Real Estate Prices and Sales Decline in France

In 2024, France experienced a decline in real estate prices, particularly for houses, and a drop in residential property sales. However, by the end of December, economists began discussing signs of market stabilization, possibly due to lower interest rates. Despite this, the overall economic situation in the country remained challenging, further complicated by political changes.

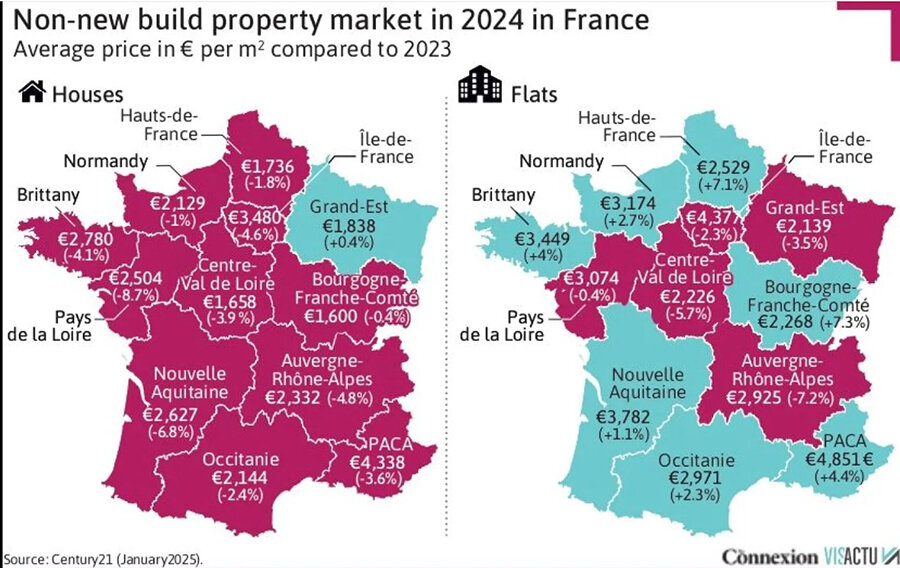

Across all regions of mainland France—except Corsica, where data was not collected—house prices fell, according to the Connexion portal, citing Century 21 data. At the same time, in seven out of 12 regions, prices for resale properties increased, with some areas seeing rises of more than 7%.

Housing prices dropped most sharply in the western regions, particularly in Pays de la Loire (-8.7%) and Nouvelle-Aquitaine (-6.8%). The highest average price per square meter for both apartments and houses was recorded in the southeast, while the lowest was in the northeast. In the Grand Est region, apartments remained the most affordable housing category, whereas in Bourgogne-Franche-Comté, houses were the more accessible option.

At the end of 2024, the average price per square meter for real estate in France stood at €2,473 for houses, marking a 3.8% decrease compared to the previous year. Apartment prices fell by 0.7%, averaging €4,113 per square meter. The average total price per unit was €265,211 for houses (-4.2%) and €224,263 for apartments (-0.9%).

The Cointribune portal previously reported on a sales volume crisis, noting that in 2024, France saw a sharp drop in real estate transactions, with only 750,000 sales recorded compared to 1.2 million in 2021. This represents a 17% decline compared to 2023. A major factor in this downturn was political instability, which followed the dissolution of parliament in June 2024. According to Priscilla Quenot, a notary and member of the High Council of Notaries, this instability led market participants to take a defensive stance, affecting all segments—older homes, new developments, and land purchases.

Economic conditions also failed to support market recovery. Falling property prices and lower interest rates were not enough to restore demand, as households continued to exercise caution amid persistent uncertainty. A joint study by Insee and the Bank of France highlighted a continued decline in household real estate wealth, now standing at €14,567 billion, a 0.9% decrease from 2023.

The decline in real estate prices in 2024 led to a notable increase in purchasing power, estimated at 4% for the year. However, this benefit was unevenly distributed. Households with higher incomes gained the most from favorable mortgage rates, which hovered around 3%, while middle-class households continued to face difficulties accessing credit.

This inequality also reflects geographic differences. For example, with a monthly payment of €800, a buyer could afford 111 square meters in Saint-Étienne, but only 41 square meters in Marseille and barely 12 square meters in Paris. These disparities highlight not only economic factors but also differences in regional attractiveness and market dynamics. The real estate sector thus mirrors a growing divide between major metropolitan areas, where prices remain exorbitant, and mid-sized cities, which are often more affordable. This widening gap exacerbates social inequality, making it even harder to balance and unify the national market.

Experts are divided on the outlook for 2024. Some argue that lower mortgage rates alone will not be enough to halt the decline in transactions. Others point out that recent quarterly results exceeded expectations, suggesting that the real estate crisis may be nearing its end. By summer 2025, the key interest rate is expected to drop to 2%, prompting banks to further reduce mortgage costs. French consumers are already taking out more loans, which is seen as a positive sign for the gradual recovery of the market.

Nevertheless, the overall economic outlook for France remains weak. After Fitch and S&P downgraded France’s credit rating, Moody’s later adjusted its forecast from a stable Aa2 to a negative Aa3. This unexpected downgrade was likely linked to political changes within the government.