read also

Iceland’s Four-Day Workweek Five Years On

Iceland’s Four-Day Workweek Five Years On

Mortgage Approvals in Ireland Slump Sharply in January

Mortgage Approvals in Ireland Slump Sharply in January

Lisney Property Market Outlook: Irish Property Market Poised for Steady Growth in 2026

Lisney Property Market Outlook: Irish Property Market Poised for Steady Growth in 2026

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Riots in Mexico Disrupt Air Links to Resort Destinations

Riots in Mexico Disrupt Air Links to Resort Destinations

UK House Prices Stabilise After 2025 Slowdown

UK House Prices Stabilise After 2025 Slowdown

Georgia’s Real Estate in October 2025: What’s Happening in Tbilisi and Batumi

Photo: Tatyana Borodina

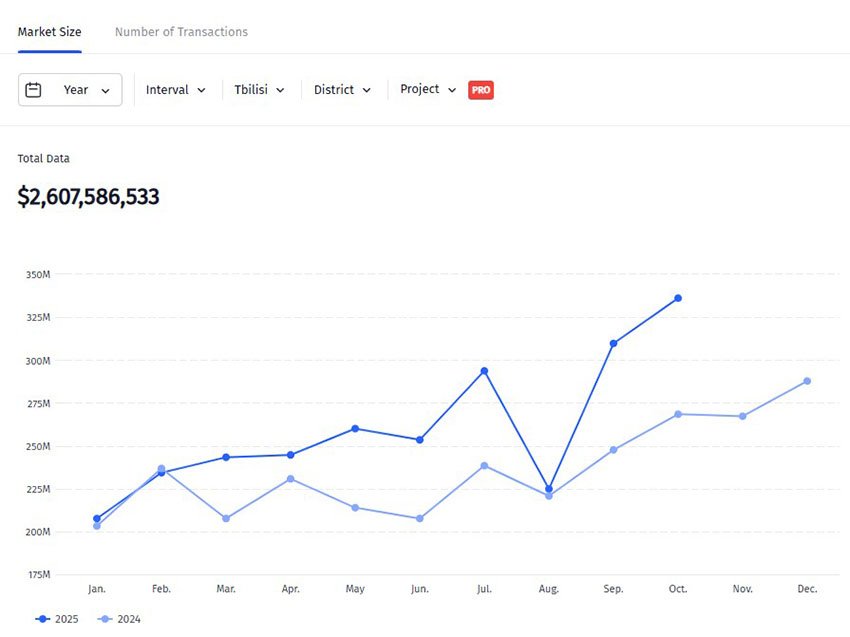

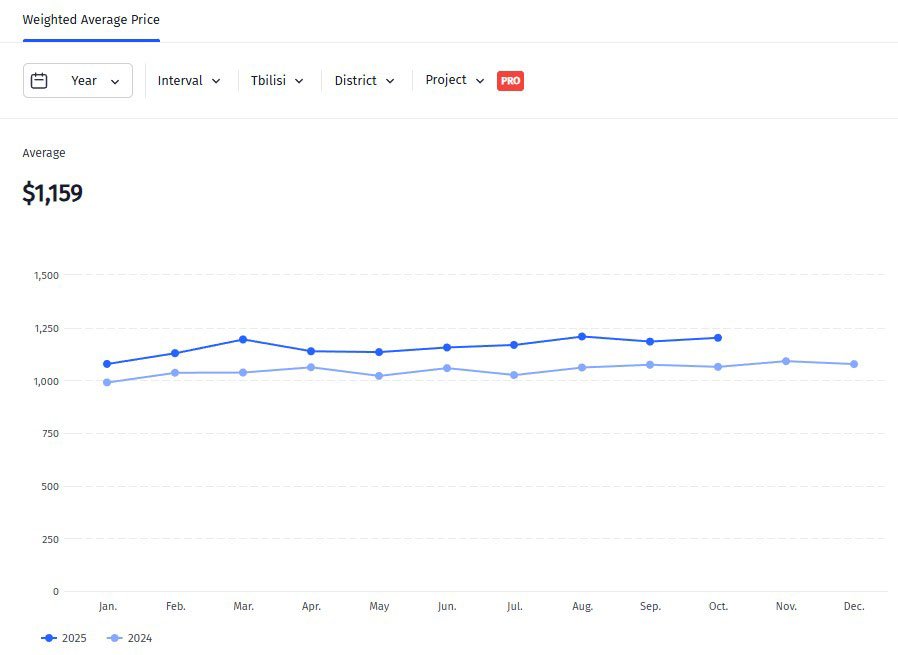

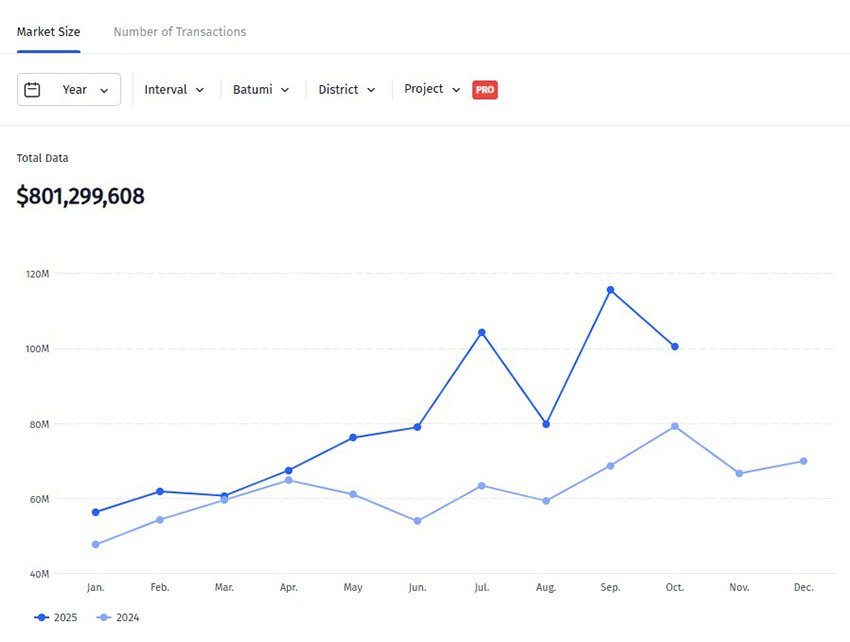

Georgia’s housing market ended October at high speed. Both the capital and the Black Sea resort city continue to increase the number of transactions and overall turnover, while the price per square meter is steadily moving upward — especially in new developments, according to analysts at Colliers Georgia. At the same time, statistics from recent years and long-term expert forecasts point to a gradual market slowdown, declining yields and softer price growth.

Tbilisi: Stronger Demand and Rising Prices in the Central Districts

In October, 4,178 transactions were registered in Tbilisi — 9% more than a year earlier. The transaction volume reached USD 336 million, adding roughly a quarter compared to last year. The primary market and new projects were growing most actively. The number of deals in these segments increased by 13.1%. In new buildings, the growth was 12.1%, while in the secondary market it reached 14.6%. Older housing stock, on the contrary, showed a 4% decline — a trend that has been stable for several recent months.

Prices increased in all parts of the city, but especially in the broader central zone. Here, the cost of new builds rose by 25.1% over the year. In the central districts, prices grew by 11.8%, and in the suburbs by 9.9%. Across the primary market, the average price increased by 17.4%, and in the wider center by 30.3%. This sharp jump is largely explained by the late registration of apartments sold earlier, which developers formalized in bulk. In the secondary market, the dynamic is softer: plus 9.4% citywide. For older housing stock, prices increased by 13.8% in the suburbs, by 9.8% in the wider center, and by 8.7% in the central parts of the capital.

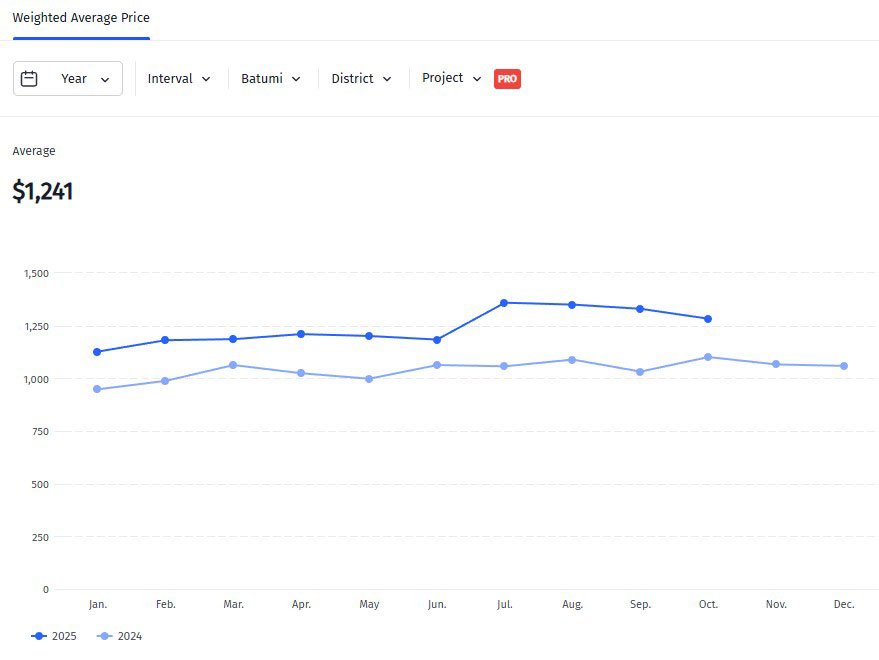

Batumi: Acceleration in Transactions

The number of apartment transactions in Batumi reached 1,625, which is 14.2% higher than a year earlier. The transaction volume grew to USD 100 million (+26.9%). New complexes were the fastest-growing segment, with sales up by 14.9%. In the primary market, growth was 8.2%, while the secondary market expanded by 21.8%. Older housing stock added 6.3%.

The average price of new builds rose to USD 1,292 per sq. m, which represents a 16.5% increase year-on-year. The main impulse came from the primary market, where prices jumped by 28%. In the secondary market, prices grew by a more moderate 5.3%. However, the monthly dynamics were distorted by transactions in two large projects: around 125 apartments sold over the past few years were registered at once. This caused the average price in the statistics to spike sharply. Without these registrations, the price increase would have been around 9.4%. Analysts remind that part of primary sales is recorded with a delay, which sometimes makes monthly figures look stronger than the real underlying trend.

Market Slowdown: Galt & Taggart

Analysts at Galt & Taggart have recorded a decline in housing sales and an oversupply of construction over the past few years. For example, in 2022–2023, the primary market in Batumi recorded 3,000–3,400 apartment transactions annually, in 2024 — around 2,000, and in the first eight months of 2025 — only 1,500, while roughly 6,000 units remained available. About 30% of new builds are put back on the market for resale within the first two years, adding another 600–700 apartments each year on top of existing supply.

In the secondary market, about 4,800 transactions were registered from January to August 2025 — roughly the same level as in 2024, but below the 2022 peak of around 7,000. It is the secondary market that currently generates the bulk of real, completed purchases.

Around 80% of buyers acquire apartments for subsequent rental. The average unit size is about 40 sq. m, and the typical budget is approximately USD 76,000. At the same time, developers plan to deliver about 58,000 new apartments between 2025 and 2029, of which 46,300 (almost 80%) will be units designed for short-term rental. This implies a sharp increase in competition between landlords, and analysts expect both prices and rental yields to come under pressure. This process has already started, and in the coming years the profitability of residential investments is likely to continue to decline.

Real Investment Returns on Residential Property

According to experts from International Investment, the actual rental yield of apartments in Batumi is significantly lower than advertised returns and even some analyst estimates, because figures are often quoted on a gross basis — without accounting for operating expenses and vacancy.

With average occupancy of about 43% and a studio purchase price of USD 59,500, annual gross income is around USD 5,900. However, after all mandatory expenses, net profit drops to roughly USD 1,700, or just 2.8% per year, implying a payback period close to 35 years.

Long-term rental improves the picture only marginally: net income of around USD 1,900 per year translates to a yield of about 3%, with a payback period of roughly 32 years. Up to 30% of gross revenue is absorbed by online booking platform commissions, another 10% goes to management and cleaning services, while utilities, taxes, and periodic repairs cost about USD 1,300 per year. As a result, real profitability ends up almost three times lower than initial expectations.

Hotel Projects: Yields Up to 19% Higher

Hotel projects by major international brands look noticeably more attractive. With an investment of around USD 286,000, the net profit from a single room under the management of a global operator — for example, Wyndham Grand Residences in Batumi — can reach USD 34,600 per year. This corresponds to a 12% annual yield and a payback period of about eight years. Under favorable conditions, total returns on such assets can approach 20%.

On average, the profitability of branded luxury-level hotels is roughly 19% higher than that of apartments. When comparing price per square meter and gross yield, an investment in a hotel room pays back approximately 4.8 times faster. This gap is driving growing demand for hotel projects in Georgia, which offer more stable occupancy and more predictable cash flows.