Immigration and the U.S. Labor Market: Declining Inflows Reshape Economic Outlook

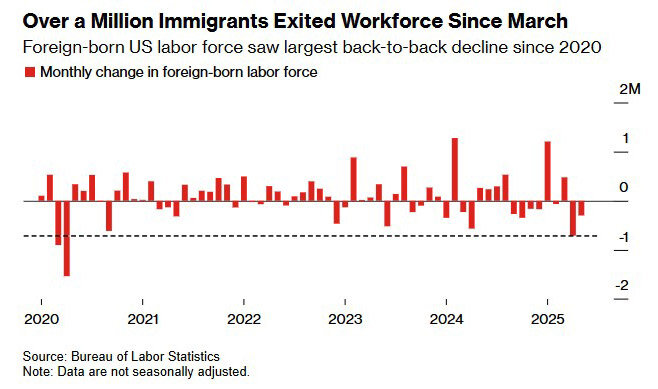

The immigration policy of Donald Trump’s administration is already leaving its mark on the U.S. economy. Bloomberg reports that the share of foreign-born workers has dropped more sharply than at any time since 2020. More than one million immigrants have left the labor market.

The official unemployment rate remains at 4.2%, though the number of jobless individuals continues to grow. Experts attribute this to falling demand among migrants. According to the Bureau of Labor Statistics, 139,000 new jobs were created in May. Figures for March and April were revised downward, revealing 95,000 fewer jobs than initially reported. Despite seemingly stable numbers, experts caution that official figures may be distorted by demographic shifts, meaning the real situation in the labor market could be less secure.

The Federal Reserve remains cautious. Fed Chair Jerome Powell noted in April that reduced immigration flows coincide with weaker demand for labor, which keeps unemployment steady. However, this complicates analysis: it’s becoming increasingly difficult to distinguish cyclical fluctuations from the consequences of policy decisions.

A key indicator has become the breakeven employment rate—the minimum number of new jobs needed each month to maintain stable conditions. Under President Biden, job gains were faster and larger, reaching up to 210,000 per month. During that period, about 5.8 million migrants received work permits. In 2024, the number of foreign workers in the U.S. peaked at 33.7 million. By May 2025, this figure had declined to 32.7 million.

Morgan Stanley forecasts that the breakeven rate will drop to 90,000 by the end of the year. Analysts at LH Meyer estimate that with further tightening of immigration policy, it could approach zero—or even turn negative. Michael Gapen, an economist at Morgan Stanley, calls this a “reverse effect of the post-COVID era.” Previously, immigration expanded the labor force and helped curb inflation. Now, the number of job seekers is falling faster than the demand for workers, pushing wages higher even as economic growth slows.

Bloomberg Government reports that the U.S. is implementing a sweeping immigration reform in 2025. New restrictions have been introduced for asylum seekers, the refugee intake program has been suspended, and birthright citizenship rules are under review. Simultaneously, a major deportation campaign has begun.

The consequences are felt most in sectors traditionally reliant on migrants, such as construction, hospitality, logistics, and agriculture. According to the Bureau of Labor Statistics, foreign-born workers are more likely to be employed in physically demanding, low-wage jobs, showing high engagement levels—especially among men.

BNP Paribas economist James Egelhoff emphasizes that declining migration remains one of the main sources of uncertainty in forecasts. Yet potential consequences are already being calculated. According to the National Immigration Forum, deporting 11 million people could cost over $150 billion, while border enforcement would require an additional $15 billion annually. Analysis from the Peterson Institute suggests that removing 8.3 million undocumented immigrants could bring economic growth to a complete halt in the coming years.

The Federal Reserve faces a difficult choice. Premature policy easing could fuel inflation, but delayed action raises the risk of recession. Economist Derek Tang warns: “We risk a downturn that might have been less painful if the Fed had acted sooner.” Immigration in 2025 is no longer merely a social or political issue—it has become a structural economic factor directly influencing growth rates, labor market dynamics, and the resilience of the entire U.S. macroeconomic model.