Housing Prices in Norway Remain Flat, but Market Stays Active

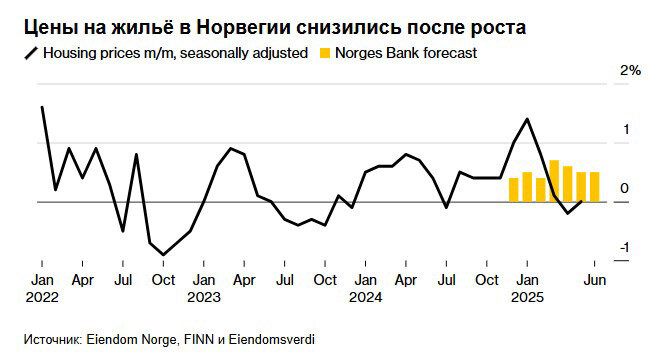

Housing prices in Norway remained unchanged in May 2025 on a seasonally adjusted basis, Bloomberg reports, citing data from Real Estate Norway. This follows a 0.2% decline in April—the first drop in nine months. Meanwhile, the country’s central bank (Norges Bank) had anticipated a 0.5% increase.

The portal Eiendom Norge clarifies that home prices actually rose 0.2% in May, but when adjusted for seasonal fluctuations, they effectively remained unchanged. Since the start of the year, prices have increased by 7%, with the average home price reaching 5,112,498 kroner (€439,000).

The most significant growth since the beginning of the year was observed in Stavanger and surrounding areas—up 12.2%. Meanwhile, price increases in Oslo were weaker than expected. In May, the sharpest monthly price gains were seen in Ålesund (+1.9%), Hamar, and Stange (+1.1%). Price declines were recorded in Tønsberg and Færder, as well as in Fredrikstad and Sarpsborg (–1.5%).

Transaction volumes in the secondary market continue to rise. In May, 11,701 residential properties were sold—7.3% more than a year earlier. Since the start of the year, 48,133 homes have been sold, 15.6% higher than the same period in 2024. The number of listings also increased: up 11.8% in May and 16.6% year-to-date. The average time to sell a home decreased to 42 days in May (compared to 47 in April). Homes sold fastest in Stavanger, averaging just 16 days, while Tromsø had the longest selling time at 72 days.

Meanwhile, Norway continues to face challenges in housing construction. Eiendom Norge CEO Henning Lauridsen noted that persistent administrative barriers and lengthy approval processes remain obstacles to the government’s goal of building 130,000 new homes by 2030. He emphasized that real progress would only be possible with political will at the municipal level, while current debt burdens and rising interest expenses pose risks that cities may delay development projects.

Henning Lauridsen believes that 2025 could become a record year for secondary market transactions. In his view, strong sales volumes indicate steady demand despite the lack of sharp price growth. He also anticipates that the traditionally active June season will significantly reduce housing supply.

Svenska Handelsbanken’s Chief Economist for Norway, Marius Gonsholt Hov, previously commented that the sudden halt in price growth is temporary. He projected increases in the second half of 2025. The expert also expected that the current interest rate of 4.5%—the highest in 16 years—would be lowered, which, along with continued wage growth, would positively impact the real estate market and buyer sentiment.

Many other analysts had also predicted an interest rate cut, with some suggesting it could happen twice in the year. However, the decision by Norway’s central bank to ease monetary conditions came as a surprise. Reuters reported that on June 19, 2025, the bank indeed cut the key interest rate by 25 basis points to 4.25%—the first cut since 2020. Central bank representatives explained the move by citing more favorable inflation forecasts.

“The outlook remains uncertain, but if the economy develops broadly in line with current projections, the policy rate may be reduced once more during 2025,” Norges Bank said in its statement. It is possible the rate could fall to around 3% by the end of 2028.

According to the OECD’s June forecast, the reduction in interest rates will support a recovery in investment activity—including in housing construction. It is also expected to boost private consumption as real incomes rise. Norway’s mainland economy (excluding oil and gas) is forecast to grow by 1.7% in 2025 and accelerate to 1.9% in 2026.

Подсказки: Norway, real estate, housing prices, property market, Norges Bank, interest rates, property investment, OECD, home sales