Rental Prices in Istanbul Reach Record Highs

Endeksa

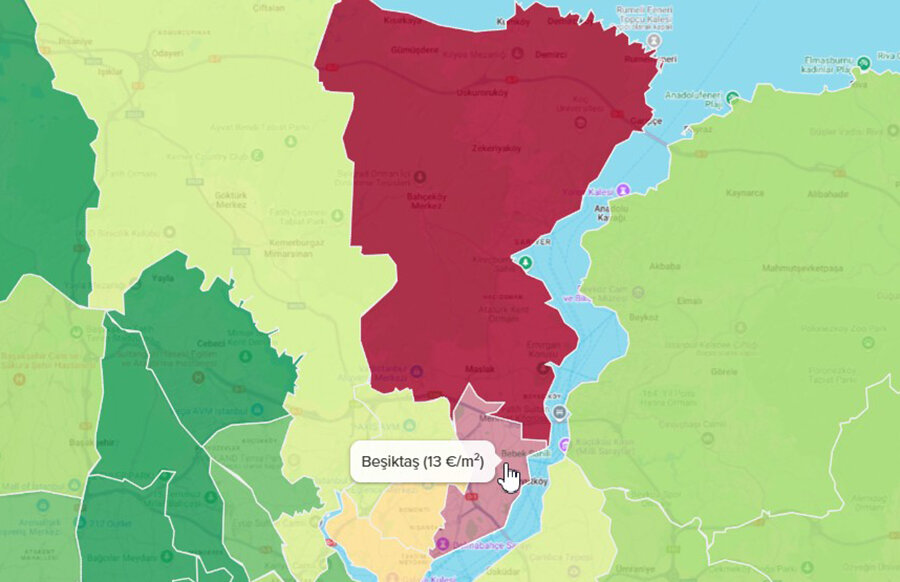

Rental housing in Istanbul has surged by 45% in early 2025 compared to the same period in 2024, reaching $735 for a 100 sq. m apartment. In elite districts, rental prices exceed $1,700, according to Turkiye Today. However, in real terms, adjusted for inflation, many rental rates have seen only slight increases, and in some cases, even decreases.

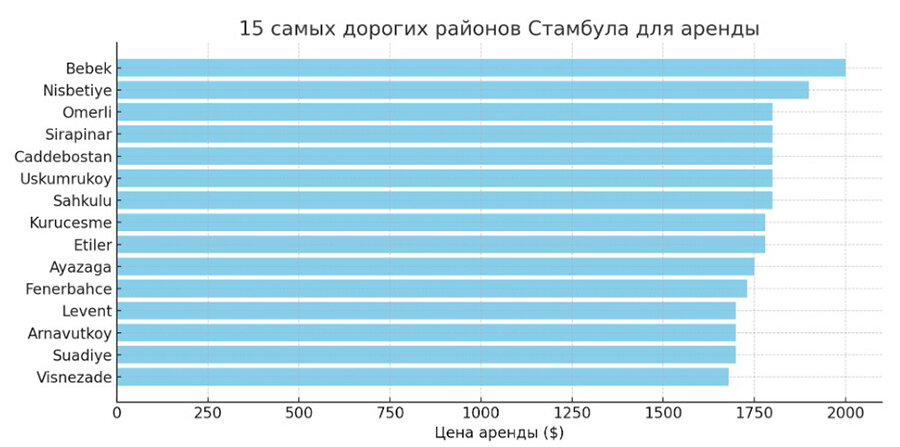

Rental Prices in Istanbul

According to Endeksa, the most expensive district for rentals in Istanbul is Bebek (Beşiktaş) at $2,000 per month for a 100 sq. m apartment. The second most expensive is Nisbetiye (Beşiktaş) at $1,900, followed by several districts at $1,800, including:

Ömerli (Çekmeköy)

Sırpınar (Çekmeköy)

Caddebostan (Kadıköy)

Uskumruköy (Sarıyer)

Şahkulu (Beyoğlu)

The cheapest rental rates among premium areas were recorded in Vişnezade (Beşiktaş) at $1,680.

These figures do not account for inflation. When adjusted, rental price increases appear less dramatic. For example, in 2024, nominal rent prices rose by 41%, while real-term growth, accounting for inflation, was just 3%, reaching ₺20,000 ($552) per month, according to Endeksa.

In Izmir and Ankara, rent prices rose by 52% nominally and 4% in real terms, with average rental costs ranging between ₺21,000–₺24,000 ($580–$662) in 2024.

Most Expensive Rental Provinces in Turkey

The highest average rental prices in Turkey were recorded in Muğla and Istanbul:

Muğla: ₺25,626 ($707) → Nominal increase: 58%, real increase: 8%

Istanbul: ₺25,331 ($699) → Nominal increase: 44%, real decrease: 1%

Antalya: ₺19,436 ($537) → Nominal increase: 36%, real decrease: 7%

Bursa: ₺18,312 ($505) → Nominal increase: 39%, real decrease: 5%

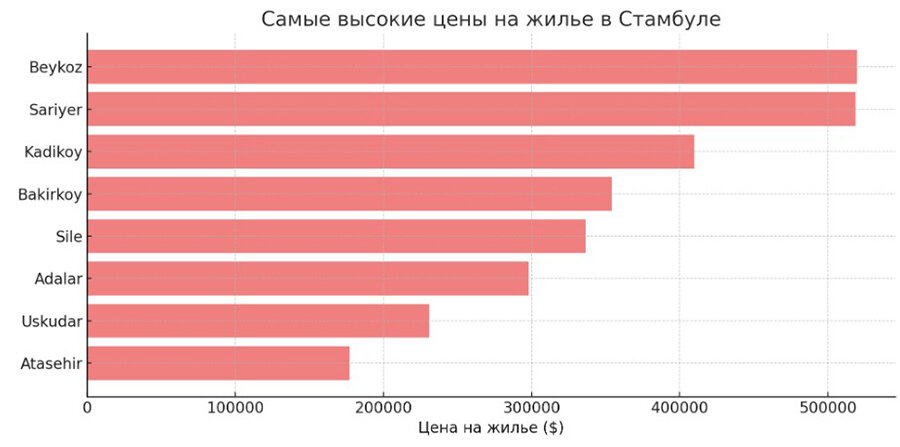

Real Estate Market and Sales Prices

Rising rental prices have also impacted the property sales market. As of early 2025, the highest average property prices were recorded in:

Beykoz – $519,600

Sarıyer – $518,600

Kadıköy – $410,000

Bakırköy – $354,000

Şile – $336,300

The lowest average sales prices among high-demand districts were in Üsküdar ($231,000) and Ataşehir ($177,000).

Turkey’s Property Market in 2024

In 2024, Turkey’s residential real estate prices:

- Increased by 25% nominally

- Decreased by 14% in real terms (adjusted for inflation)

- The average property price was ₺3.8 million ($105,000), with a square meter price of ₺29,724 ($820).

Among major Turkish cities (populations over 2 million), the highest nominal growth was in:

Gaziantep – +33% (real decrease of 9%)

Nurdağı (rebuilt after the February 2023 earthquake) had new homes priced at ₺21,605 ($596) per sq. m, with average property prices of ₺3.4 million ($94,000)

In Izmir, Ankara, and Adana, nominal prices rose by 28–29%, but real-term values fell by 12%:

Izmir → ₺38,579/sq. m ($1,065) | ₺4.8 million ($133,000) per home

Ankara → ₺25,482/sq. m ($703) | ₺3.3 million ($91,000) per home

Adana → ₺22,147/sq. m ($611) | ₺3.3 million ($91,000) per home

In Istanbul, property prices:

Increased by 23% nominally

Declined by 15% in real terms

Average price per sq. m → ₺44,755 ($1,235)

Average property price → ₺5.1 million ($144,000)

In Muğla, property prices saw:

19% nominal increase, 19% real decrease

₺63,387 ($1,750) per sq. m

₺8 million ($221,000) per home

Longest return on investment period → 20 years

In Antalya:

20% nominal increase, 18% real decrease

₺37,969 ($1,048) per sq. m

₺4.3 million ($119,000) per home

The cheapest housing in Turkey was in Muş:

₺14,915 ($412) per sq. m

₺2.4 million ($66,000) per home

Real Estate Sales and Foreign Investment Trends

According to the Turkish Statistical Institute, total home sales in 2024 exceeded 1.4 million, marking a 20.6% increase compared to 2023. The highest number of transactions occurred in:

Istanbul – 239,213 sales

Ankara – 134,046 sales

Izmir – 80,398 sales

Decline in Foreign Transactions

Despite overall market growth, foreign home purchases dropped by 32.1%, totaling 23,781 transactions, making up only 1.6% of total sales.

The top cities for foreign buyers were:

Istanbul – 8,416 sales

Antalya – 8,223 sales

Mersin – 2,112 sales

Among foreign buyers:

Russians → 4,867 transactions

Iranians → 2,166 transactions

Ukrainians → 631 transactions

For non-residents, the Turkish market remains a high-risk investment.

Market Outlook and Challenges

Experts attribute the rising rental and sales prices to:

- Limited housing supply

- Rising construction costs

- Increasing domestic demand

If these trends persist, housing could become even less affordable, leading to economic and social challenges.