read also

Luxury Real Estate in Spain: Foreign Buyers Focus on Seaside Villas

Spain is witnessing a rise in high-end properties priced above €1 million, with around 20% exceeding €3 million, according to a report from Idealista. The most significant interest in this segment comes from foreign buyers, especially in tourist regions where over 60% of luxury housing searches originate abroad.

Q4 2024 Trends: Demand Dominated by Villas

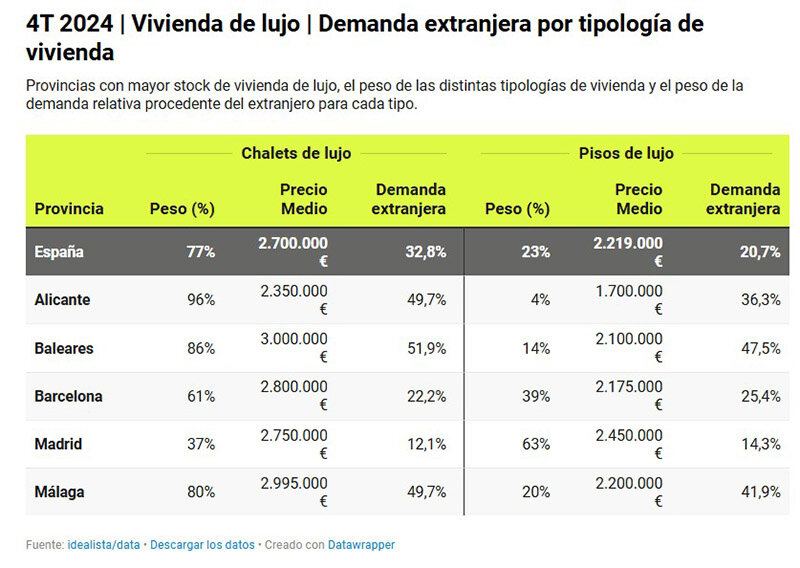

According to data from Idealista for Q4 2024, 77% of all national luxury properties listed were houses, while 23% were high-end apartments and penthouses. Foreign interest in million-euro villas reached 32.8%, and for luxury apartments — 20.7%.

Regional Breakdown: Where Foreign Buyers Dominate

Balearic Islands: 86% of listings are villas (~€3M), only 14% are apartments. Foreign demand is extremely high — 52% for villas and 47.5% for apartments.

Costa del Sol: 80% of listings are villas (~€3M). Foreigners account for 49.7% of demand. In Málaga, 41.8% of interest in apartments comes from non-Spanish buyers.

Alicante: 96% of luxury properties are villas (~€2.3M), with foreigners forming nearly 50% of house demand. For apartments (4% of listings), international interest is 36.3%.

Barcelona: More balanced — 61% houses, 39% apartments. Foreign buyers represent 25.4% of apartment demand and 22.2% for villas.

Madrid: 63% of listings are apartments, with just 14.3% of sales involving international buyers.

Foreign Hotspots: Ibiza, Mallorca, Costa Blanca

Ibiza (Dalt Vila - La Marina): 72.9% of villa inquiries come from abroad (mostly Germans, Dutch, British). Avg. price: €2.15M. Apartments: ~€1.9M.

Port d'Andratx (Mallorca): 73.3% foreign demand for apartments (€1.87M), 66.8% for villas (€7.5M).

Peguera (Calvià, Mallorca): 68.2% foreign interest in €1.59M apartments, 39.7% in €4.25M villas.

Altea la Vella (Alicante): 62.4% demand for €2M homes, 50% for €2.1M apartments.

Nueva Andalucía (Marbella): Foreign demand: 62% for villas, 46.6% for apartments.

El Velerín (Estepona): Luxury homes ~€7.5M (50.4% foreign demand), apartments ~€2.19M.

San Carlos (Ibiza): Villas ~€7M (58.2% foreign interest), apartments ~€1.5M (56.9%).

Policy Shift: From Investment to Regulation

Despite sustained interest, Spanish authorities are responding to concerns about housing affordability. In April 2025, Spain officially closed its Golden Visa program, which granted residency for real estate investment. This move aims to ease pressure on the housing market.

Rising Pressure on Short-Term Rentals

Balearic Islands: Fines up to €500,000 for illegal short-term rentals, license transfers banned, and violators must transfer homes to the government for social rent.

Málaga: New registrations for tourist housing are suspended.

Madrid: Ban on rentals without separate entrances.

Barcelona: From 2028, all short-term rentals will be banned. Legal challenges have failed.

Further proposals under discussion include:

A temporary ban on property sales to foreigners

A 100% tax on property purchases by non-residents

These measures reflect a shift toward social housing policy, price control, and prioritizing affordability for residents. For foreign buyers, flexibility and awareness of new restrictions are essential in adapting to Spain’s transforming real estate landscape.