read also

Japan Corporate Bankruptcies Hit 13-Year High

Japan Corporate Bankruptcies Hit 13-Year High

Japan’s New Condo Prices Reach Record High

Japan’s New Condo Prices Reach Record High

European Gas Prices Surge Amid Middle East War

European Gas Prices Surge Amid Middle East War

EU prepares new foreign investment screening rules

EU prepares new foreign investment screening rules

Collapse of Air Travel in the Middle East

Collapse of Air Travel in the Middle East

New research highlights rising hotel tax compliance costs in the United States

New research highlights rising hotel tax compliance costs in the United States

Spain’s Real Estate: Record Prices and Falling Yields

Photo: Idealista

In October 2025, the price of existing homes in Spain reached 2,555 euros per sq. m., rising by 15.7% compared to the same month of 2024. This is the highest level since records began, notes Idealista. Quarter-on-quarter growth amounted to 3.4%, and month-on-month (vs September) — 1.5%.

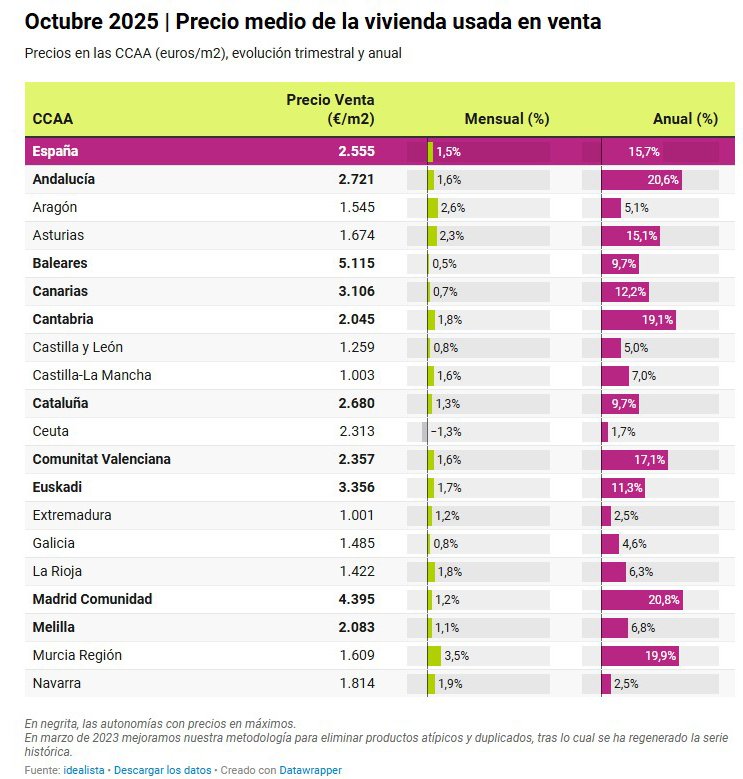

Autonomous Communities

All regions of Spain recorded annual growth in the price of existing homes. The leaders were Madrid (+20.8%) and Andalusia (+20.6%), followed by Murcia (+19.9%), Cantabria (+19.1%) and Valencia (+17.1%).

Closer to the national average were Asturias (15.1%), the Canary Islands (12.2%) and the Basque Country (11.3%). Catalonia and the Balearic Islands posted increases of 9.7%. More moderate dynamics were seen in Galicia (4.6%), La Rioja (6.3%) and Castilla-La Mancha (7%). The smallest changes were in Navarre and Extremadura, where prices rose by just 2.5%.

The Balearic Islands remain the most expensive region in the country at 5,115 euros per sq. m. They are followed by Madrid (€4,395), the Basque Country (€3,356) and the Canary Islands (€3,106). Prices are lower in Andalusia (€2,721) and Catalonia (€2,680). More affordable housing is traditionally found in Extremadura (€1,001), Castilla-La Mancha (€1,003) and Castilla y León (€1,259).

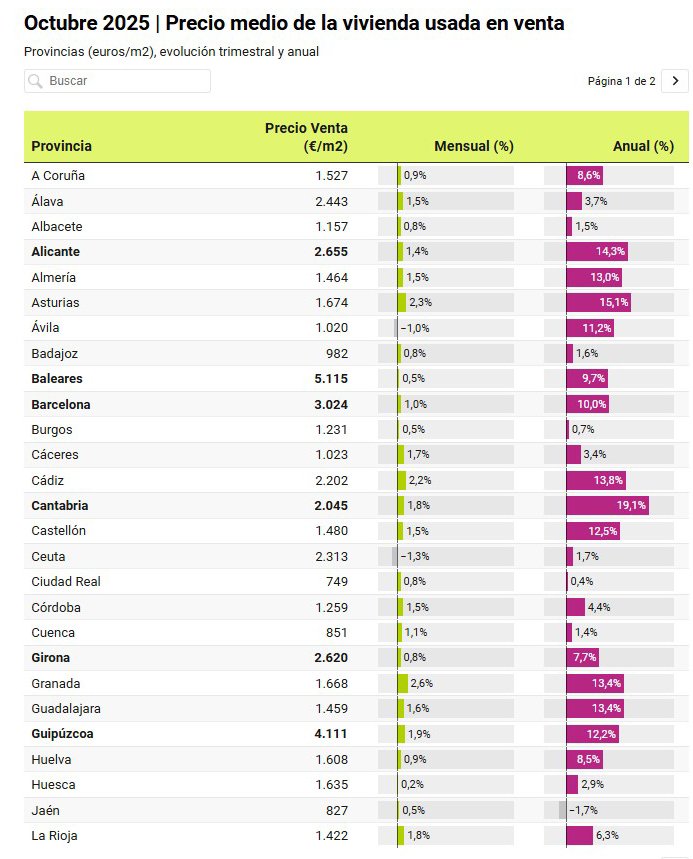

Provinces

Similar trends are seen at the provincial level. In 47 out of 50 provinces, home prices increased, with only three ending the year in negative territory. Valencia became the absolute leader with a rise of 21.7%. Close behind were Madrid (+20.8%), Murcia (+19.9%), Cantabria (+19.1%) and Malaga (+17.1%). In Barcelona, the price of existing homes grew by 10%, which also exceeds the average rates of previous years. Declines were recorded only in Ourense (–4.4%), Teruel (–4.2%) and Jaén (–1.7%).

In terms of price levels, the Balearic Islands again stand apart at 5,115 euros per sq. m. Madrid ranks second at €4,395 per sq. m. Next are Gipuzkoa (€4,111) and Malaga (€4,023). In Santa Cruz de Tenerife housing costs €3,295, in Biscay — €3,212, and in Barcelona — €3,024.

The inland provinces contrast sharply with coastal and island areas: in Ciudad Real the square metre costs €749, in Jaén — €827, and in Cuenca — €851.

Provincial Capitals

Over the year, prices increased in 51 out of 52 provincial capitals, with only Girona deviating from the trend with a 2.9% drop. The most notable surges were recorded in León (+19.9%) and Madrid (+18.1%). Significant growth occurred in Guadalajara (+17.5%), Oviedo (+17.3%), Palencia and Santander (both +17%).

Among major cities, strong increases were seen in Valencia (+16.8%), Alicante (+15.7%), Malaga (+15.5%) and Palma (+15.1%). Double-digit growth also persisted in San Sebastián (+12.5%), Bilbao (+11.3%) and Seville (+10%). Barcelona closed the group with a 9.7% rise.

San Sebastián was named the most expensive city in the report — €6,337 per sq. m. High prices also remain in Madrid (€5,705) and Barcelona (€5,042). The most affordable homes are found in capitals such as Zamora (€1,272), Jaén (€1,321) and Lleida (€1,427).

Rental Yields

Average gross rental yield in Spain fell from 5.60% in Q1 2025 to 5.43% in Q3, according to Global Property Guide and Idealista. Net yields stand only slightly above 3%.

In Barcelona, the nominal yield is above the national average at 7.17%. The most profitable purchases are studios in the city centre or nearby. Such units cost more than 182,000 euros. With a monthly rent of €1,300, this can generate up to 8.56% annually. At the same time, many property types offer only 3–4%, especially in districts such as Sarrià–Sant Gervasi and Les Corts.

Average yield in Valencia is 6.11%. A one-bedroom apartment purchased for €220,000 can provide a return of 7.09%, while a studio priced at €200,000 yields around 6.90%. The lower bound hovers slightly above 3%. In Córdoba, profitability stands at 5.61%, with a potential maximum of 6.27% when buying a two-bedroom unit for €143,500 and renting it for €750.

Other cities:

Murcia – 5.99%

Alicante – 5.59%

Tenerife – 5.11%

Madrid – 5.04%

Seville – 4.96%

Marbella – 4.87%

Palma de Mallorca – 4.68%

Malaga – 4.65%

It is worth noting that this is a gross yield, meaning it does not include expenses, analysts at International Investment recommend.. Net returns are typically 2–3 percentage points lower. Accordingly, the national average is below 4%, around 5% in Barcelona, and decreasing from there. Rates and profitability drop off-season. Returns may be even lower given that apartments rarely achieve full, year-round occupancy — vacancy periods can last for months. In addition, Spain continues tightening regulations on short-term rentals, which raises costs and reduces landlords’ income. There is also a significant risk of illegal occupation; in such cases, owners still have to cover expenses for a property they cannot actually use.

Read more:

Barcelona to Recalculate Property Taxes: The More Apartments You Own, the Higher the Rate

Properties with “Okupas” for Sale in Spain: An Emerging Segment of the Market

Investor’s Notes: Spain – Where Renting is Harder and Risks Are Higher