Georgia’s Real Estate Market Continues to Grow

Experts from Colliers Georgia highlighted an increase in all key indicators in Batumi as of January 2025. The number of transactions has risen, and both new developments and existing properties have become more expensive. The market has also significantly expanded in Tbilisi and Batumi.

Changes in Tbilisi

In Tbilisi, 2,892 apartments were sold in January 2025. The market volume increased by 2.9% to reach $208 million. The number of transactions in new projects grew by 0.5% year-over-year, though experts note that this is a preliminary estimate. Many developers register contracts later, so the final numbers are expected to be even higher.

The weighted average price of new developments rose by 24.8% compared to January 2024, which analysts attribute to two major projects that have been under construction for 3-4 years. Prices in suburban areas increased by 8.8%, while in downtown Tbilisi, prices rose by 5.8%.

Meanwhile, in the secondary market, the number of transactions declined, but the price of old apartments grew by 12.5% year-over-year. In the suburbs and the city center, price increases were recorded at 10.4% and 7.2%, respectively.

According to Georgia’s National Statistics Office, the Residential Property Price Index (RPPI) in Tbilisi grew by 5.2% in Q4 2024 compared to July-September. The year-over-year increase reached 10.4%, while compared to 2020, the index has surged by 54.3%.

In the apartment segment, prices increased by 4.7% per quarter, while private house prices rose by 6.7%. Over the year, apartment prices climbed by 9.8%, while private houses appreciated by 12.3%. Among the most expensive districts in Tbilisi at the end of 2024 were Mtatsminda, Vake, Didube, and Saburtalo. The most affordable areas remained Samgori, Nadzaladevi, Gldani, and Isani.

Earlier, Colliers Georgia reported that apartment transactions in Tbilisi increased by 2% in 2024 compared to 2023, reaching 41,284 transactions. The market volume rose by 12% to $2.8 billion. New developments saw an 8.5% increase in contracts. While secondary market activity was lower, the weighted average price grew by 13% in suburban areas and 15% in the city center.

Experts from Galt & Taggart estimated the average rental yield in Tbilisi at 9%, which is higher than in many other capitals worldwide.

Batumi’s Record Growth

In Batumi, 1,049 apartment sales were registered in January 2025, an increase of 3.2% compared to January 2024. The total market volume grew by 17.4%, reaching $57 million.

Transactions in new developments in Batumi increased by 3%, while deals for older apartments grew by 5.7%.

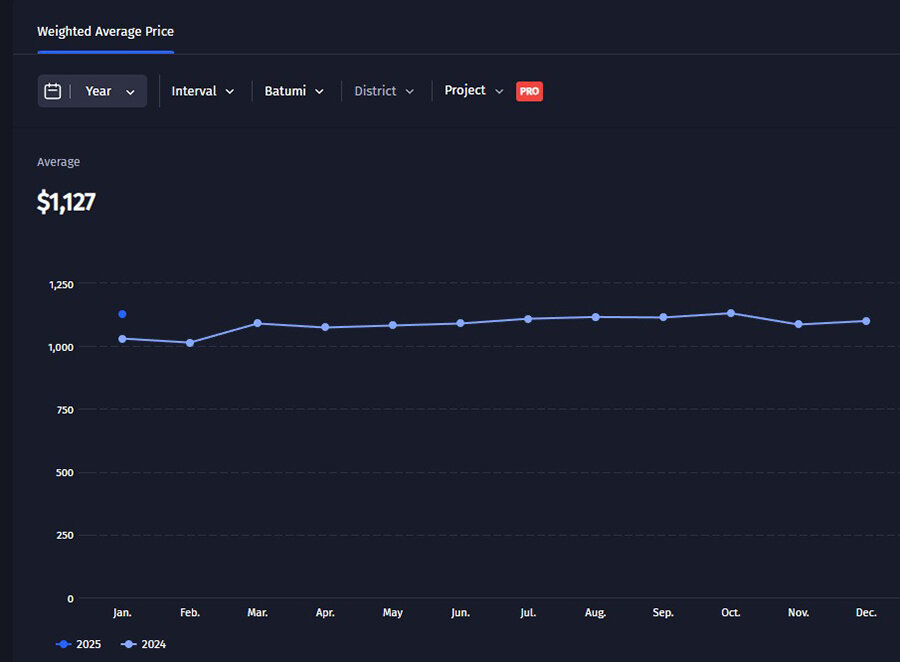

The weighted average price of new properties rose by 8%, reaching $1,130 per square meter, while the secondary market price surged by 16.2%, reaching $1,100 per square meter.

For the entire year 2024, 15,034 apartments were sold in Batumi, and the market volume grew by 6%, reaching $778 million.

The weighted average price of new developments increased by 7% year-over-year, while secondary market housing became 4% more expensive.

In December 2024, the primary market saw a 11% price increase, reaching $1,114 per square meter, while the secondary market price remained almost unchanged at $985 per square meter.

According to Galt & Taggart, real estate sales to Israeli buyers in Batumi grew by nearly 55% in Q3 2024 compared to the same period in 2023. The Batumi market remains one of the most profitable, with higher investment returns in the hotel sector.

The number of hotels in Georgia grew by 2.4% year-over-year to 1,212 units, while the total room capacity increased by 4.7% to approximately 37,000 rooms.

Demand for Airbnb rentals in Tbilisi increased by 9.5%, reaching 151,300 booked nights in Q4 2024. In Batumi, bookings rose by 20.8%, totaling 56,200 nights.

In Batumi, hotel reservations continue to grow even outside the peak season. Average occupancy increased from 36.9% in the same period of 2023 to 52.5% in 2024. ADR (Average Daily Rate) remained stable.

Hotel Industry Outlook

According to the National Tourism Administration, more than 300 new hotels are expected to open in Georgia by 2028. The number of rooms will reach 18,778, accommodating 37,101 guests.

By 2025, 17 new hotels will open across Georgia. Among the most ambitious projects are:

Hilton Garden Inn Adjara

Hilton Tbilisi

Hotel Sololaki Hills

Ambassador Batumi

Paragraph Golf & Spa Resort Tabori Hill

The largest hotel complex, Wyndham Grand Batumi Gonio, will feature 1,055 rooms, family residences, townhouses, and Georgia’s first all-inclusive 5-star resort infrastructure.

Abu Dhabi-based Eagle Hills Properties LLC announced two major projects in Georgia, with a total investment of $6 billion.

In Tbilisi, the developer plans Krtsanisi Park, a multi-functional residential and commercial complex spanning 590 hectares, including 170 hectares of parks.

In Batumi, the Gonio Marina project will cover 260 hectares, featuring branded residences, hotels, shopping areas, parks, and a yacht marina.

According to the Georgian government, public investment in tourism infrastructure will exceed 1 billion GEL ($355+ million) by 2028, with additional private investments of a similar scale expected in the hospitality industry.