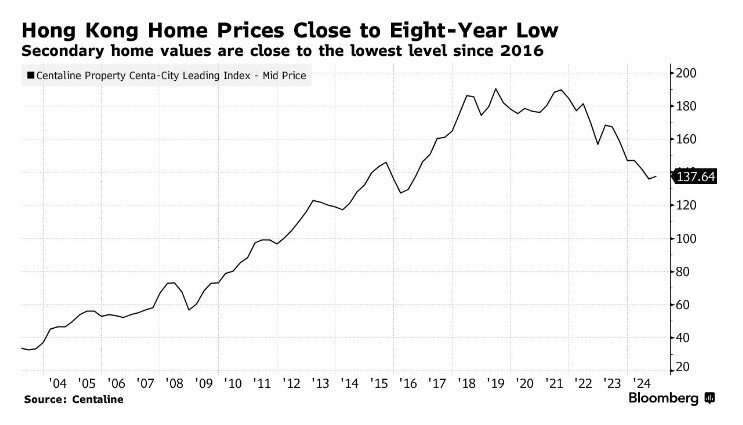

Property Prices Near Record Lows

Housing prices dropped to their lowest level since 2016 in September 2024. The last temporary price increase of 1.1% occurred in March, but this followed a 10-month decline. In February, prices fell by 1.7%, prompting the government to lift all restrictions to support the struggling market.

Key policy changes included:

✔ Removing additional taxes for foreign buyers and second-home purchasers

✔ Eliminating penalties for selling a property within two years

The market immediately reacted with a surge in transactions. However, 30% of second-hand property sales in Q1 2024 resulted in losses.

Despite the downturn, Hong Kong remains Asia’s most expensive city for housing, with an average price of $22,554 per square meter. By comparison:

? Singapore – $19,264

? South Korea – $11,964

? Taiwan – $7,500

? Japan – $5,161

? China – $4,516

Rental Market Strengthens Amid Housing Slump

While home sales struggled, Hong Kong’s rental market strengthened, as high mortgage costs prevented many from buying property. Other factors supporting rental demand included:

? Government initiatives to attract foreign talent

? Mainland Chinese students arriving for the new academic year

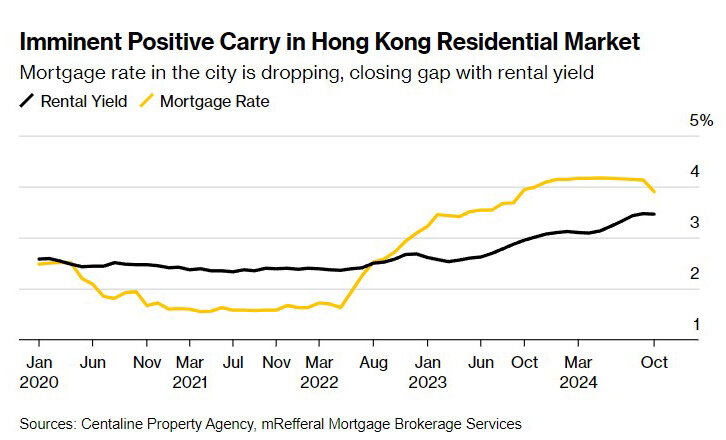

In autumn 2024, rental prices were only 1.2% below their 2019 peak. According to Centaline Property, rental yields in Hong Kong reached 3.46% in October, marking the second-highest return in 13 years. Meanwhile, mortgage rates fell to 3.5%, according to mReferral Mortgage Brokerage Services.

However, compared to global markets, Hong Kong’s rental yields remain relatively low.

For example:

? Tbilisi, Georgia – 9.15%

? Batumi, Georgia – 9.21%

? Riga, Latvia – 8.47%

? Chișinău, Moldova – 8.38%

? Belgrade, Serbia – 8.25%

European cities with low rental yields, similar to Hong Kong, include:

? Berlin, Germany – 3.59%

? Oslo, Norway – 3.50%

? Copenhagen, Denmark – 3.26%

? Zurich, Switzerland – 2.76%

However, in these cities, real estate is often seen as a wealth-preservation asset rather than a high-yield investment.

Forecasts for 2025: Will Prices Recover?

Cushman & Wakefield previously stated that housing prices had bottomed out, but significant growth remained unlikely due to economic uncertainty and high borrowing costs. Now, various analysts predict that the market will find its lowest point in 2025, followed by a gradual rebound.

Factors supporting market stabilization:

✔ Lower mortgage rates

✔ An influx of professionals from mainland China

✔ Steady rental demand

According to Bloomberg Intelligence analyst Patrick Wong, a recovery in transaction volumes and property prices is likely, as cheaper mortgages unlock pent-up demand.

DBS Group Holdings real estate analyst Jeff Yau is also optimistic, believing that rental yields surpassing borrowing costs could attract investors. He predicts that as rental demand from mainland immigrants grows, rental yields will soon match mortgage rates.

Oversupply May Still Limit Price Growth

Hannah Chong, head of valuation and advisory services at CBRE Group in Hong Kong, estimates that new home sales in 2025 will rise by 10%, reaching 20,000 units. However, she warns that housing supply will still far exceed demand.

? "Even if demand increases, it won’t solve the oversupply problem," she cautioned, adding that some developers will still have to offer discounts.

? In early 2025, a developer slashed prices to the lowest levels in Hong Kong since 2013, according to Midland Realty.

? In mid-2023, prices in the Oria project were 30% lower than previous phases, reported Centaline.

? Chong expects housing prices to remain stable in 2025, while BI forecasts a modest 5–10% increase.

Beyond interest rate cuts, analysts hope for government policies that will support price growth. "When mortgage payments become more affordable, the market will benefit," said Wong from Bloomberg Intelligence.

Economic Risks Still Loom Over the Market

? The IMF recently downgraded Hong Kong’s 2025 GDP growth forecast from 3% to 2.7%, warning of risks to the city’s economy as it becomes more integrated with mainland China.

By 2029, the IMF expects growth to slow further to 2.5%. The report highlights that challenges are compounding, putting Hong Kong on a path of slow, uneven recovery.

Key risks include:

⚠ Hong Kong’s increasing economic dependence on China

⚠ Housing market vulnerabilities

⚠ Global geopolitical tensions

⚠ Struggles in logistics and trade sectors

⚠ An aging population affecting long-term economic prospects

Hong Kong has already lowered its own GDP growth expectations, citing declining exports and weaker consumer spending.

? The IMF concluded that the drop in housing prices was primarily driven by oversupply rather than high interest rates.

? "Given the ongoing economic slowdown and external and internal pressures, policies should focus on supporting domestic demand and reducing risks," the report recommended.