How Much Money Tourists Spend in Georgia: National Bank Data

Photo: Unsplash

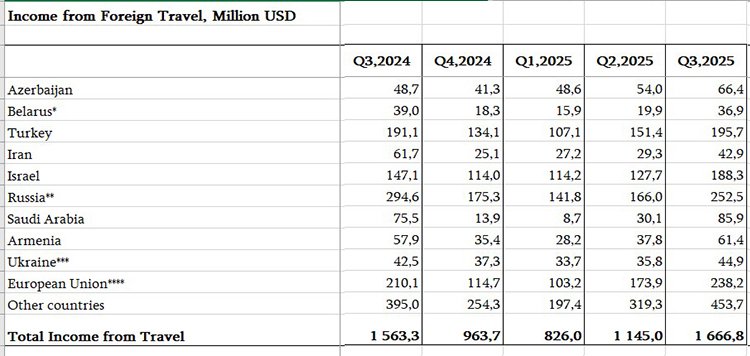

In the third quarter of 2025, tourism revenues in Georgia reached $1.67 billion, marking a new all-time high — up 6.6% compared to the same period in 2024. The cumulative total for the first nine months rose by 5.1%, to $3.64 billion, according to the National Bank of Georgia.

The growth reflects a steady rise in tourist arrivals across all seasons. From January to June, Georgia earned over $2 billion, with the July–September quarter setting a new record. The tourism sector has now surpassed the pre-pandemic 2019 level ($3.27 billion) and is on track for a fresh annual record. If current trends persist, total receipts for 2025 could exceed $4.8 billion.

Top-Spending Markets

Russia remains the leading source of tourism spending, even as figures soften. In Q3 2025, Russian visitors spent $252.8 million, down 14.2% year-on-year, yet still the largest contributor. Over January–September, revenues totaled $560.6 million (-3.7%), the highest among all foreign markets. Russians also lead by visits — 1.25 million trips in nine months — though the average spend per visitor remains modest, around $450.

Turkey ranks second, with spending up 2.4% in Q3 to $195.7 million, and +3% in the first nine months to $454.2 million. Turkish citizens made 963,600 visits, spending an average of $470 per trip.

Israel climbed to third place, showing strong momentum: up 28% in Q3 to $188.3 million, and +24.9% year-to-date to $430.4 million. Arrivals grew 27.8% to 293,700, and Israel’s average spend of $1,470 is among the highest of all markets.

Saudi Arabia entered the top four for the first time, with Q3 spending of $85.9 million (+13.8%), and $125 million (+11.9%) over nine months. About 84,400 Saudis visited Georgia, leading all markets in average spending per trip — $1,480.

Azerbaijan closed the top five, showing the fastest growth: +36.3% in Q3 to $66.4 million, and +32.4% over nine months to $157.9 million. Tourist arrivals surged 34.9% to 220,200, with average spending of $720 — higher than most neighboring countries.

Armenia ranked sixth, maintaining steady performance. In Q3 2025, Armenian visitors spent $61.4 million, up 6% year-on-year. Cumulative nine-month revenue rose 4.3% to $127.4 million, with 720,000 visits and an average spend of about $180 per tourist — the lowest among major markets.

European Union and Other Regions

The European Union remains a key source of tourism revenue. In Q3 2025, EU visitors generated $238.2 million (+13.4%), and $515.3 million (+9.8%) in nine months.

Visits from EU citizens nearly reached 400,000 (+13.3%), led by Germany, Poland, France, and the Baltic States.

Overall, more than 4.3 million visits from Europe were recorded in the first nine months (+5.4%), accounting for 81.3% of total arrivals.

East Asia and the Pacific ranked second (+5.5%, to 390,912 visitors), the Middle East grew 6.1%, and arrivals from the Americas rose 10.1% to 60,059.

In total, 6.1 million international visits were recorded — +5.4% year-on-year — according to the National Tourism Administration.

Tourism as a Growth Engine

The 2025 surge in tourism revenue stems not only from more visitors, but also from shifting spending patterns. Georgia is attracting a larger share of high-spending travelers, and average expenditure per tourist continues to rise, even with moderate growth in arrivals.

This strengthens the sector’s role as a key foreign-currency earner and one of the most resilient contributors to Georgia’s economy.

Growing inflows are driving new hotel investments across the country.

International brands are expanding their footprint, particularly along the Black Sea coast of Adjara, where the luxury segment is booming.

The resort area of Gonio is emerging as Georgia’s next premium destination: the Wyndham Grand Batumi Gonio hotel complex is under construction, Eagle Hills plans to develop the Gonio Yachts & Marina — a 260-hectare coastal cluster with a yacht harbor, hotels, and luxury residences.

Such initiatives are reshaping the landscape of Georgian tourism, blending mass travel with a growing high-end segment, and setting new service benchmarks through global hospitality brands.