Hungary Housing Prices Keep Rising as Transaction Volumes Decline

Photo: Unsplash

In Q1 2025, activity in Hungary’s real estate market slowed: the number of transactions fell by 10% compared with the same period of 2024. At the same time, the composite housing price index rose by 12.5% in nominal terms and by 6.9% in real terms, the Central Statistical Office reports.

Sales of existing homes declined by 8.2% at the start of 2025, while primary-market sales volume was half that of Q1 2024. The share of new apartments fell to 1.9%, attributed to reduced construction. On average, residential prices in Q1 were 5.3% higher than in October–December. In the secondary market, prices rose by 5.7% over the same period in nominal terms and by 3.1% in real terms. New builds added only 2.3%, effectively signaling stagnation.

In Budapest, the average price on the secondary market rose sharply to HUF 62.5 million (about €158,000)—HUF 8.8 million more than a year earlier. The price per sq m increased to HUF 1.2 million (€3,023). The strongest growth was recorded for apartments in panel high-rises (+29% y/y). Detached houses rose by only 1.7%. The most expensive area remained the Buda Hills—around HUF 1.5 million (€3,800) per sq m.

In regional capitals, the average price per sq m increased by 12%, while apartment prices rose by 3.2%. Szeged saw 22% growth—to HUF 43.8 million (€110,374); Székesfehérvár +20% to HUF 47.9 million (€120,705); Debrecen +14% to HUF 51.7 million (€130,281); Pécs +13% to HUF 36.5 million (€91,978). In Kecskemét, prices were up 9% to HUF 37.1 million (€93,490); in Veszprém up 8% to HUF 41.6 million (€104,830). Szombathely recorded a decline of nearly 8% to HUF 34.6 million (€87,190).

Resort areas are also posting gains: in the Lake Balaton agglomeration, the price per sq m reached HUF 867,000 (€2,185), up 11% year-on-year. In the Budapest agglomeration, the increase was a more modest 5.9%, and in real terms prices were roughly flat at HUF 735,000 (€1,852).

In the new-build segment, the gap between the capital and the regions is also notable. Nationwide, the average price of a new apartment rose from HUF 70.4 million to HUF 71.9 million (€177.4k–€181.2k), while the price per sq m nearly reached HUF 1.2 million (€3,023). In Budapest, the average primary-market price is estimated at HUF 88.8 million (€224,000), and the price per sq m exceeded HUF 1.5 million (€3,800). By comparison, the average in regional capitals was HUF 66.8 million (€168,437), and in small towns HUF 57.8 million (€145,619).

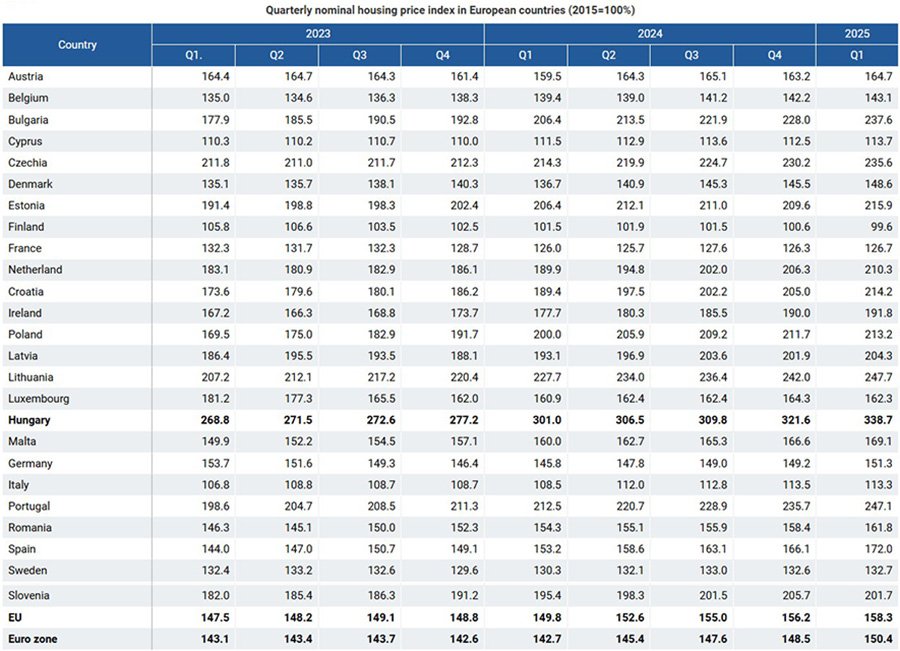

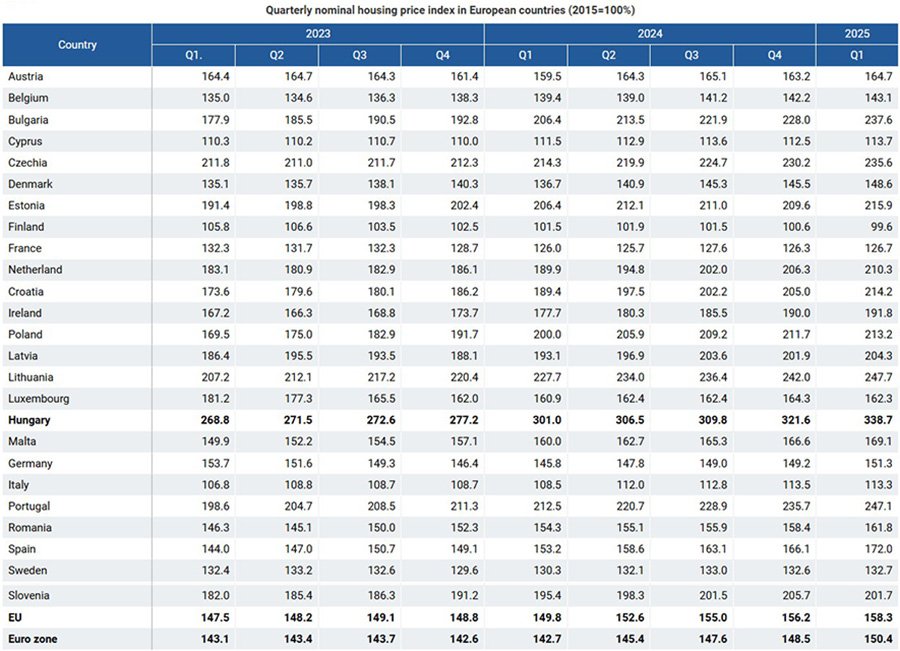

Against European trends, Hungary looks overheated. The EU’s average housing price index reached 158% of its 2015 level, and the euro area 150%. Hungary’s index is about twice the EU average, rising to 339%. Year-on-year dynamics in Q1 2025 were similar in Hungary and Slovakia (+12%). Romania, Austria, and Slovenia saw increases of only 3–5%. Portugal (16%), Bulgaria (15%), and Croatia (13%) led by annual growth, yet Hungary still holds the EU’s highest nominal price index.

According to the MNB House Price Index, in Q1 2025 prices [leech=https://www.globalpropertyguide.com/europe/hungary/price-history]rose[/leech

] 15.34% year-on-year in nominal terms and 9.57% in real terms. Quarter-on-quarter growth came in at 7.04% and 4.36%, respectively. Budapest saw the largest increase (+22.3%), followed by Southern Transdanubia (+16.8%) and Northern Hungary (+15.9%). The smallest rise was in Pest County (+7.8%).

Analysts at OTP Mortgage Bank and RE/MAX Hungary expect housing prices to grow by an average of 15% in 2025–2026, and up to 20% in investment-attractive districts. At the same time, rental yields are gradually declining—Global Property Guide estimates put early-2025 yields at around 5.09%, versus 5.78% in 2024.

Experts also point to potential accelerators. One proposal under discussion would allow the use of pension savings to buy or renovate homes tax-free, which could add another 10–15% to prices, especially in Budapest. Unique prime assets in the capital and major cities are expected to keep appreciating, and over the next two years the market is likely to remain among the most active in the EU.

Despite rising prices, the market remains regulatory-heavy. Non-EEA buyers typically need a purchase permit, which lengthens closing timelines and adds costs for legal counsel and translations. Mortgage lending is constrained by borrower-based limits (LTV/DSTI), so investor leverage is lower than desired, and net returns are sensitive to interest rates and mandatory charges. An additional burden comes from the 4% transfer duty and VAT specifics for new builds, which do not apply to all projects and depend on unit characteristics and completion timelines.

There are operational risks as well. In Budapest, targeted restrictions on short-term rentals are periodically debated and implemented, which can reduce revenues for apartment owners in tourist areas. A significant share of the stock outside the city center needs modernization: energy-efficiency retrofits, new building systems, and “green” standards increase CAPEX and lengthen payback periods. With prices elevated, rental yields are gradually cooling, and euro-based investors face currency risk due to forint volatility.

Read also:

Housing

in Hungary: From Growth to Stagnation

Retail

Under Pressure: New Limits for Big Stores in Hungary

Who

Buys Property in Hungary: Trends, Restrictions, Outlook

Cost

of Living in Hungary 2025: Prices, Salaries, Living Conditions

European

Real Estate Investment 2025: Colliers Study

Подсказки: Hungary, housing market, real estate, Budapest, price index, KSH, MNB, secondary market, new builds, price per sq m, Balaton, EU comparison, OTP, RE/MAX, rental yields, pension savings, investment, Central Europe, 2025