Mtatsminda Leads in High Property Prices in Tbilisi

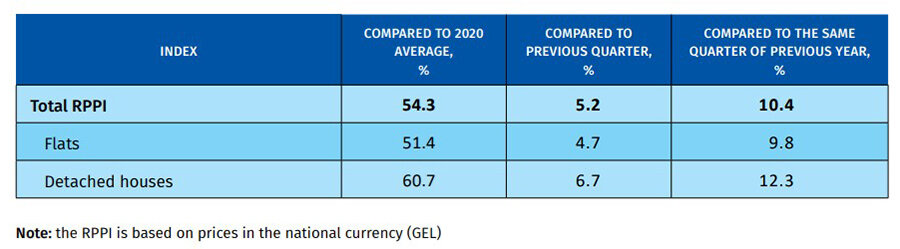

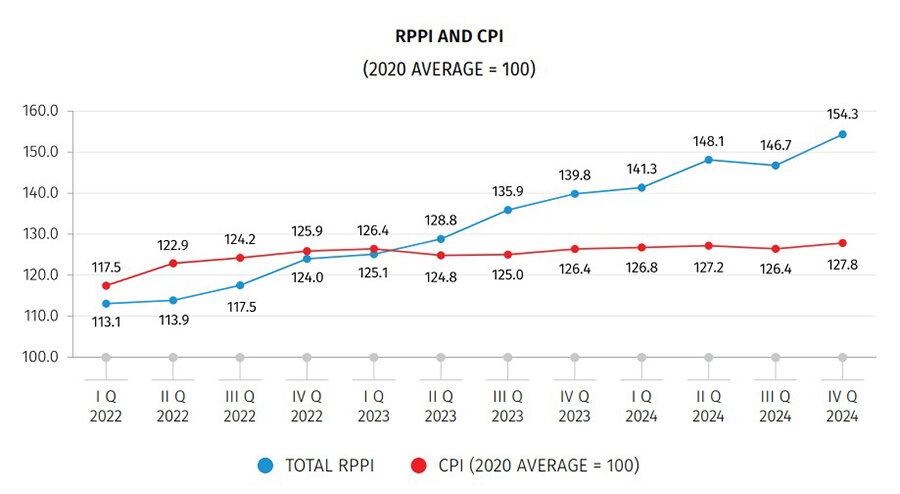

In the fourth quarter of 2024, Georgia’s Residential Property Price Index (RPPI) rose 5.2% compared to the July-September period. On an annual basis, prices increased by 10.4%, and since 2020, the overall change has reached 54.3%, according to the National Statistics Office of Georgia (Geostat).

The index covers the new residential property market in Tbilisi.

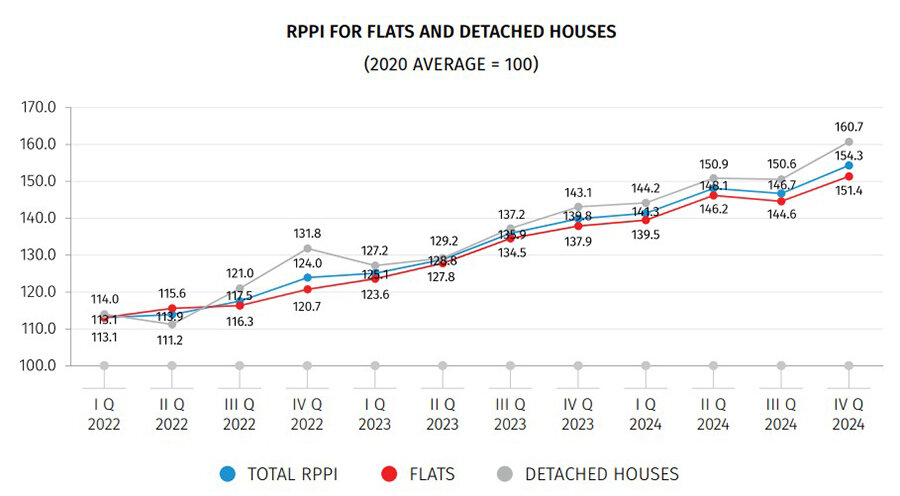

Apartment prices increased by 4.7% quarterly and 9.8% annually.

Private house prices rose by 6.7% quarterly and 12.3% annually.

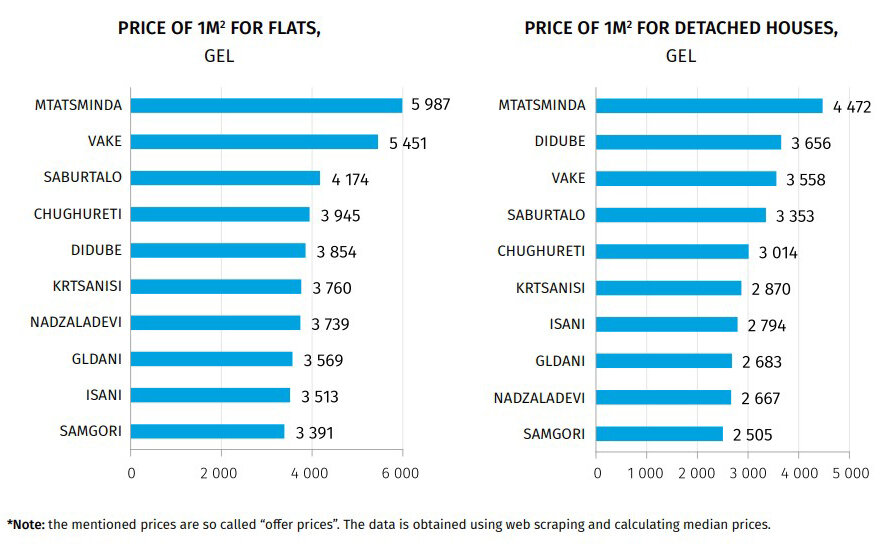

Most Expensive and Affordable Districts in Tbilisi

Mtatsminda remains the most expensive district for newly built apartments and houses, with prices at:

₾5,987 ($2,083) per square meter for apartments

₾4,472 ($1,556) per square meter for houses (Exchange rate as of January 28, 2025).

For apartments, the second most expensive district is Vake at ₾5,451 ($1,896) per square meter.

For houses, Didube takes second place at ₾3,656 ($1,272), while Vake ranks third at ₾3,558 ($1,238).

Saburtalo rounds out the top three for apartments at ₾4,174 ($1,452) and ranks fourth in house prices at ₾3,353 ($1,167).

The most affordable district for both property types is Samgori, where:

Apartments cost ₾3,391 ($1,180) per square meter

Houses cost ₾2,505 ($872) per square meter

For affordable apartments, Isani follows at ₾3,513 ($1,222), while Nadzaladevi is the most affordable for houses at ₾2,667 ($928).

In Gldani, both apartments and houses are relatively inexpensive at ₾3,569 ($1,242) and ₾2,683 ($934) per square meter, respectively.

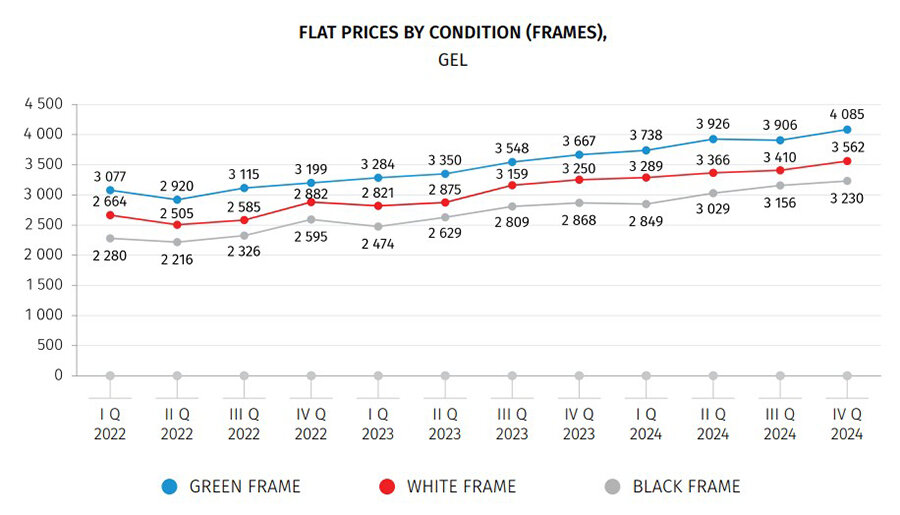

The chart below illustrates price trends for newly built apartments, depending on their construction stage.

Real Estate Market Growth in Georgia

According to Colliers Georgia, the number of apartment transactions in Tbilisi increased by 2% in 2024, reaching 41,284 deals. The market volume grew by 12%, reaching $2.8 billion.

New developments saw an 8.5% increase in contracts signed.

The secondary market showed lower activity, but the average price rose by 13% in the suburbs and by 15% in the city center.

Analysts at Galt & Taggart estimated Tbilisi’s average rental yield at 9%, which is higher than in many other capitals worldwide.

In Batumi, 15,034 apartments were sold in 2024, with the market volume rising by 6% to $778 million.

New construction prices increased by 7% year-over-year.

Secondary market prices rose by 4%.

In December 2024, the primary market saw an 11% price increase to $1,114 per square meter, while the secondary market increased by 0.2% to $985 per square meter.

Foreign Investor Interest in Batumi

Galt & Taggart noted that real estate sales to Israeli buyers in Batumi surged by nearly 55% in Q3 2024 compared to the same period in 2023.

The Batumi market remains one of the most profitable, with prices continuing to rise, albeit at a slower pace.

In the first nine months of 2024, the total market value of sold apartments in Batumi reached $675.5 million.

Experts predict further price increases, provided foreign investor interest remains strong.

Why Georgia Remains Attractive to Investors

High rental yields and a lack of property purchase restrictions make Georgia a hotspot for real estate investors.

Foreigners and local residents have the same property rights.

Property details can be verified online through the Real Estate Registry.

Visa-free entry for nearly 100 countries allows foreigners to stay in Georgia for up to one year and reset the duration simply by exiting and re-entering.

Georgia’s Economic Growth Outlook

Georgia’s economic prospects remain positive.

In 2024, GDP grew by 9%.

Prime Minister Irakli Kobakhidze expects an increase of 10% or more in 2025, given the country’s economic potential.

International organizations, including the IMF, have upgraded their economic forecasts for Georgia.

The World Bank projects that from 2024 to 2026, Georgia will have the highest average economic growth in Europe and Central Asia—6.7%.

Analysts estimate that Georgia’s 2025-2026 GDP growth forecast is 1.5 times higher than other EU candidate countries and five times higher than the Eurozone’s growth rate.