read also

Flight Delays and Cancellations at Boston Logan Airport: 145 Disruptions in One Day

Flight Delays and Cancellations at Boston Logan Airport: 145 Disruptions in One Day

Norway Keeps Capital Buffer. Norges Bank decision in January 2026

Norway Keeps Capital Buffer. Norges Bank decision in January 2026

Key International Real Estate News Overview | February 18–25

Key International Real Estate News Overview | February 18–25

Lithuanian Conservatives Propose Property Restrictions

Lithuanian Conservatives Propose Property Restrictions

Norway Earned €36,000 Per Resident in 2025

Norway Earned €36,000 Per Resident in 2025

Tomorrowland Launches in Thailand

Tomorrowland Launches in Thailand

UK Housing Demand Slows Down

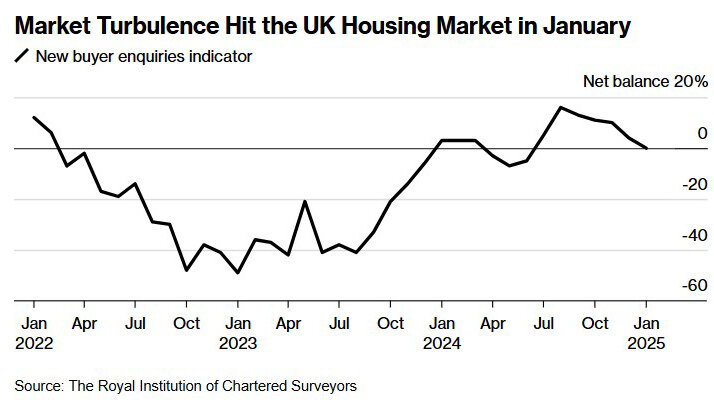

The UK real estate market experienced a decline in buyer interest in January 2025, Bloomberg reports, citing data from RICS (Royal Institution of Chartered Surveyors). The slowdown in demand occurred amid a sharp rise in borrowing costs. Previously, an increase in transaction volume was expected in Q1 due to the stamp duty hike scheduled for April.

According to RICS, the number of new buyer inquiries fell to zero for the fifth consecutive month, indicating no change in demand over the past month. Property surveyors also reported a decline in agreed sales transactions.

Tarrant Parsons, head of market analysis at RICS, explained that buyer demand slowed slightly at the beginning of the year, likely due to financial market instability in early January.

Impact of Bond Market Volatility on Housing Demand

A drop in bond prices temporarily caused base interest rates to fall to levels last seen during the 2008 financial crisis, making mortgages more expensive. However, since then, rates have fallen, and agents remain optimistic about home sales and prices this year, despite unfavorable economic conditions.

Demand is still partially supported by urgency as buyers rush to complete purchases before the stamp duty increase in April. The approaching deadline is particularly boosting sales of smaller homes in high-priced areas, such as London.

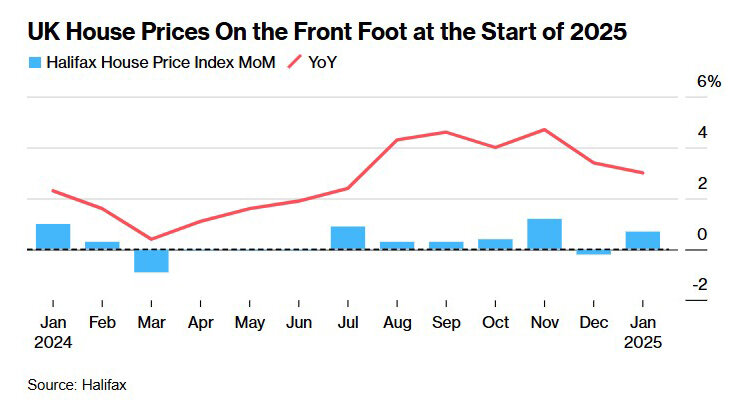

UK House Prices Reach New Highs

According to Halifax, house prices in the UK reached a new record high at the start of 2025, as buyers rushed to take advantage of tax relief before the stamp duty increase.

In January, the average house price rose to £299,138 ($371,810), marking a 0.7% increase from December. On an annual basis, house prices rose by 3%, the weakest growth rate since July.

Over the past year, the strongest-performing region was Northern Ireland, where house prices rose by 5.9%. In London, prices increased by just 2.8%, even though the capital remains the most expensive region, with an average property price of £548,288 ($685,000+)—almost twice the UK average.

Ashley Webb, a UK economist at Capital Economics, warned that house price growth could slow further,

"if the recent economic weakness persists throughout the year."

Many experts predict a decline in transaction volumes following the tax increase, and London is one of the regions where house prices are expected to fall over the next three months.

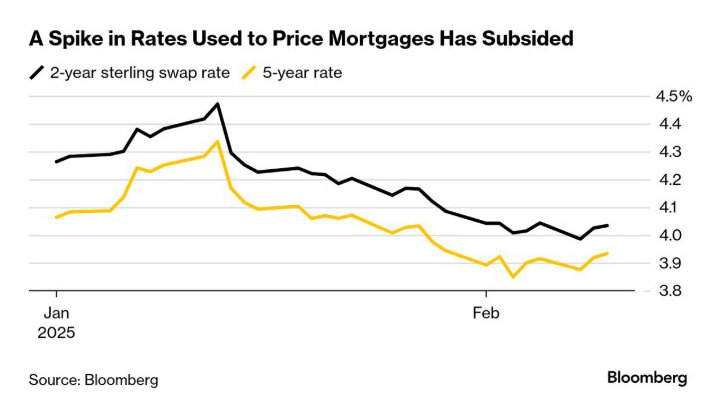

Mortgage Market Reactions and Buyer Support

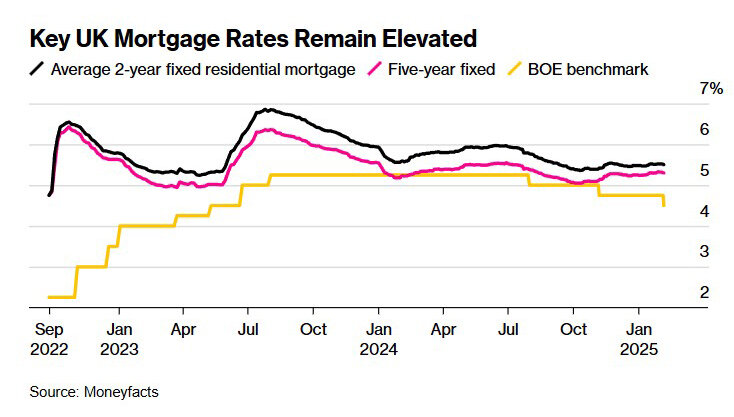

By mid-February, homebuyers received support as Barclays Plc followed Santander in lowering mortgage rates below 4%, sparking hopes for increased competition among lenders. These moves followed the Bank of England’s rate cut on February 6 and a drop in swap rates (which influence mortgage pricing) in recent weeks.

Economists believe that mortgage rates returning below 4% will help strengthen demand. However, much will depend on:

- How much financial support the government can allocate

- The broader UK economic outlook amid escalating global trade wars

- Inflation and interest rates remain high, creating uncertainty in the housing market.

Government Plans for Housing Affordability

Prime Minister Keir Starmer aims to make housing more affordable by building 1.5 million new homes over five years, though this target seems far from reality.

On February 13, the government announced plans to develop "next-generation new towns," revealing that over 100 sites across England have already applied.

Starmer also vowed to take action against those opposing new housing developments, stating:

"We will urgently use every available tool to build the homes we need, so more families can have a place to live," he said. "We are removing obstacles to housing construction and will no longer accept ‘no’ as the default answer."