The Ultra-Wealthy Are Growing in Number: Demand for Luxury Real Estate Will Increase

According to the Residential Real Estate 2025 report by Altrata in partnership with REALM, the number of ultra-high-net-worth individuals (UHNW) with assets over $30 million is projected to grow by 33% by 2030. This will significantly increase demand for luxury real estate and create new opportunities for financial, consulting, and service firms targeting this clientele.

The average UHNW individual owns three luxury residences, including a primary home and vacation properties. With rising mobility and global diversification, their impact on international property markets is intensifying. Experts emphasize the importance of tracking not only their geographic distribution but also lifestyle preferences and investment strategies.

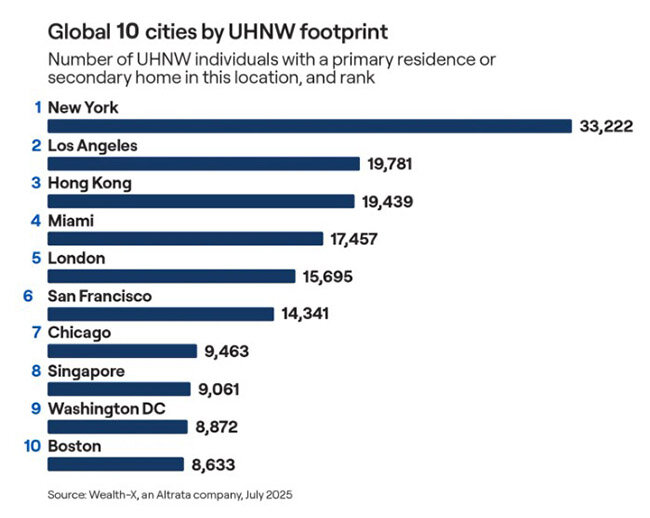

U.S. Cities Dominate Global Rankings

U.S. cities hold 75% of the top 20 spots. Among the top 10 cities with the most UHNW property owners, American locations prevail. New York leads with 33,222 owners holding over $30 million in assets. Next are Los Angeles (19,781) and Hong Kong (19,439). Miami ranks fourth (17,457), followed by London (15,695). Others include San Francisco (14,341), Chicago (9,463), Singapore (9,061), Washington (8,872), and Boston (8,633).

The strong presence of U.S. cities underscores their lasting influence on the global luxury property market, while Hong Kong, Singapore, and London maintain key positions in Asia and Europe.

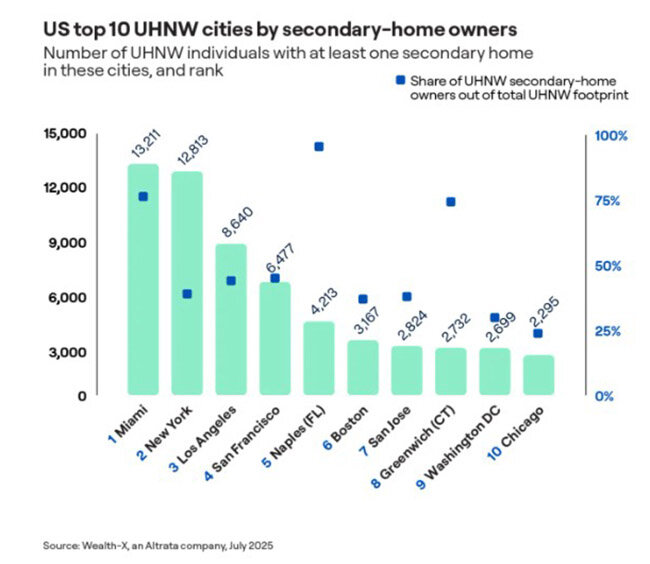

Miami: The New Global Hub for Second Homes

One standout trend is Miami’s rise as a preferred destination for second homes among the ultra-wealthy. Over 13,200 individuals own at least one additional home here, with second-home ownership reaching 75%. Miami has surpassed New York, L.A., and other metropolises, becoming a leading hub for secondary residences.

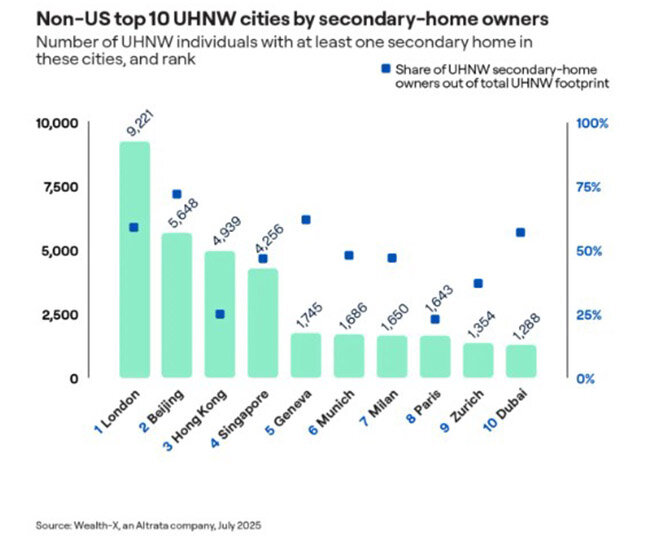

Among non-U.S. destinations, London is the top city for UHNW second homes, with over 9,200 owners (59%).

Monaco leads globally in UHNW population density, with one ultra-wealthy person per 22 residents. In the U.S., Aspen, Colorado, ranks highest—one UHNW individual per 77 people.

Global Country and City Rankings from Knight Frank

According to Knight Frank, with global GDP growing 3% annually, an estimated 268 people enter the $10 million+ wealth bracket every day, and 11 exceed $100 million. Around 60% of UHNWI are concentrated in the U.S. and China—making both crucial markets for high-end real estate.

Dubai led global super-prime ($10M+) real estate sales in 2024, accounting for 20% of all such transactions. Indian and Chinese investors drive this market. Miami and Palm Beach saw 118% and 170% growth, respectively, driven by wealthy Americans relocating to low-tax states. New York saw moderate growth due to market saturation and capital migration.

In London, super-prime prices dropped 17% in GBP and over 35% in USD over the last decade, but the city remains the third-largest global market in this segment. High taxes and political uncertainty continue to hinder growth.

Singapore has overtaken Hong Kong in luxury housing deals, but its 60% foreign buyer tax suppresses demand. In Europe, Monaco leads, with prices double those in London and consistently high demand due to land scarcity and tax benefits.

In the International Private Investment report, Georgia’s luxury segment is noted for its growing appeal. High-end residential and branded hotel developments with spas, fine dining, and fitness amenities are attracting investors seeking lifestyle and rental income potential.

Georgia is increasingly seen as an affordable alternative to more expensive European markets, thanks to low entry barriers, simplified purchase rules for foreigners, and booming tourism in Tbilisi and the Black Sea region.

Investment Trends and Future Outlook

The average billionaire age has risen from 63 in 2014 to nearly 66 in 2024. In tech, it's around 57, reflecting slow wealth transfer across generations. Women increased their share of total capital by 38% in a decade but still account for just 11%.

Roughly 65% of millennial UHNWI prefer assets with social value. There’s growing demand for “private members’ club” real estate—housing integrated with wellness, social, and culinary services. Nearly 80% of young UHNW individuals aim to reduce consumption and create sustainable portfolios focused on ESG principles.

This trend fuels “mission-driven investing” with an emphasis on ecology, inclusion, and long-term value.

“The ultra-wealthy are more mobile, diversified, and globally connected than ever,” says REALM CEO Julie Faupel. “Today, they think in currencies—not countries.” The luxury segment remains resilient amid global economic instability. Understanding clients’ residential preferences is key. Experts expect strong, sustained demand, expanded transaction geography, and new emerging hubs.

Подсказки: UHNW, luxury real estate, Miami, New York, London, Knight Frank, Altrata, elite property, second homes, ESG investing, global markets, ultra rich, wealth report