read also

Wealthy Americans Cut Spending: Risks for the U.S. Economy

A slowdown in the stock market and increased uncertainty surrounding the economic policies of Donald Trump's administration have led to reduced consumer spending among high-income U.S. households—a key driver of recent growth, reports Bloomberg.

Rising Vulnerability

In recent years, wealthy Americans have sustained economic momentum, even amid Federal Reserve tightening and dwindling pandemic-era savings. The primary driver was the so-called wealth effect—the psychological sense of financial security that comes from rising asset values, even if actual incomes remain flat.

But the stock market correction that began last month has already wiped out trillions in market value. This has cooled spending enthusiasm even among those who recently spent tens of thousands on major purchases. Take 66-year-old David Lowell from Georgia: during the market rally, he invested $40,000 in a kitchen renovation without hesitation. But after seeing his portfolio shrink by hundreds of thousands, he paused all major spending.

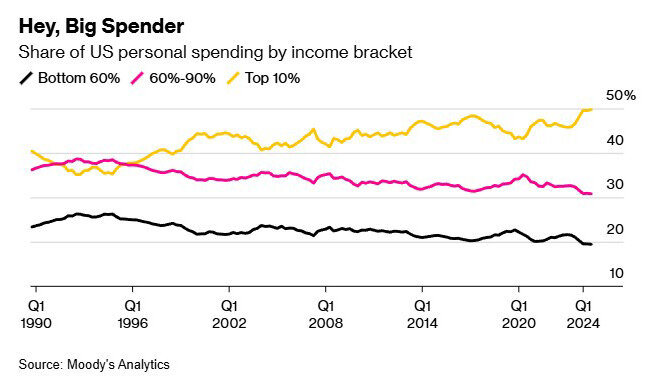

Analysts warn that given the significant role of high-income households, any spending cutbacks from wealthy Americans could ripple through the broader economy. Moody’s Analytics estimates that households earning over $250,000 account for about 50% of total U.S. consumer spending—compared to just one-third in the 1990s. This dependency makes current growth particularly fragile.

Frances Donald, chief economist at the Royal Bank of Canada, notes that “we are effectively witnessing two separate economic cycles—one for the wealthy, and one for lower-income Americans.” Any shock impacting the top 10% of households, she adds, has an outsized effect.

According to a study by the Institute for New Economic Thinking (INET), the surge in wealth from 2020 to 2023 among the top 10% of earners was nearly unprecedented, enabling the rich to keep spending despite real income declines. Economist Thomas Ferguson, one of the study's authors, explains: “A strong market boosts consumption, but the reverse is also true—a weak market dampens it. And if investor anxiety deepens, we could see a sharp pullback in spending—we simply ‘close our wallets.’ We’re not there yet, but warning signs are emerging.”

Commerce Department data shows retail sales growth in February missed forecasts, with January posting the sharpest drop since July 2021. Restaurant and bar spending saw the biggest yearly decline. Meanwhile, a Conference Board survey revealed the share of Americans planning overseas trips in the next six months fell to a five-month low of around 17%.

“Buy American” Policy

Adding pressure is Trump’s aggressive “Buy American” policy, effectively a global trade war. Experts highlight that such campaigns rarely deliver sustained results. According to the Federal Reserve Bank of St. Louis, these initiatives were typically launched during recessions alongside protectionist tariffs. While they temporarily reduced imports, foreign purchases quickly rebounded post-crisis. Historian Dana Frank notes that major industrial patriotism waves in the 1930s and 1980s coincided with U.S. manufacturing job losses.

Modern global supply chains further complicate matters. For example, Delta flies Airbus planes built in Europe and North America; Honda assembles Accords in Ohio; and the Chevrolet Silverado—an “American” pickup—is produced in the U.S., Canada, and Mexico with foreign-sourced parts. Raising tariffs could disrupt these supply chains, hurting both domestic demand and U.S. trade relations with Canada, Mexico, the EU, China, and other key partners.

Shifting Sentiment and Forecasts

Consumer sentiment is also trending down. The University of Michigan’s sentiment index fell in March to its lowest level in over two years. Americans’ financial outlooks hit record lows, while a New York Fed survey showed the share of respondents expecting worsening personal finances rose to a 15-month high.

A surprising indicator of growing pressure came from VantageScore: delinquencies (60-89 days past due) among borrowers earning over $150,000 doubled in January 2025 compared to two years earlier. For lower-income groups, delinquencies rose about 30%. Chief economist Rickard Bandebo warns: “If this segment starts showing stress, it raises worrying signals for future consumer spending.”

Unsurprisingly, the Federal Reserve has revised its 2025 U.S. economic growth forecast downward—from 2.1% to 1.7%—reflecting heightened uncertainty tied to Trump’s trade policies and market volatility.