read also

Sweden Urges Citizens to Hold Cash for Emergencies

Sweden Urges Citizens to Hold Cash for Emergencies

Indonesia Faces Growing Credit Rating Pressure

Indonesia Faces Growing Credit Rating Pressure

Poland Rethinks Rate Cuts as Iran War Risks Rise

Poland Rethinks Rate Cuts as Iran War Risks Rise

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Housing Market Enters Moderate Cooling Phase

UAE Housing Market Enters Moderate Cooling Phase

How Georgia Supports Its Economy and Investments in Times of Crisis

How Georgia Supports Its Economy and Investments in Times of Crisis

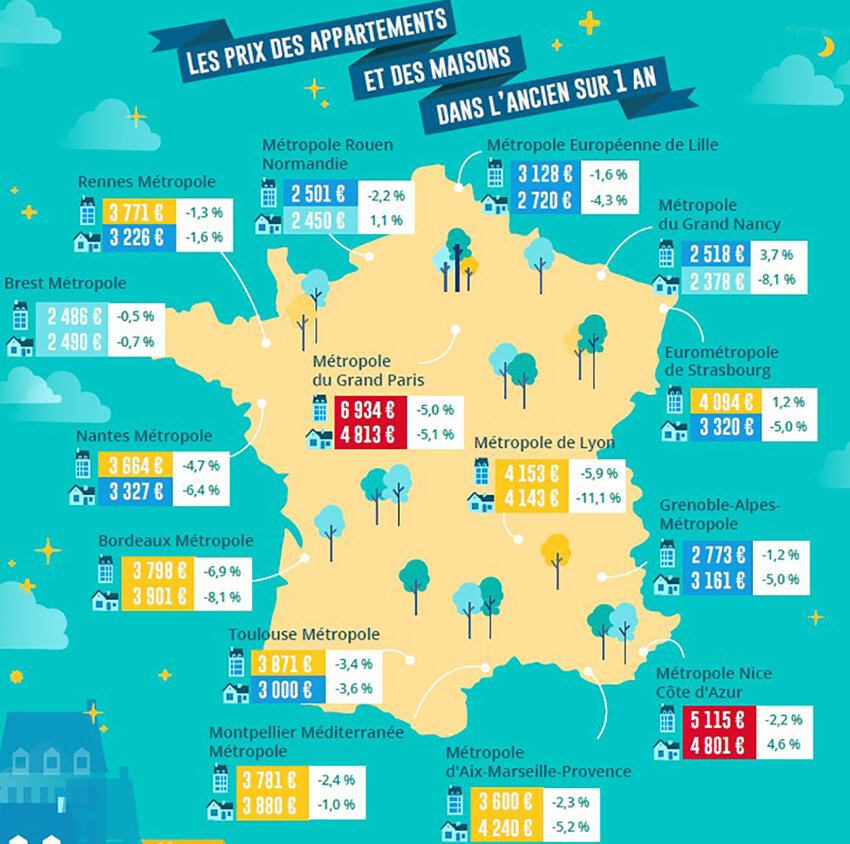

Increased Housing Affordability in Select French Cities: A Recent Trend

The real estate agency network IAD reports that housing prices have dropped significantly in several major cities and tourist areas of France, creating new opportunities for buyers. However, the average price per square meter on the secondary market has stabilized, decreasing by only 1.6% over 2024 to €3,217. Regional differences remain substantial.

In Bordeaux, the average price of apartments dropped by 6.9% to €3,798, while house prices fell by 8.1% to €3,901. Experts attribute this to changing economic conditions, rising mortgage rates, and the withdrawal of investors who were previously interested in the region. The most significant declines were seen in older properties and multi-apartment buildings, while new constructions maintained their value due to strong demand for energy-efficient housing.

Another region experiencing a decline is the French Riviera. In cities such as Nice and Cannes, prices for luxury real estate have fallen by approximately 10%. For example, apartments that sold for €1.5 million in 2023 were valued at €1.35 million in 2024 due to decreasing interest from foreign buyers.

In Antibes and Fréjus, the prices of apartments and villas dropped by 7-9%, from an average of €6,000 per square meter to €5,500. Real estate agencies also note a rise in interest in long-term rentals, as some property owners prefer leasing over selling.

In Lyon, apartment prices fell by 5.9% to €4,153, while house prices dropped by 11.1% to €4,143. This trend is mainly observed in areas farther from the city center. Analysts explain this as a price correction after an overheated market. In Toulouse, the price per square meter declined by 6% over the year—from €4,200 to €3,950. Some districts in Toulouse are seeing new developments entering the market at lower prices, stimulating demand.

In Paris, the average price per square meter for secondary housing is now €6,934, a 5.0% drop compared to last year. Private house prices have also decreased by 5.1% to €4,813. The most significant changes are observed in areas further from the city center. In the Seine-et-Marne and Essonne departments, apartment and house prices have dropped from €3,500 to €3,200 per square meter due to lower demand and higher competition among sellers. Meanwhile, areas closer to Paris, such as Nanterre and Saint-Denis, have maintained stable prices at €5,000-5,200 per square meter, although experts predict a possible correction in the coming months.

Price reductions have also affected some resort and rural areas of France. In Normandy and Brittany, where housing prices previously surged due to high demand for countryside homes, a 4-6% price drop has been recorded. For instance, in Deauville, the price per square meter fell from €4,800 to €4,500, while in Saint-Malo, house prices decreased from €3,700 to €3,500. Analysts suggest this is due to some buyers who sought country homes during the pandemic now returning to major cities.

The new construction sector in France is struggling with unstable demand, difficulties in obtaining loans, and reduced government support. Despite developers offering discounts and incentives to boost sales, price declines in new apartments have slowed, reaching 2.1% year-on-year by the end of 2024. However, sales volumes remain below pre-crisis levels, highlighting the need for further measures to support the sector.

Experts cite higher mortgage rates, reduced purchasing power, and changing investor priorities as the main reasons for price declines across all types of residential real estate. Increasing requirements for transactions also play a role, with buyers becoming more selective, focusing on energy efficiency, infrastructure, and transport accessibility.

It is important to note that price reductions are limited to specific locations and property types. For example, in Nancy, the average apartment price increased by 3.7% to €2,518 per square meter, while house prices fell by 8.1% to €2,378. In Strasbourg, apartment prices rose by 1.2% (to €4,094), while house prices fell by 5.0% (to €3,320).

Prices in central Paris and high-end resorts remain consistently high. In Saint-Tropez, the cost per square meter is still around €13,000, reflecting strong demand for premium real estate. Overall, property prices in France remain elevated. Meanwhile, the average gross rental yield stood at 4.70% in Q4 2024, according to Global Property Guide. The highest yields were recorded in Marseille (5.17%), Montpellier (4.84%), and Paris (4.83%), while lower yields were observed in Nice (4.66%), Lyon (4.63%), Nantes (4.60%), Bordeaux (4.50%), and Toulouse (4.39%).