Luxury Housing Prices in Paris Rise Amid Declining Sales

Photo: Knight Frank

Despite a decline in the number of luxury real estate transactions in Paris, prices continue to rise. The strongest demand is concentrated in niche segments with limited availability—such as new developments, mansions, and temporary residences, according to Knight Frank.

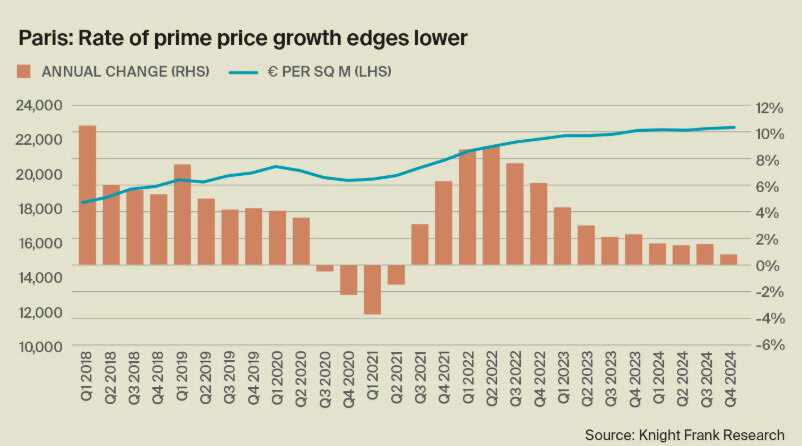

Since the pandemic began, the average price per square meter for luxury property in Paris has increased by 12%, from €20,370 to €22,730. Yet in H2 2024, only 12,220 transactions were recorded—fewer than during H1 2020, when the market had slowed due to lockdowns.

Strong Segments: New Builds, Mansions, and Temporary Residences

In exclusive high-end formats, sellers and developers still hold the upper hand. Fewer than 2,000 new units are introduced annually in Paris, which limits access and supports prices. This supply deficit makes such assets resilient to the broader market’s liquidity constraints.

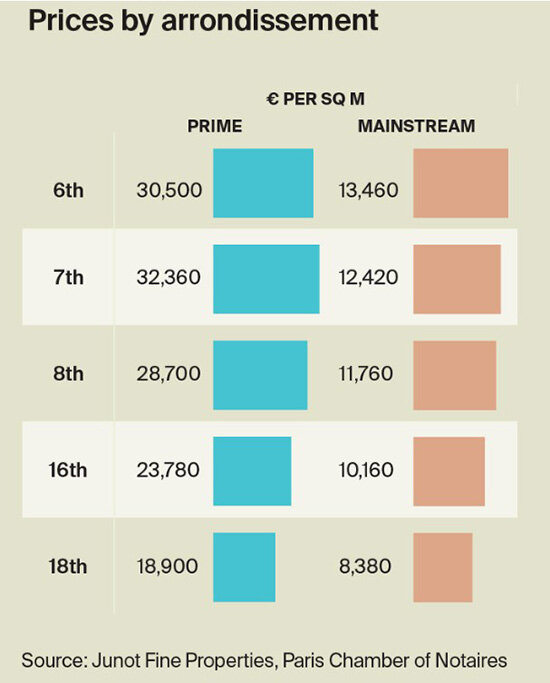

Temporary housing remains in high demand. According to Junot Fine Properties, the average value in 2024 was €7.6 million for a 235 sq. m residence, translating to €33,833 per sq. m. Nearly half of all buyers in this segment are Chinese nationals—drawn by the flexibility and prestige of partial or short-term living in Paris.

Ultra-Prime Market: Mansions Command Record Prices

Mansions remain the rarest and most capital-intensive properties. In 2024, just six such homes were sold. One fetched €50,000 per sq. m; another sold for €33 million. In 2025, two notable sales in the 7th arrondissement have already been recorded—one for €55 million and another for €100 million. These properties are increasingly attractive to wealthy French buyers seeking privacy and spacious urban living.

Monetary Policy and Global Capital Shifts Boost Market

Demand is driven not just by local factors but by global capital movements. The European Central Bank has cut interest rates seven times, with further reductions expected in 2025. Combined with political and tax changes in other countries—like the abolition of the UK’s non-dom regime, higher flat taxes in Italy, and political uncertainty in the U.S. under Donald Trump—Paris is viewed as a stable market with a clear legal framework and reliable currency.

According to the Knight Frank European Lifestyle Report 2024, Paris ranks first among European cities considered for relocation, topping the list across all age groups from Gen Z to Baby Boomers.

Wider Market Shows Signs of Recovery

Sales of historic apartments rose by 25% in Q1 2025 year-over-year, with the Île-de-France region up 21%. This marks the first notable activity boost after two years of decline. Average price per square meter in Paris now stands at €9,420—still below the 2022 peak.

Prices in the 6th arrondissement dropped by 1.7% to €13,550, and in the 7th to €14,330. The 3rd and 4th districts saw price drops of 6.7% and 6.2% respectively, although Gros-Caillou saw a 2.6% increase. Energy-efficient properties continue to attract buyers, especially in northern Marais.

Outer districts are drawing attention from investors and young professionals. A hike in transfer taxes effective April 2025 encouraged early transactions. Slight mortgage rate cuts and a return of renovated properties have also helped.

Q2 2025 may bring further demand increases. Premium segment prices could rise to €25,000–30,000 per sq. m, and up to €35,000 in exceptional cases. The city-wide average could reach €9,750—a 2.7% YoY gain.

Groupe BPCE forecasts a 3–6% rise in transactions in H2 2025, with a modest 1% price increase and mortgage rates stabilizing around 3.2%. Expanded government programs may provide extra support, especially for first-time buyers.

But Long-Term Risks Remain

According to Investropa, prices in Paris and other French regions may correct by 7–15% in 2026. The main risks: overreliance on rate dynamics and falling rental yields. As prices outpace rent growth, investor appetite may weaken.

Подсказки: Paris, real estate, luxury housing, premium property, France, Knight Frank, 2025, property market, mansions, investment, ECB, temporary residence, elite housing