Real Estate Prices in Turkey: Rising or Falling?

Photo: Emlakkulisi

In May 2025, Turkey's residential real estate market continued to see nominal price increases. However, when adjusted for inflation, real values showed a decline, according to Endeksa.

Housing prices rose by 2% compared to April and 26% year-on-year. However, real value dropped by 1% month-on-month and 8% compared to May 2024. The average price per square meter reached 32,693 TRY ($841), and the average apartment price was 4.2 million TRY ($108,000). The average payback period for property investment stands at 13 years.

Regionally, Diyarbakır saw the highest nominal annual growth at 61%, with an 18% real increase. Çanakkale rose by 46% (7% real), Manisa by 43% (4% real). In Hatay, prices grew by 17% nominally but fell 14% in real terms. Similar discrepancies were seen in Muğla (+20% to –12%) and Eskişehir (+23% to –10%).

Among the four largest cities, Ankara led with a 34% nominal annual increase — though this translated to a 2% real drop. Izmir rose by 28% (–6% real), Istanbul by 24% (–9% real), and Antalya by 21% (–12% real).

Rental trends are also mixed. While rents increased by 34% year-on-year and 4% monthly, inflation-adjusted figures indicate a 2% decline. Average rent across Turkey stood at 212 TRY ($6) per m², or 22,041 TRY ($568) per unit.

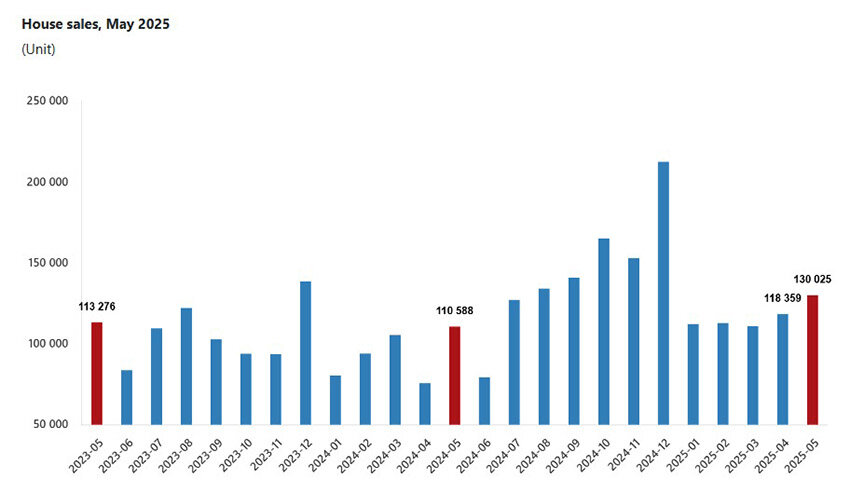

According to TÜİK (Turkish Statistical Institute), over 130,000 housing transactions took place in May 2025 — up 17.6% year-on-year. Istanbul (22,103), Ankara (11,975), and Izmir (7,817) led in volume. The lowest numbers were in Ardahan (48), Bayburt (67), and Gümüşhane (91). Between January and May, sales reached 584,170 units — up 25.4%.

Mortgage-backed sales surged: 19,412 in May — up 95.9% year-on-year, accounting for 14.9% of total transactions. From January to May, 88,606 homes were purchased with loans (↑98.7%), including 4,674 first-time purchases and 21,062 overall.

Non-mortgage sales rose by 9.9% in May to 110,613 units. In the five-month period, they totaled 495,564 (↑17.7%), accounting for 85.1% of the market.

In May, 39,546 new homes were sold (+11.2%), bringing the year-to-date total to 174,055 (+17.7%). Resales accounted for 90,479 units in May (+20.6%) and 410,115 in five months (+29%). Secondary sales made up 69.6% of all transactions, with primary sales at 30.4%.

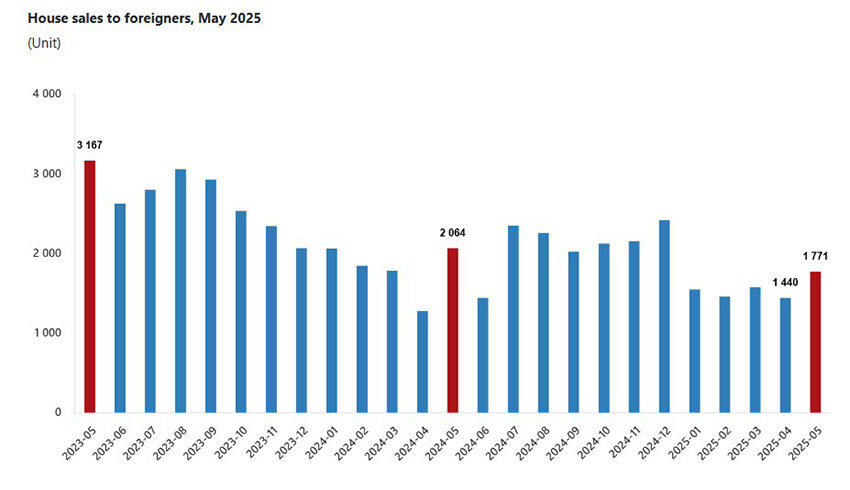

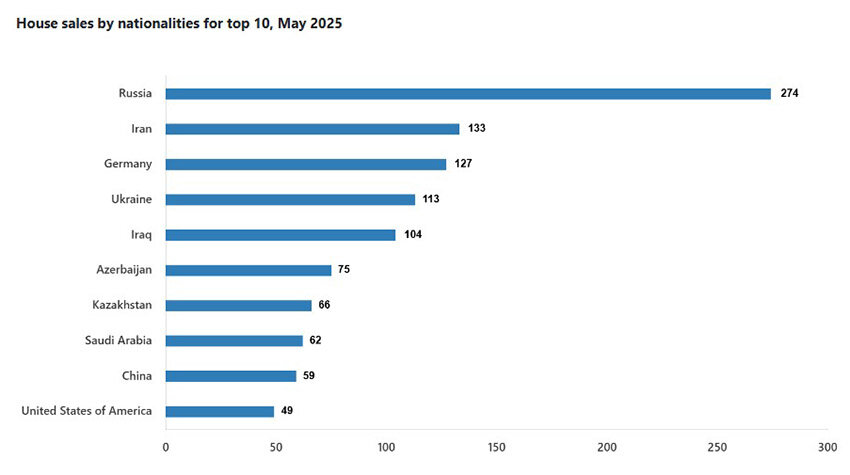

Transactions involving foreign buyers dropped 14.2% in May to 1,771 (1.4% of all deals). Most sales were in Istanbul (648), Antalya (594), and Mersin (145). Russians led by nationality with 274 purchases, followed by Iranians (133) and Germans (127). Between January and May, foreign sales fell by 13.7% to 7,789.

Endeksa CEO and co-founder Görkem Öğüt stated that May’s activity reflects seasonal trends and rising demand. However, structural issues persist: construction lags behind demand, and land and material costs continue to climb. In this context, delaying a purchase may lead to further price increases. While short-term financial tools may seem appealing amid high interest rates, real estate remains a strong long-term investment. Still, investors should consider tightening Turkish policies on foreign buyers, increasing financial thresholds, and political volatility.

Подсказки: Turkey, real estate, housing market, investment, inflation, Istanbul, Antalya, mortgage, foreign buyers, 2025 trends