European Real Estate Market: Rental Dynamics, Prices, and Yields in 2025

Europe’s housing crisis continues to worsen: rents are rising, new construction is slowing down, and the number of overcrowded apartments keeps increasing. These are the key findings of the Catella Residential Market Overview Q1 2025 report.

Rental Prices Continue to Climb

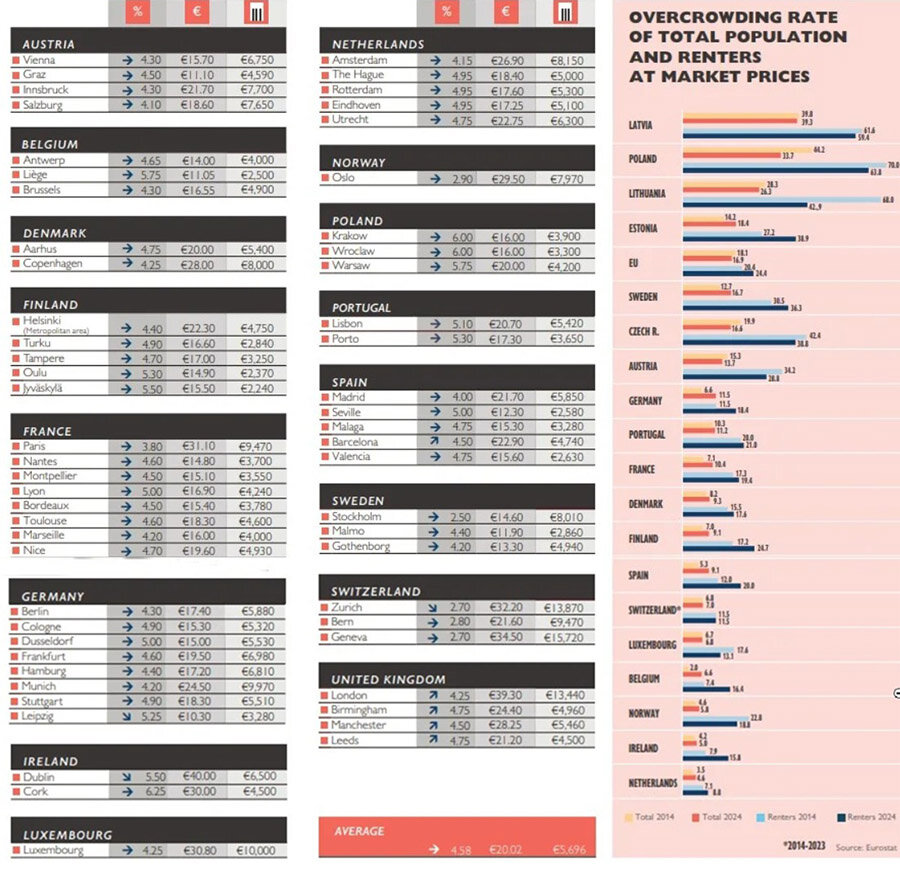

Catella analysts recorded rent increases in 48 out of 59 European cities. By the end of Q1 2025, the average rent across Europe reached €20.02 per square meter per month — a 2.4% increase compared to late 2024. Dublin (€40), London (€39.3), and Geneva (€34.5) remain the most expensive cities for renters. The most affordable markets are Leipzig (€10.3), Liège (€11.05), and Graz (€11.1).

In Germany, rental prices rose in all surveyed cities. Munich leads with €24.5 per square meter, followed by Frankfurt (€19.5) and Stuttgart (€18.3). Despite high prices, demand remains strong, indicating a persistent housing shortage.

Overcrowding on the Rise

The report also highlights growing overcrowding rates. According to Eurostat, the percentage of renters living in overcrowded conditions rose from 20.4% in 2014 to 24.4% in 2024. In Germany, overcrowding increased from 11.5% to 18.4% over the past decade. Similar trends are observed in Belgium (+9 pp), Spain (+8 pp), and Ireland (+7.9 pp).

Catella’s Head of Research, Dr. Thomas Beyerle, stated:

“Europe’s rental market is under pressure. Overcrowding and rising rental costs create risks not only for urban development but also for economic stability. We’re seeing a clear supply-demand imbalance, especially in major cities.”

Home Prices Also Increasing

Housing purchase prices are also climbing. Average prices rose 0.9% compared to the previous period, reaching €5,696 per square meter. Geneva (€15,720), Zurich (€13,870), and London (€13,440) remain the most expensive cities for homebuyers. The most affordable markets are in Finland’s Jyväskylä and Oulu (around €2,240).

Some cities are experiencing particularly rapid growth. In Madrid, prices rose by 11.9% in the second half of 2024 to €4,290 per square meter. Gothenburg saw a 10.5% increase (€4,940), and Copenhagen rose 9.6% to €7,970.

Residential Yields Remain Stable

The average residential property yield in Europe stood at 4.58%, unchanged from the previous period. The highest yields were recorded in Cork (6.25%) and several Polish cities — Kraków, Wrocław, and Warsaw (5.75%–6.00%). The lowest yields were found in Stockholm (2.5%), Zurich, and Geneva (both 2.7%), reflecting a wide gap in regional investment potential.

Rising Prices May Widen Inequality

Dr. Beyerle warns that continued price increases may exacerbate social inequality. Europe is entering a phase where housing becomes a factor of social instability, and EU countries must cooperate to expand affordable housing stock. Analysts are calling for a pan-European strategy to restore market balance.

Housing Deficit Worsens Across Europe

Additional data from CBRE confirm the severity of the situation. The firm estimates Europe’s housing deficit at 9.6 million units, equivalent to 3.5% of the total housing stock. Over the past 12 months, new construction has declined in many countries:

In Germany, fewer than 250,000 housing permits were issued in 2024 — 26% fewer than in 2023.

In France, housing completions dropped to 2016 levels.

In the Netherlands, permits declined by 11% year-over-year.

EU Housing Affordability Under Strain

The European Commission reports that by 2024, the ratio of housing prices to disposable household income exceeded 145% of the 2000–2019 average, with sharp increases particularly in Austria, Germany, and the Netherlands.

Public Pressure Mounting

In the UK, Housing Ombudsman Richard Blakeway reported a 474% surge in complaints about social housing conditions compared to 2019. Tenant grievances have reached unprecedented levels, with 45% of complaints related to unaddressed repairs and maintenance issues. Blakeway warned of growing public dissatisfaction that could escalate unless landlords and local authorities take urgent action.

Governments Respond with New Measures

In Germany, authorities have proposed extending rent control measures until 2029 in 18 cities, including Berlin, Munich, and Frankfurt. Rent increases would be capped at 15% over three years — or 11% in some districts — to ease pressure on tenants. However, construction industry representatives caution that such restrictions could deter investors and slow new housing development.

Additionally, mayors of ten major EU cities sent an open letter to European Commission President Ursula von der Leyen urging immediate action on the housing crisis. They highlighted that over 13 million Europeans lack access to affordable housing, especially in urban employment hubs, and called for a long-term EU strategy to address the issue.

Подсказки: real estate, Europe, housing crisis, rents, property prices, yields, Catella, overcrowding, EU policy, Germany, UK, France, 2025, investment