Real Estate / Investments / Tourism & hospitality / Analytics / Research / Georgia / Real Estate Georgia 03.11.2025

From Housing to Hotels: How the Investment Structure in Batumi Is Changing

The growth rate of Batumi’s housing market has slowed, and returns are declining amid increasing construction volumes and limited demand, noted in a Galt & Taggart report. Investment purchases still dominate, but the share of apartments for permanent residence is gradually increasing. At the same time, the hotel sector continues to expand rapidly, with profitability rising, especially in the luxury category.

Sales and Market Structure

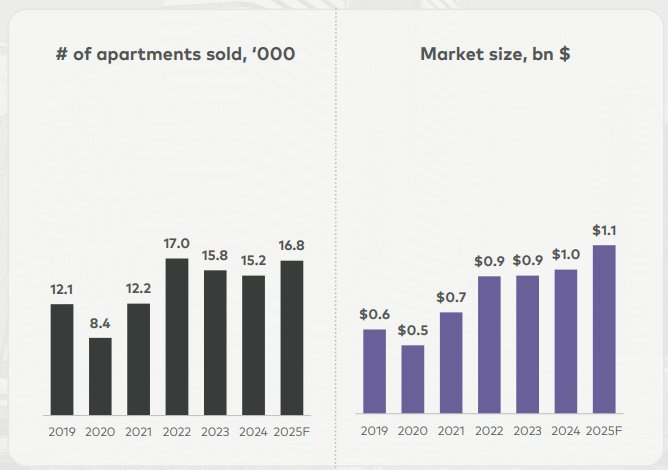

In 2019, 12.1 thousand apartments were sold in Batumi, and by 2022, the figure had reached a peak of 17 thousand. After that, demand declined: in 2023 there were 15.8 thousand transactions, and in 2024 – 15.2 thousand. Galt & Taggart experts expect 16.8 thousand contracts to be registered by the end of 2025. The total transaction value over six years will nearly double – from $0.6 billion to $1.1 billion – reflecting price growth even as sales volumes shrink.

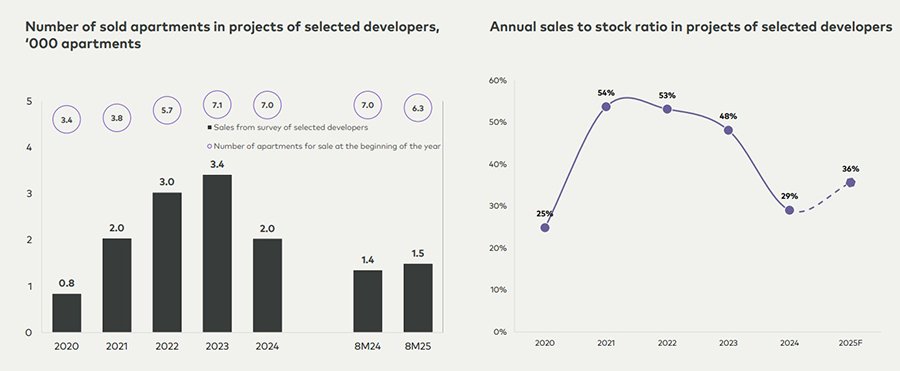

Analysts note that developer activity in the primary market is weakening. In 2022–2023 some 3–3.4 thousand new apartments were sold, while in 2024 only about 2 thousand. In the first eight months of 2025, just 1.5 thousand units were sold, with about 6 thousand offered – indicating oversupply. About 30% of new properties enter the secondary market within the first two years after completion, accelerating market saturation.

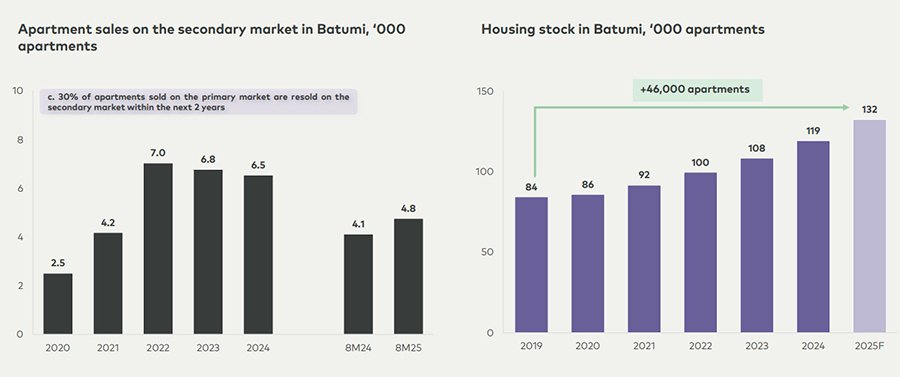

In 2025, about 4.8 thousand apartments were sold on the secondary market – comparable to the same period of 2024. The peak came in 2022, when sales reached 7 thousand. The segment is supported by an expanding housing stock and a redistribution of demand: some buyers prefer ready properties, where quality and transaction conditions are easier to assess.

The sales-to-stock ratio rose from 29% in 2024 to 36% in 2025 but remains below the 2022–2023 peak of 50%+. This indicates a shift from rapid expansion to a more balanced market phase, where key activity is moving to the secondary segment.

Demand and Buyers

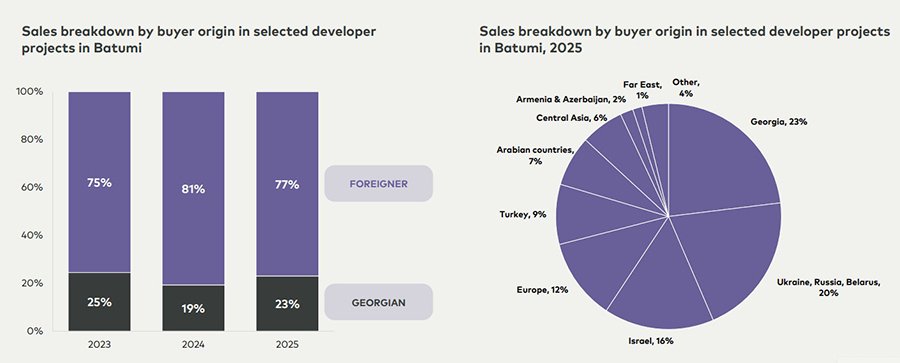

About 80% of transactions in Batumi’s residential market are made for investment purposes, while apartments for permanent residence account for 20%. The average purchased unit is 40 sq. m., with an average investment value of $76 thousand. Foreign buyers generate about 60% of transactions, Georgians – 40%. External demand remains the key driver of market dynamics.

The largest groups are from Ukraine, Russia, and Belarus, together making up 20% of sales. Over the past two years, Israeli investors have become more active: their share increased from 8% to 16%. European buyers account for 12% and remain stable despite a slight slowdown.

Turkey accounts for about 9% of purchases. The share of Arab countries has reached 7%, viewing Georgia as an affordable, stable market with growth potential comparable to Dubai – and as an opportunity for residence permits for investments above $100 thousand.

Central Asian countries contribute about 6% of demand, mainly in the tourism segment. Buyers from the Far East represent around 1%, though Galt & Taggart analysts see potential for expansion. The broadening geography – from Europe to the Middle East and Asia – makes the Batumi market more resilient and less dependent on individual countries.

Supply and Construction

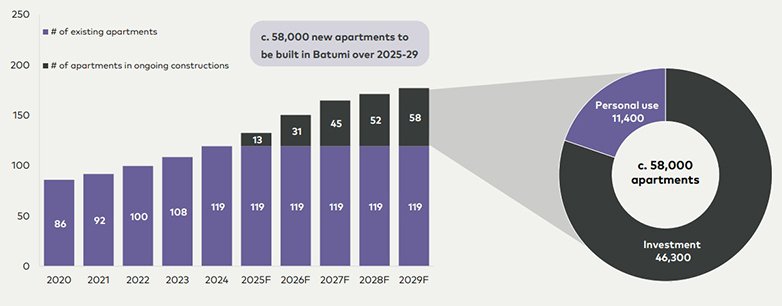

In recent years, Batumi’s housing stock has expanded significantly – from 86 thousand units in 2020 to 119 thousand in 2024. The increase has been driven primarily by investment-oriented projects. Between 2025 and 2029, about 58 thousand new apartments are planned, 46.3 thousand (about 80%) for short-term rental and 11.4 thousand for permanent living.

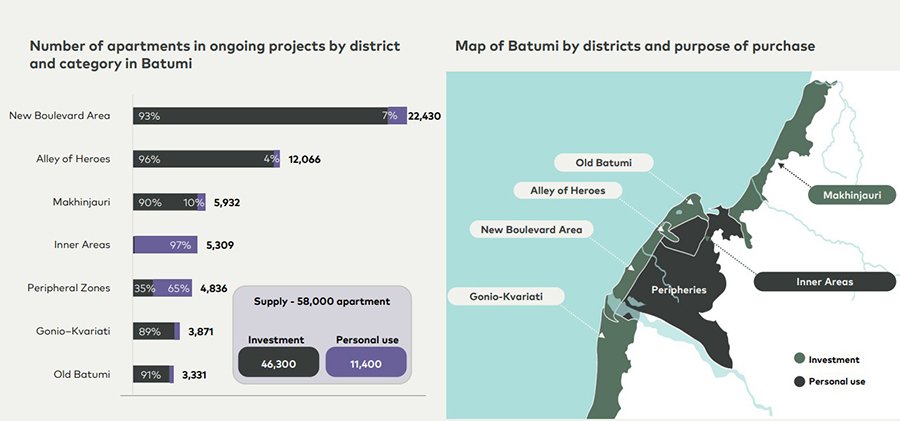

Most projects are concentrated along the coast. In New Boulevard and Heroes Alley districts, short-term rental apartments account for 93–96%, making them the main hubs of new construction – with 22.4 thousand and 12 thousand units planned, respectively. In Old Batumi the share is 91%, in Makhinjauri – 90%, and in Gonio–Kvariati – 89%.

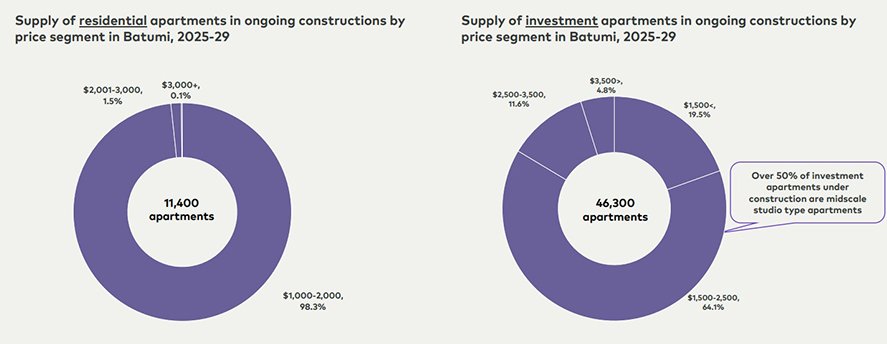

Residential buildings are mainly developed in inner and peripheral districts, where rental projects make up no more than 7%, and up to 65% of apartments are built for residents. This contrast highlights the divide between coastal investment zones and interior neighborhoods. Between 2025 and 2029, 11.4 thousand new residential units will be built: 98% priced at $1,000–2,000 per sq. m., 1.5% at $2,000–3,000, and only 0.1% above $3,000 per sq. m. – indicating an almost complete absence of high-end projects in the residential segment. Galt & Taggart estimates the city’s annual housing demand at about 2.3 thousand units.

In the investment market, the structure is more diverse but still dominated by mid-range projects. Of the 46.3 thousand apartments under construction, 64% are priced $1,500–2,500 per sq. m., 20% below $1,500, 12% in $2,500–3,500, and 5% in the premium segment. More than half of all investment units are mid-priced studios, raising the risk of oversupply of similar products.

Market Prices

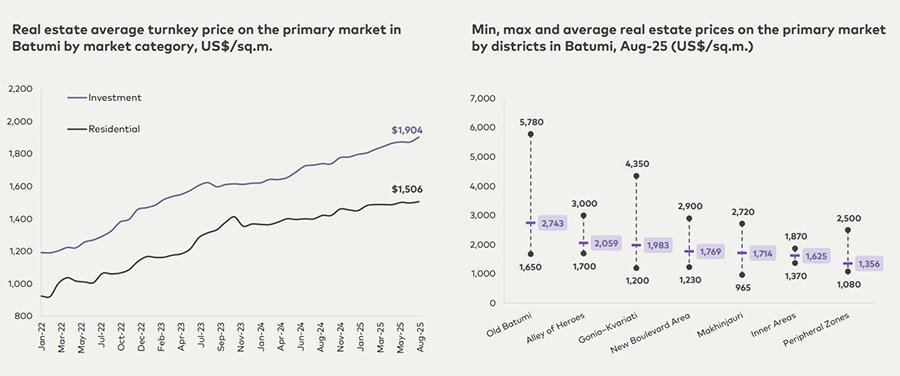

In August 2025, the average price in Batumi’s primary market was $1,812 per sq. m. The gap between investment and residential units reached $400: apartments designed for rental were sold at $1,904 per sq. m., while homes for permanent residence averaged $1,506.

The most expensive areas were Old Batumi and Heroes Alley, with average prices of $2,743 and $2,059 per sq. m., respectively, and some seaside projects exceeding $5,780. In Gonio–Kvariati, prices ranged from $1,200 to $4,350 per sq. m., averaging $1,983. In New Boulevard the average was $1,769, in Makhinjauri – $1,714, in inner districts – $1,625, and in peripheral zones – $1,356.

In the secondary market, apartments sold for about 14% less than new builds – around $1,550 per sq. m. Prices rose nearly 10% year-on-year in both categories, but Galt & Taggart analysts warn that such growth is unlikely to continue: sales are slowing, and the share of unsold inventory remains significant.

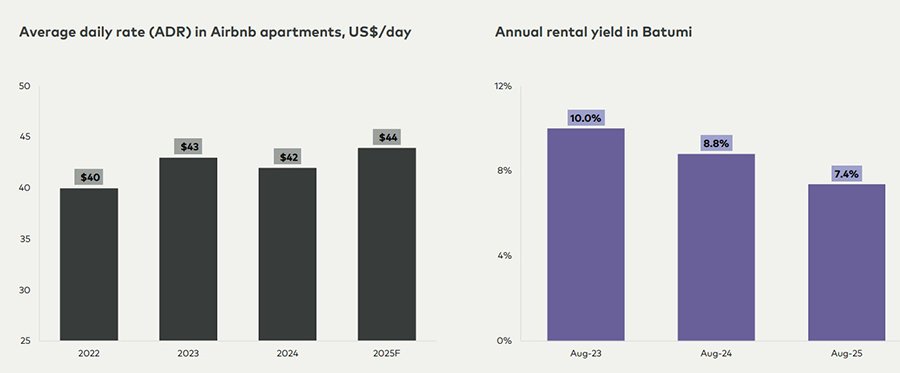

Rental yield of housing

Price growth continues to outpace the dynamics of rental rates. On Airbnb, the average daily rental price in August reached $44 — only two dollars higher than a year earlier. As a result, returns have declined: while in 2023 investments in Batumi real estate generated about 10% per annum, they now bring 7.4% before expenses, with actual figures lower by 2–3 percentage points. In addition, the price per square meter is rising faster than rental income, and investment payback periods are becoming longer.

Scenario analysis shows that without an increase in tourist inflows and average length of stay, returns will continue to fall. With a moderate 5% annual growth in tourism, yields would drop to 3.4%; with 10% growth — to 5.1%. Only if tourism expands by at least 15% annually will the current yield level be maintained.

Nevertheless, Batumi still looks attractive compared with other resort markets. The annual yield of 7.4% is below Dubai’s 9% but higher than the European average of 4–6%. A Batumi apartment of 40 sq. m costs around $76,000, compared with $118,000 in Nicosia and Antalya, $152,000 in Budva, and over $300,000 in Dubai. Even with shrinking margins, the city remains one of the most affordable markets in terms of price-to-income ratio.

Market experts note that the Galt & Taggart report overstates profitability. The average annual rental rate on Airbnb is indeed around $44 per day, but this platform is among the most expensive and includes commissions and additional fees. In the real market, the figure is closer to $30 per day, due to seasonal fluctuations between summer and winter. The average occupancy rate does not exceed 30% per year, as Batumi still lacks sufficient infrastructure for year-round living.

As a result, the net return on apartments amounts to only about 4%. In addition, if the current pace of construction continues, the short-term rental market in Batumi will face oversupply risks, analysts warn. While in 2017–2018 the city authorities approved construction projects totaling 2.1 million sq. m, in 2024 this figure had already reached 2.9 million, creating a substantial surplus in the market.

By the end of 2024, there were around 18–20 thousand short-term rental units in the city, and by 2029 this number may rise to 35–40 thousand, further reducing profitability. In 2017–2018, the Batumi City Hall approved construction projects totaling about 2.1 million sq. m, and by 2024 the figure had reached 2.9 million — creating a significant oversupply.

Hotel sector

A completely different picture is observed in Batumi’s hotel segment. In branded hotels, occupancy reached 68.6% in 2022, 70% in 2023, and 71% in 2024. The average revenue per city hotel with standard infrastructure such as a spa, gym, and restaurant is about $250 per year: summer rates rise to $400+ and drop to $150–200 in winter, depending on the level of the hotel. Hotel returns are estimated at 10% and above, reaching up to 17% in branded chain properties.

Stable demand

Vice President of McInerney Hospitality International Maya Tsereteli reported that during the summer, hotel occupancy in Batumi reached 90–100%, and remained at 80% in September, exceeding expectations. The gap between peak and low seasons is narrowing: off-season demand remains stable, and winter bookings are already actively growing. Analysts at TBC highlight that the luxury hotel segment is expanding particularly fast. In the first half of 2025, the average occupancy rate in this category reached 54% — up 4% year-on-year — while the average daily rate (ADR) stood at $126. Hotels in Batumi are most frequently chosen by guests from Asia and the Middle East, with growing flows from Eastern Europe and the United Kingdom. Such diversification makes demand more stable and allows maintaining high occupancy levels throughout the year.

Hotel offerings remain exclusive. There are a number of pseudo-branded projects where apartments are marketed under a brand name but are not actually affiliated with international hotel chains. As a result, these properties do not enter high-end service systems and are not managed by professional hoteliers. Such residences will perform as ordinary apartments.

For buyers, it is essential to distinguish genuine branded real estate. Currently, only four companies in Batumi hold such properties. Their standards vary, as not all of them are operated by professional management teams. The highest yield can be expected only from truly branded projects under professional international hotel management.

Luxury Projects

The luxury segment is concentrated in the most prestigious areas: in Tbilisi – Vake, Vera, Mtatsminda, and new riverside projects; in Batumi – the first coastal line, especially Gonio. One of the largest luxury projects there is the Wyndham Grand Batumi Gonio hotel complex, combining five properties. A management agreement has already been signed with Aimbridge Hospitality, one of the world’s leading hotel operators with over 1,500 properties worldwide.

The project offers a guaranteed return of 10% per year in USD with potential growth up to 17%. This far exceeds residential market returns. Payouts in a stable currency reduce risks and make investment more appealing for long-term income-oriented buyers. The combination of brand strength, luxury format, and tourist growth ensures high occupancy and ADR, while limited quality supply boosts investment potential.

The area has also attracted Eagle Hills, a UAE developer that opened a representative office in Georgia and confirmed $6.6 billion in project funding. One of them is Gonio Yachts & Marina – a 260-hectare coastal cluster with a yacht marina, hotels, residences, and recreation zones.

Batumi’s real estate market is gradually stabilizing after years of rapid growth. Residential sales have slowed but remain strong, while investor interest is shifting toward hotel projects. The city retains its appeal thanks to tourism

Подсказки: Batumi, real estate, hotels, investment, Georgia, tourism, property prices, luxury, yield